Recently, ARK Investment Management LLC, a well-known investment management company, released the latest "Big Ideas" report. This investment company founded by Catherine Wood, known as the "Female Buffett", started in 2017 at the beginning of each year. Published a "Big Ideas" report, predicting the most investment-worthy cutting-edge technology this year. In the previous report, ARK accurately predicted investment opportunities for Tesla and Bitcoin.

01.

Deep learning

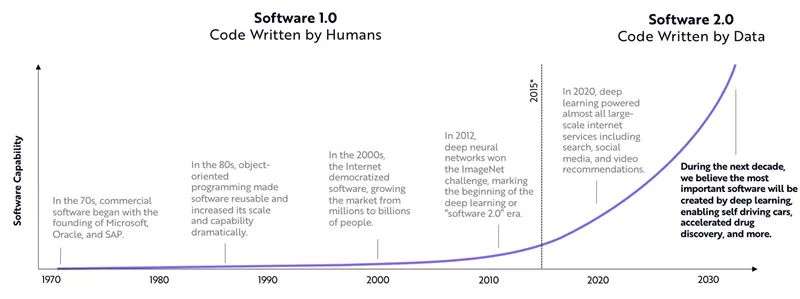

Deep learning technology may be the most important software breakthrough that our generation can see. In the past, all programs were written by "humans", but the emergence of deep learning has changed this situation. As a form of AI (artificial intelligence), deep learning technology can use data to automatically write programs, which will bring revolutionary changes to all walks of life.

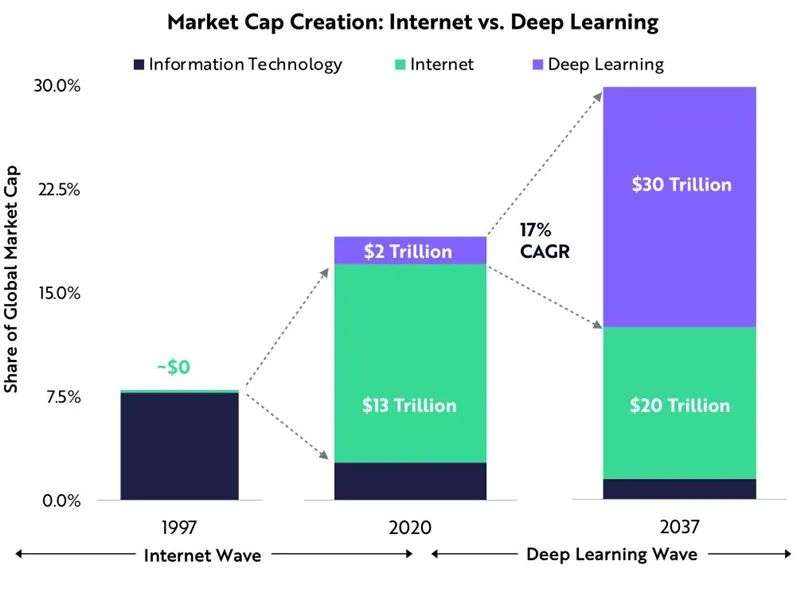

According to ARK's research, in the next 15-20 years, deep learning will increase the global stock market by $30 trillion in market value.

▲Since 2015, deep learning technology using data automatic programming has developed rapidly

In many ways, deep learning is creating a new next-generation computing platform. In 2020, smart speakers with AI technology responded to 100 billion voice commands worldwide, an increase of 75% over 2019.

In terms of autonomous driving, Waymo’s self-driving cars have collected more than 20 million true driving miles in 25 cities including San Francisco, Detroit and Phoenix.

TikTok, a Chinese company that uses deep learning technology for video recommendation, has surpassed Snapchat and Pinterest.

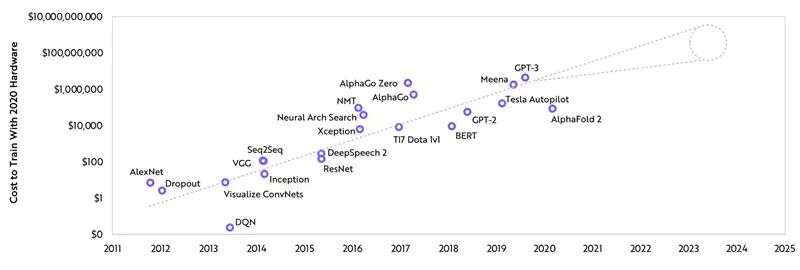

Although advances in hardware and software reduce the cost of artificial intelligence training by 37% each year, AI models are growing faster, increasing by 10 times each year. Therefore, the total cost of AI training continues to climb. By 2025, the most advanced AI training cost will reach 100 million US dollars.

▲The cost of AI training is increasing year by year

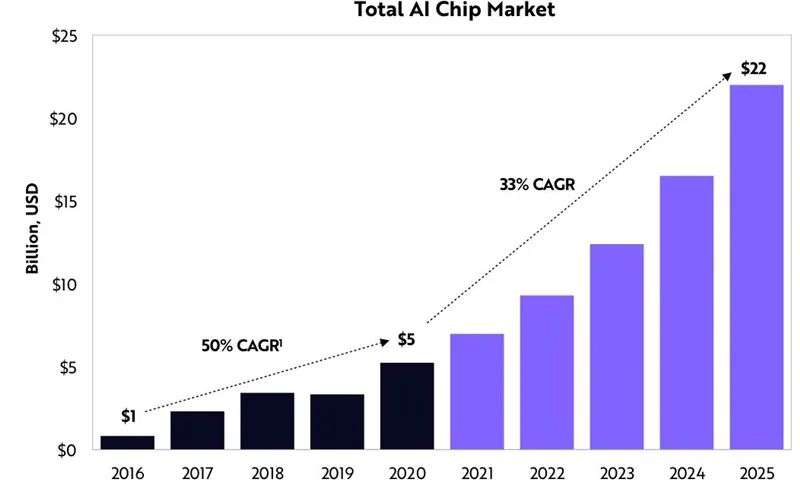

As the hardware carrier of deep learning, AI chips have also exploded with the general trend. The cost of AI training has increased from $1 to $100 million. Most of the cost comes from the training chip.

ARK estimates that in the next five years, data center spending on AI processors will increase more than fourfold, from $5 billion a year now to $22 billion in 2025.

▲The growth of the AI chip market

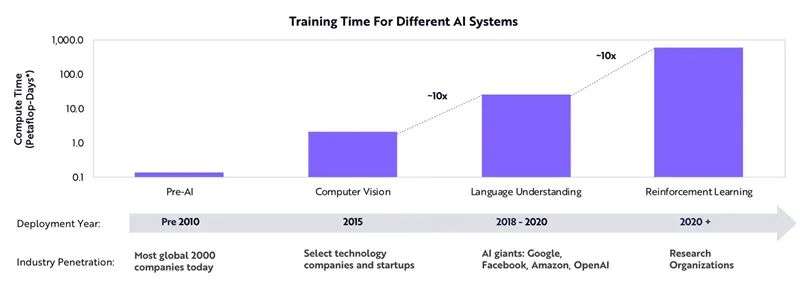

2020 is a breakthrough year for conversational AI. For the first time, an AI system can understand and generate language with human accuracy. Conversational AI requires 10 times the computing resources of computer vision, which should stimulate massive investment in the next few years.

▲Training time of different AI systems

Deep learning technology will create greater value than the Internet. In the past 20 years, the Internet has increased the market value of the global stock market by $13 trillion. By 2020, deep learning has created $2 trillion in market capital. ARK believes that in the next 15-20 years, deep learning will increase the market value of the stock market by $30 trillion.

▲Comparison of value created by deep learning and the Internet

02.

Another revolution in the data center

Data centers, power stations of computing power, are undergoing a revolution. Although Intel accounts for more than 90% of the world's processor revenue, now cheaper, faster, and more energy-efficient processors are beginning to replace Intel.

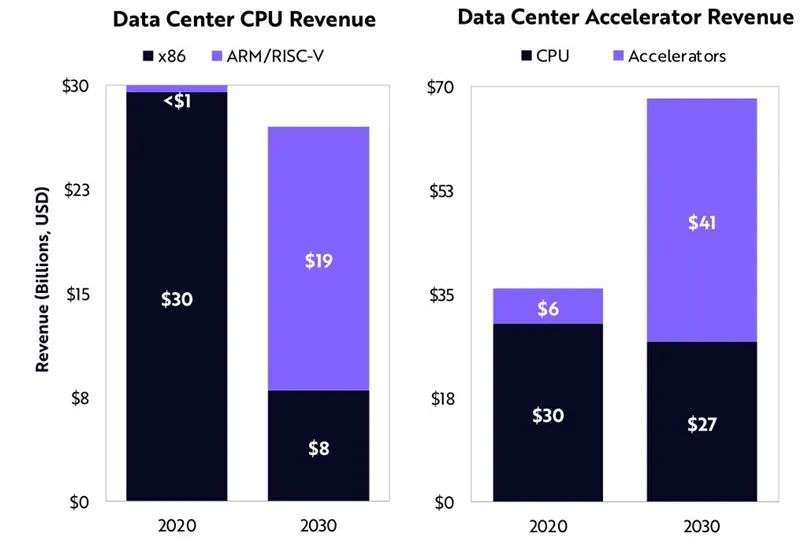

ARK believes that ARM, RISC-V and graphics processing units (GPUs) may become new powerful cloud computing processors. The annual revenue of these two companies will grow at a rate of 45%, reaching $19 billion by 2030.

In the data center, ARK believes that the GPU will become the main accelerator, which will grow to $41 billion by 2030 at a rate of 21% per year.

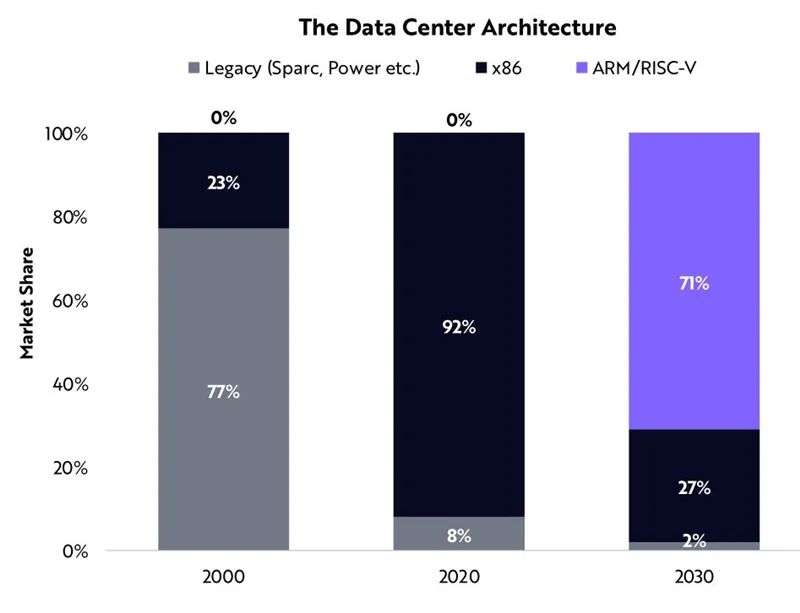

The last revolution in the data center was the x86 architecture derived from RISC processors to Intel's low-cost PCs in the 1990s. Relying on the performance of the personal computer market, Intel has overturned established companies in the high-end market.

Today, ARM processors are relying on the mobile ecosystem to subvert Intel. Applying open source principles to hardware, RISC-V is also becoming the standard in the field of low-cost computing.

ARK predicts that the combination of ARM and RISC-V will increase from 0% market share in 2020 to 71% server market share in 2030.

▲Data center architecture

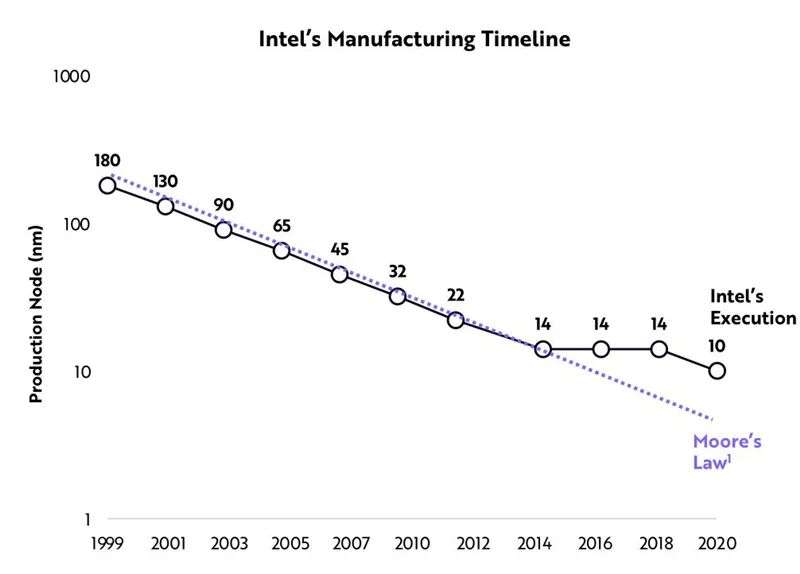

Over the years, Intel seems to be somewhat numb to the changes of the times. As a world leader in semiconductor manufacturing, Intel seems to have lost its way.

Intel has struggled with 10nm processors for four years, successfully letting rivals Taiwan Semiconductor Manufacturing Company (TSMC) and AMD lead the market in 2020.

As of 2020, Intel has not yet launched 10nm server chips. At the same time, TSMC is mass producing 5nm processors.

▲Intel process timeline

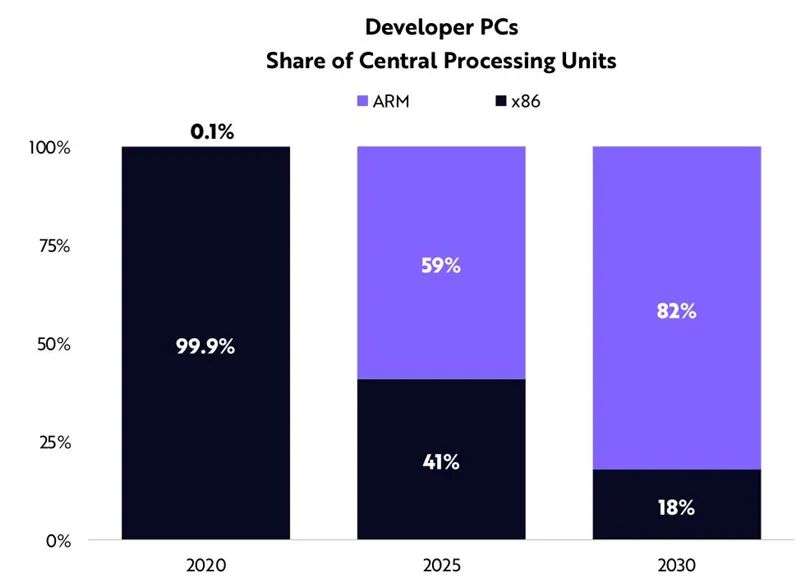

Although almost all software developers now write code on Intel x86 personal computers running Windows, Mac, or Linux operating systems, Apple, which has one-third of the world’s developer users, has plans to remove mac computers from Macs in the next two years. The x86 system transitioned to an ARM-based central processing unit (cpu) system.

At the same time, Microsoft is also redoubled efforts to support the Windows operating system running on ARM processors. According to ARK’s research, by 2030, most developers’ personal computers will use ARM processors, marking the end of Intel’s x86 era.

▲Developer's personal computer processor changes

In the cloud, ARM processors will also become a new standard. The public cloud is the default platform for deploying new applications, generating 140 billion U.S. dollars in revenue worldwide in 2020.

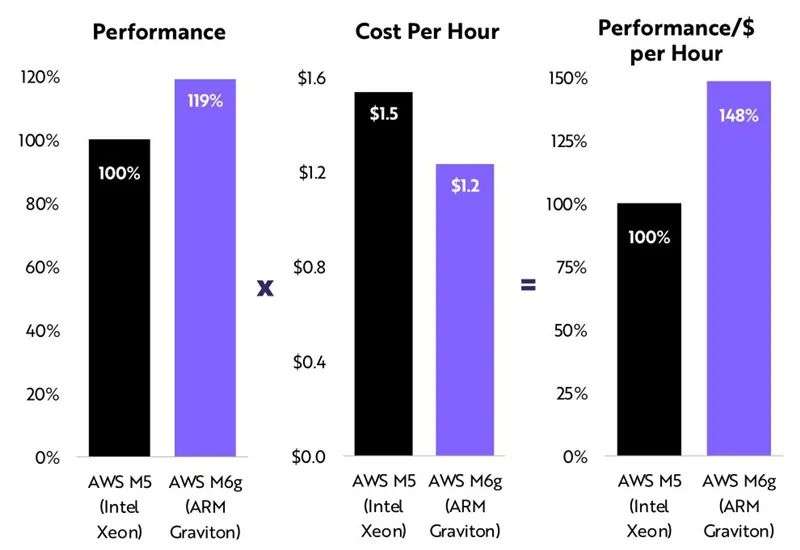

Amazon Web Services (AWS) is the world's largest public cloud provider. It launched Graviton 2 ARM CPU in 2020, reducing the need to buy chips from Intel and AMD.

AWS's Graviton 2 is cheaper and faster than Intel's cpu, and the same price can provide 48% additional performance. In the future, AWS may migrate most of its servers to ARM-based processors.

▲Comparison of AWS equipped with Intel processors and ARM processors

By 2030, ARM and RISC-V may become the new processor standards. PCs and servers with ARM processors will create an ecosystem with sufficient scale, tools, and vendor support to challenge Intel's x86.

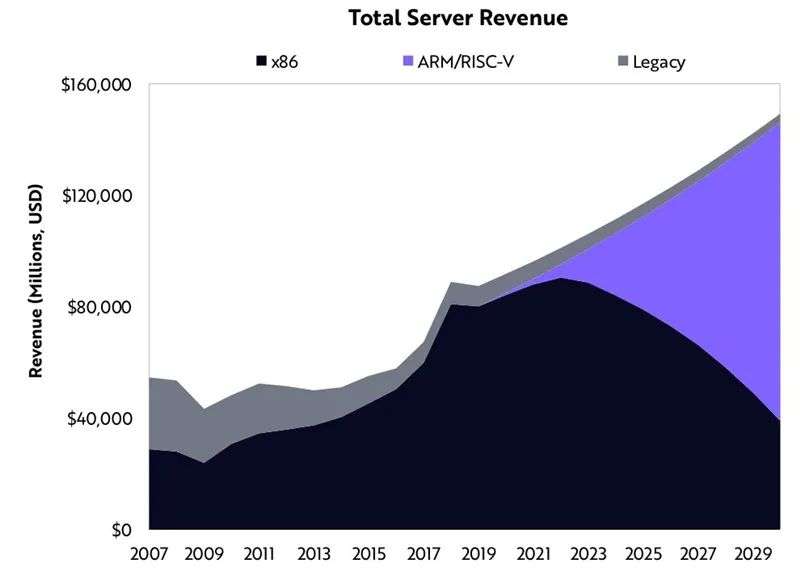

The revenue of ARM servers may increase 100 times, from less than US$1 billion in 2020 to US$100 billion in 2030, which is even higher than the revenue of current x86 servers.

Although x86 processors may continue to grow, their revenue may be reduced by half.

▲Total server revenue

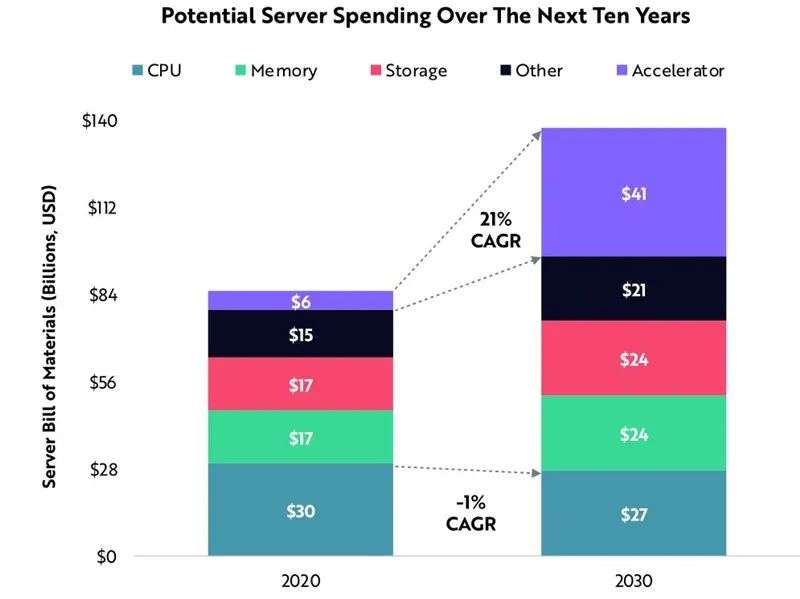

Accelerators, including GPUs, tensor processing units (TPUs), and field programmable gate arrays (FPGAs), are widely used in performing demanding computing tasks, including artificial intelligence (AI), analysis, drug discovery, and cloud gaming. By 2030, the accelerator will replace the CPU as the main computing engine of the server.

Despite fierce competition, ARK believes that GPUs will continue to dominate the accelerator market in the next five years, thanks to their unparalleled programmability and software stack.

▲Potential server overhead in the next ten years

ARK believes that server processors will change in the next decade. ARM and RISC-V are likely to replace Intel's x86 in the field of cloud computing. By 2030, the CPU revenue and server revenue of the two companies will grow at a rate of 45% per year, reaching $19 billion and $100 billion, respectively.

The GPU-led accelerator will become the dominant processor in the data center, with an annual growth rate of 21%, reaching $41 billion.

▲Comparison of data center CPU and accelerator revenue

03.

virtual reality

The virtual world includes video games, augmented reality (AR) and virtual reality (VR).

The definition of a virtual world is a computer-simulated environment that anyone can access at any time. Society interacts with virtual worlds every day, and these virtual worlds are still in their infancy.

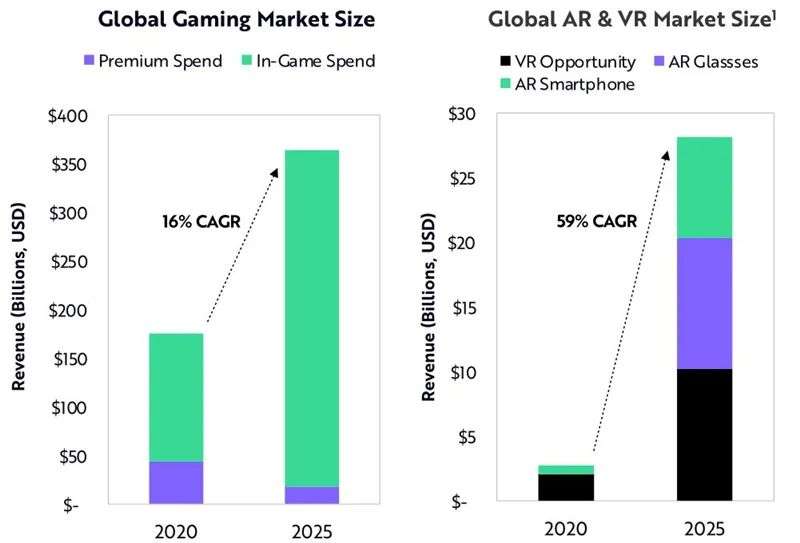

According to ARK's research, the revenue of the virtual world will grow by 17% every year, from about 180 billion US dollars now to 390 billion US dollars in 2025.

Today, virtual worlds are independent of each other, but in the future, they may operate with each other, eventually forming what futurists think of as the "Metaverse" world.

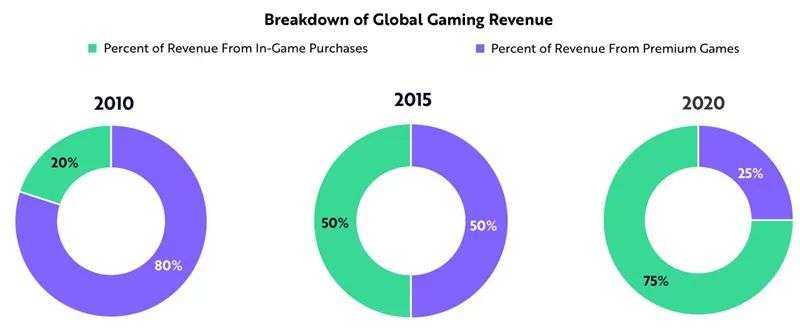

With the development of video games, their business models are constantly evolving, and now the profit model of video games is shifting to virtual goods. According to ARK's research, in the past 10 years, the proportion of in-game purchases in total game revenue has risen from 20% to 75%. By 2025, this proportion will reach 95%. Global game revenue breakdown

▲Global game revenue breakdown

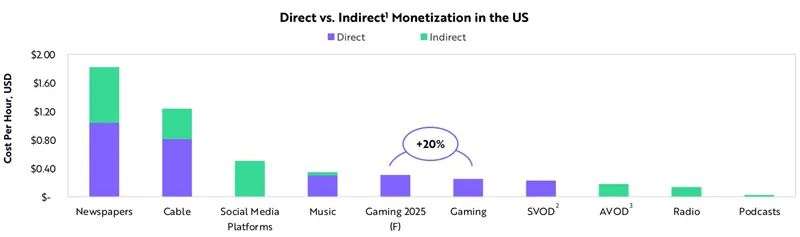

ARK believes that the profitability of the game will increase. In the next five years, the cost of playing video games per hour may increase by 20%, but it is still relatively cheap compared to other sources of entertainment and information.

▲Direct and indirect profits of American games

Now, video games are becoming the "third place" away from home and work. According to ARK's research, in the next five years, the average time spent playing video games will increase from 1.1 hours per person per day to 1.5 hours.

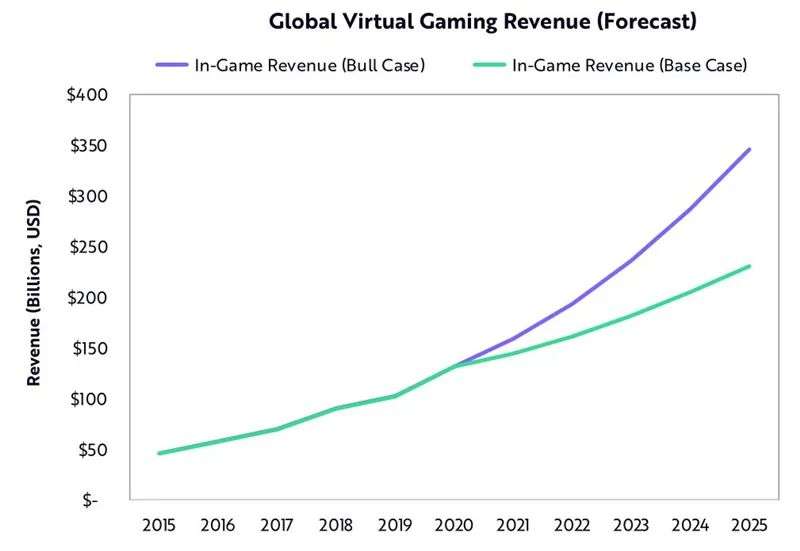

If the growth trend of profitability and investment time remains the same, then in-game in-game purchase revenue will increase by 21% annually in the next 5 years, from USD 130 billion in 2020 to USD 350 billion in 2025.

▲Global virtual game revenue forecast

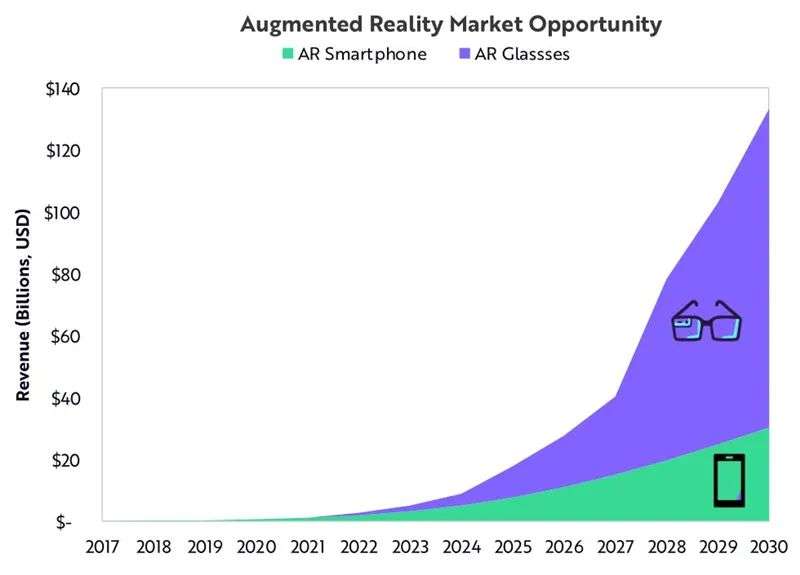

AR is ready for scale. In the past few years, companies such as Snapchat, Facebook, and Apple have increased their investments in augmented reality (AR), encouraging the widespread use of AR tools on mobile devices.

By 2022, consumer AR headsets will contribute to this trend. ARK predicts that by 2030, the AR market will expand from less than 1 billion Australian dollars to 130 billion US dollars.

▲AR market opportunity

"Virtual Reality VR" will become a real reality in 2030. Based on ARK's proprietary scoring system (UVI), the best VR headsets currently only reach 10% of human visual immersion.

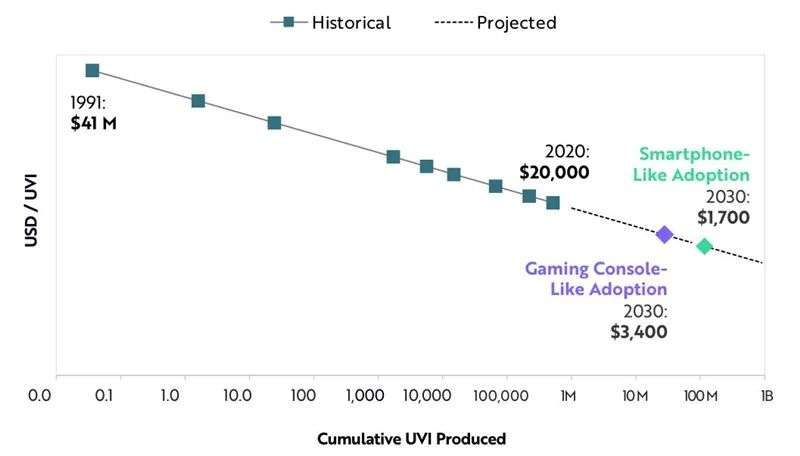

If consumer virtual reality is limited to the handheld gaming market, we believe that virtual reality headsets will not be able to expand to the human immersion capabilities of the mass market. According to Wright's law, when the price of a PC is comparable, complete visual immersion will require VR headsets to follow the usage curve of smartphones by 2030.

▲Declining trend of unit visual immersion (UVI) cost

By 2025, the revenue of the virtual world will be close to 400 billion US dollars. According to ARK's research, the global game market will grow at a compound annual growth rate of 16% in the next 5 years, from US$175 billion in 2020 to US$365 billion in 2025.

In the next five years, the AR and VR market will grow at a compound rate of 59% annually, from US$3 billion to US$28 billion in 2025.

▲The scale of the world game market, AR and VR market

04.

Digital wallet

The digital wallet represents a $4.6 trillion opportunity in the pocket. Venmo, cash applications and venture capital startups are digital wallets to disrupt traditional banking.

Today, digital wallets are beginning to penetrate all traditional financial services, including brokerage and loans. Digital wallets can become the dominant platform for business activities other than financial products.

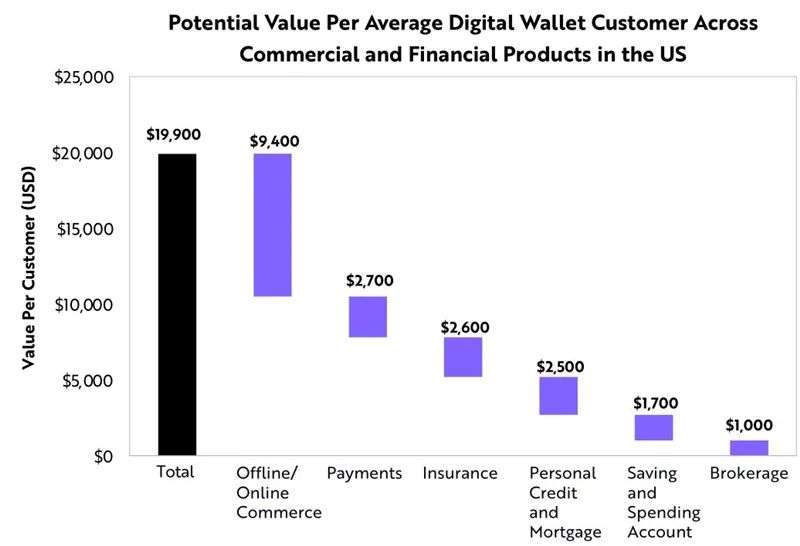

ARK's research shows that the current value of digital wallets is between US$250 and US$1900 per user, but by 2025, the value of digital wallets may expand to US$20,000 per user, which means that the United States will have US$4.6 trillion. Opportunity.

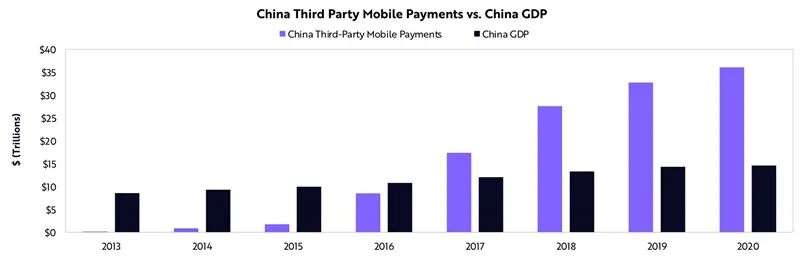

Mobile payment in China is already 2.5 times its GDP. In just five years, the scale of China's mobile payment has increased by more than 15 times, from approximately US$2 trillion in 2015 to an estimated US$36 trillion, which is almost three times China’s GDP in 2020.

▲Comparison of China's third-party mobile payment and GDP

▲Digital wallets have become a global phenomenon

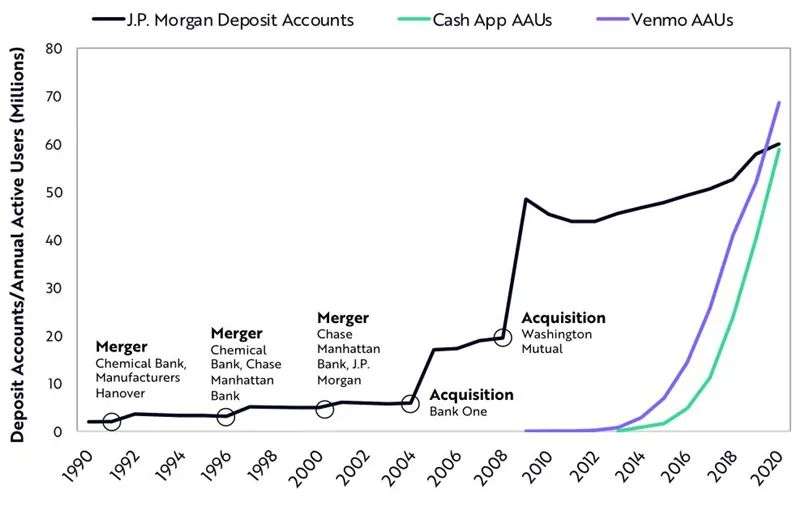

In the United States, the number of digital wallet users is surpassing deposit account holders in large financial institutions. Square's cash app and PayPal's Venmo have accumulated about 60 million active users in the past 7 and 10 years respectively. It took more than 30 years and 5 acquisitions for JPMorgan to reach this milestone. As of the end of 2020, the total number of JP Morgan Chase deposit account holders is approximately 60 million, while the annual active users (AAUs) of Cash App and Venmo have increased to 59 million and 69 million, respectively.

▲Comparison of JPMorgan Chase deposit accounts and Venmo annual active users (AAUs)

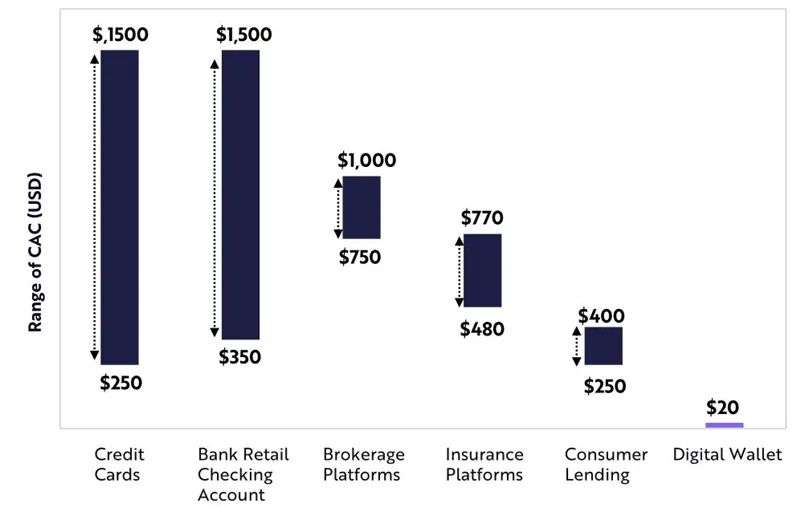

Digital wallets can acquire customers at a small cost. The main driving force for the explosive growth of digital wallets is lower user acquisition costs. ARK’s research shows that traditional financial institutions may have to pay about US$1,000 to obtain a new checking account customer, while the investment in digital wallets is only US$20. This is due to the viral peer-to-peer payment ecosystem, smart marketing strategies and Significantly reduced cost structure.

▲Customer acquisition cost (CAC) across financial products

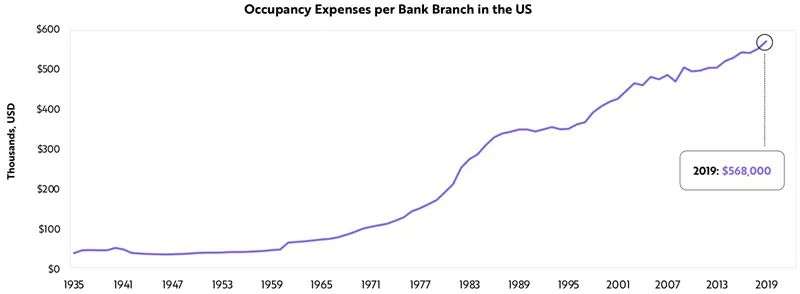

At the same time, the costs of banking institutions are rising, while their effectiveness is declining. As consumers abandon physical banks in favor of mobile banking, the occupancy fees of bank branches have increased, reaching a record US$568,000 in 2019.

▲Occupation fees of Bank of America

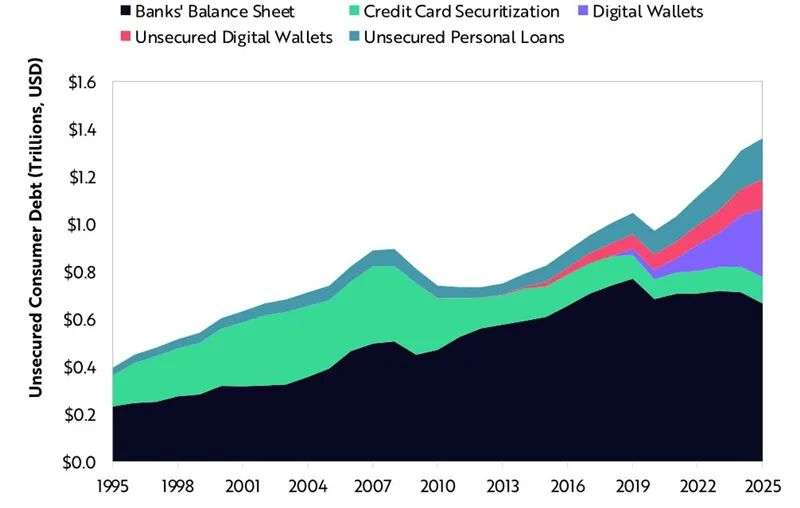

Traditional banks are facing potentially huge risks. Now digital wallets are entering the unsecured loan market, which means that traditional bank loans are unlikely to return to their peak levels in 2019. According to ARK's estimates, interest income from bank credit cards has fallen by more than 10%, to about 16 billion U.S. dollars in 2020, and may fall by more than 25%, from 130 billion U.S. dollars in 2019 to 95 billion U.S. dollars in 2025. Digital lenders such as Square, PayPal, Affirm, klarna, and LendingClub may steal share from traditional banks.

▲U.S. total unsecured consumer debt

After maturity, the value of each digital wallet user is approximately US$20,000. ARK estimates that if digital wallets become a consumer's financial dashboard, the net present value related to their financial services revenue will exceed the average US user by $10,000.

In addition to financial services, digital wallets may also become the leading platform for offline and online commerce, which may add another US$9,000 to US$10,000 to their net present value of revenue.

▲Average potential value of digital wallet customers in U.S. commercial and financial products

According to ARK's research, if the value of each of the 230 million digital wallet users in the United States reaches 19,900 US dollars by 2025, the value of the US digital wallet will reach 4.6 trillion US dollars.

05.

Fundamentals of Bitcoin

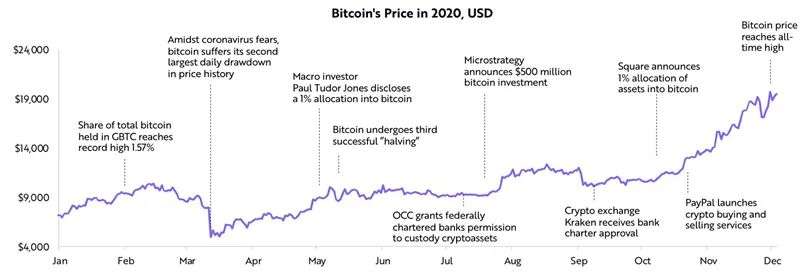

Supported by strong network fundamentals, the price of Bitcoin hit a record high. And ARK's research shows that its network fundamentals are still healthy.

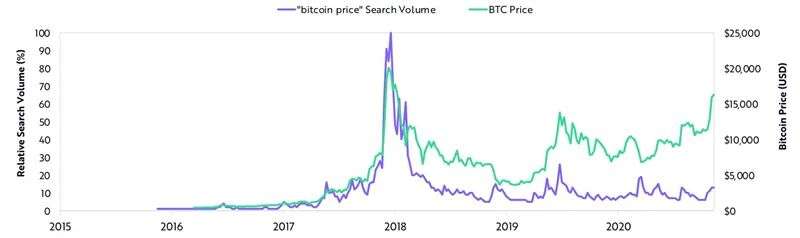

Judging from the search volume in 2017, the rise in the price of Bitcoin does not seem to be driven by hype. As Bitcoin seems to gain more trust, some companies are seeing it as cash on their balance sheets.

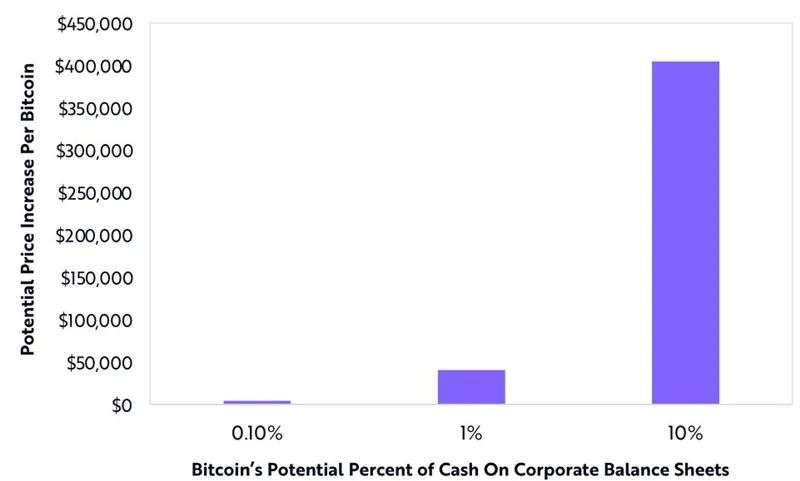

ARK estimates that if S&P 500 index companies spend 1% of their cash in Bitcoin, the price of Bitcoin will increase by approximately $40,000.

With the increase in support for the Bitcoin network, the price of Bitcoin hit a record high at the end of 2020.

▲2020 U.S. Bitcoin price

Bitcoin market participants have never been so concerned about long-term investment. As of November 2020, about 60% of the Bitcoin supply has not changed in more than a year, which proves the long-term concern of the market and also proves that Bitcoin holders are more confident.

▲Bitcoin "HODL" line

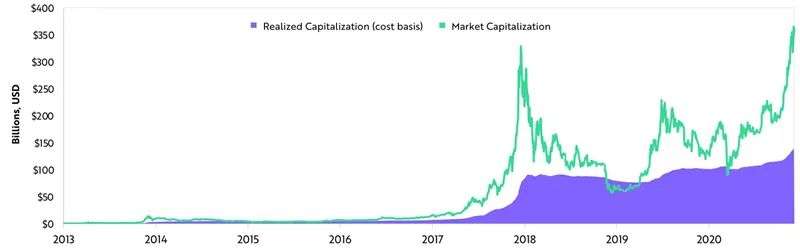

Moreover, the Bitcoin market and investor community seem to be maturing. Bitcoin's actual capitalization (measured by the holder's cost basis) has reached the highest level in history. The growing cost base indicates that early investors are taking profits, while new investors are establishing positions and creating higher levels of price support.

▲In 2020, the total cost base of Bitcoin hit a new high

In addition, compared to 2017, the hype surrounding Bitcoin seems to be under control. Relative to its price increase, Bitcoin's search interest is low. As the price of Bitcoin is close to the highest level in history, its Google search interest has reached 15% of the highest level in history.

▲ Comparison of Bitcoin price and search volume of "Bitcoin price"

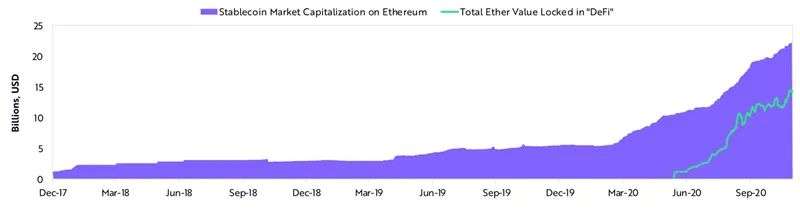

Bitcoin is accepted by more and more people, laying the foundation for Ethereum and a new round of financial experiments. ARK believes that decentralized finance is a positive catalyst for more adoption of the Ethereum network. By using Ethereum as collateral for "minimizing trust", market participants can relieve the intermediary role of traditional financial companies and obtain financial services such as credit and lending, market making, trading, custody, and investment.

▲Financial experiments on the Ethereum network

Bitcoin can play a key role as corporate cash. Both Square and Microstrategy have invested in Bitcoin on their balance sheets, which points the way for listed companies to use Bitcoin as a legitimate alternative to cash.

According to ARK’s research, if S&P 500 index companies allocate 1% of their cash to Bitcoin, its price may rise by approximately $40,000.

▲Assuming that Bitcoin will replace the cash on the balance sheets of S&P 500 index companies and the price will rise

06.

Bitcoin: preparing for institutions

ARK believes that the rapid growth of Bitcoin provides its positioning in the investment portfolio, and Bitcoin provides the most compelling risk return among assets. As ARM analysis shows, in the next 5 to 10 years, its network capital scale may expand from approximately US$500 billion to US$1-5 trillion.

In ARK's view, capital allocators should consider ignoring the opportunity cost of Bitcoin as a new asset class. ARK believes that Bitcoin should be strategically allocated in institutional investment portfolios.

Bitcoin is not bound by traditional rules and regulations, and is usually not related to the behavior of other asset classes. It seems to have won strategic allocation in a diversified investment portfolio. In the past 10 years, Bitcoin is the only major asset that has consistently low correlation with traditional asset classes.

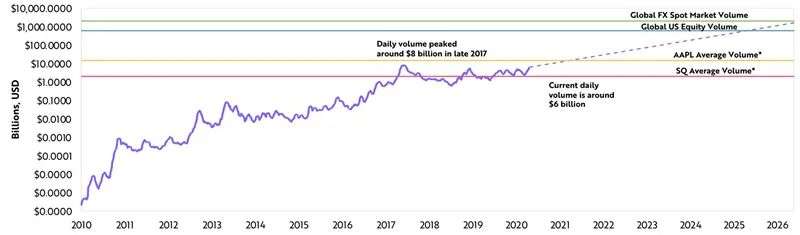

Bitcoin trading volume is comparable to that of large-cap stocks and is growing exponentially. ARK estimates that the daily trading volume of Bitcoin may exceed the trading volume of the U.S. stock market in less than 4 years, and the global foreign exchange spot market trading volume in less than 6 years.

▲The daily trading volume of USD on major exchanges in the Bitcoin spot market

Institutional investors can acquire Bitcoin in complex ways. In October 2020, the Chicago Mercantile Exchange (CME) Bitcoin open interest, that is, the total outstanding value of futures contracts hit a record high. This number has increased tenfold, reaching nearly $1 billion by 2020. The Chicago Mercantile Exchange is integrated into the established financial infrastructure, allowing all risk-appreciated investors to gain exposure.

▲ BTC futures open positions on the Chicago Mercantile Exchange

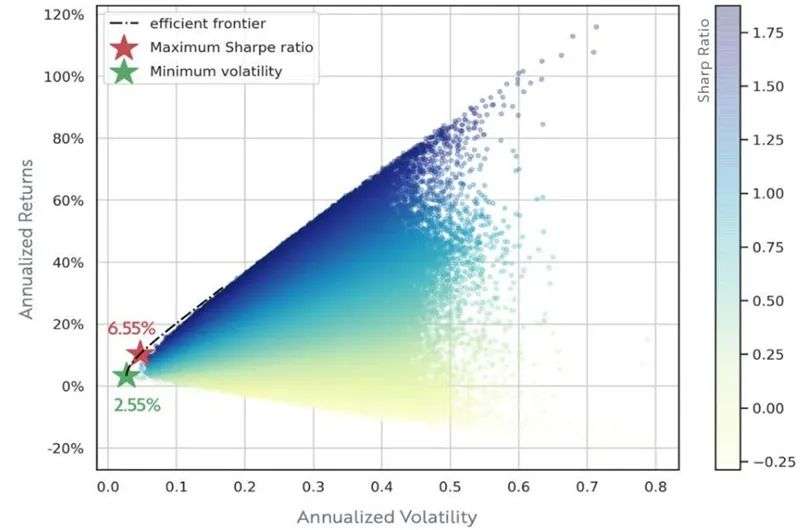

ARK believes that Bitcoin has already gained a certain share in the diversified portfolio. Based on the daily rate of return of each asset class in the past 10 years, ARK's analysis shows that Bitcoin should be allocated between 2.55% (when volatility is minimized) and 6.55% (when returns are maximized).

In the analysis of ARK, Monte Carlo simulation was performed on 1 million investment portfolios composed of various asset classes, as shown in the figure. The effective frontier refers to the highest return possible under a given level of volatility. The stars represent the allocations associated with the largest Sharpe ratio and the smallest volatility.

▲Simulated portfolio optimization based on daily asset class returns

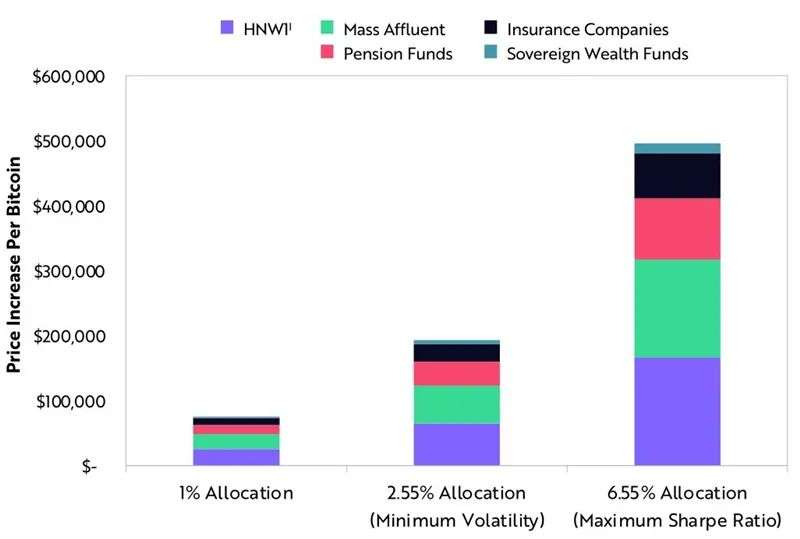

Institutional investment can have a significant impact on the price of Bitcoin. According to ARK's simulated portfolio allocation, an institutional allocation between 2.5% and 6.5% may have an impact of 200,000 to 500,000 U.S. dollars on the price of Bitcoin.

▲The hypothetical impact of institutional investment on Bitcoin prices

07.

electric car

Electric vehicle sales will increase substantially. The price of electric vehicles is approaching the parity of gasoline-powered vehicles. Leaders in the electric vehicle market are developing innovative battery designs to create lower-cost electric vehicles that can travel longer.

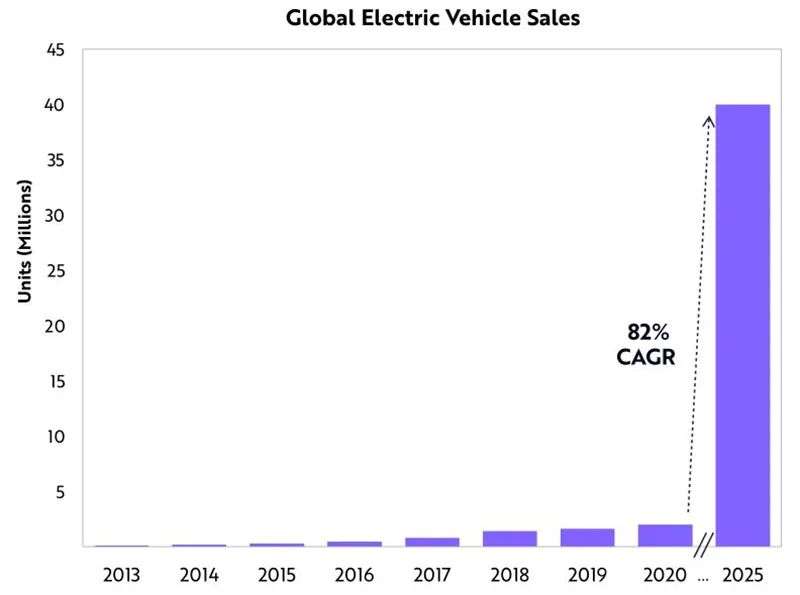

According to Lay’s Law, ARK predicts that by 2025, the sales of electric vehicles will increase approximately 20 times from 2.2 million in 2020 to 40 million.

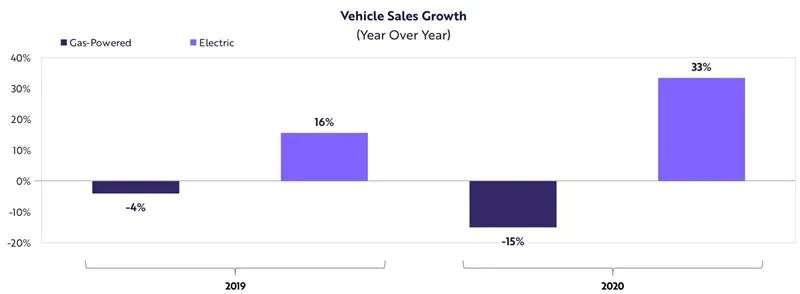

Whether it is during the boom or the difficult period, the sales of electric vehicles have occupied a significant market share. During the recent COVID-19 epidemic, gasoline vehicle sales have declined, but global electric vehicle sales continue to grow.

▲Global electric vehicle growth

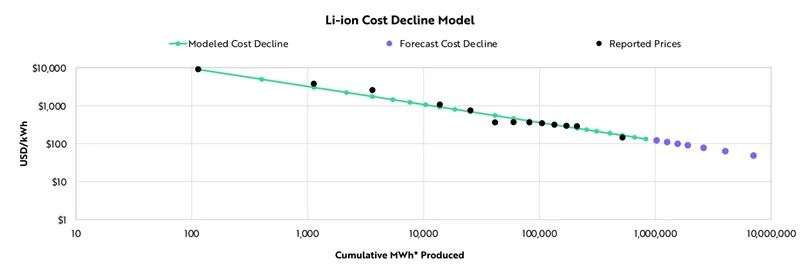

According to Lay’s Law, battery cost will drop by 28% for every doubling of battery output. The largest cost component of electric vehicles is the battery, so these cost reductions are crucial to achieving price parity with gasoline-powered vehicles. Leeds' Law successfully simulated the decline in battery costs.

▲Declining cost of lithium-ion batteries

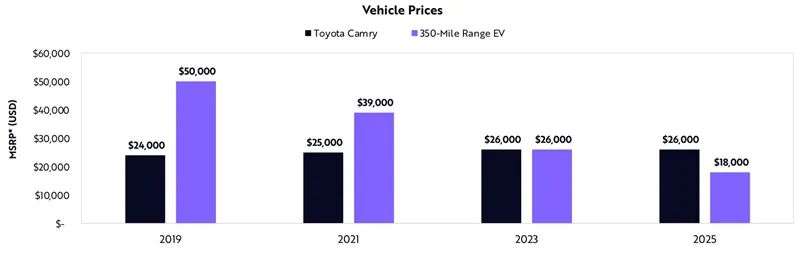

The price of electric vehicles is approaching the price of gasoline-powered vehicles. In 2019, the total cost of ownership of similar electric vehicles is lower than that of the Toyota Camry. Soon, the list price may also be the same.

▲Car prices

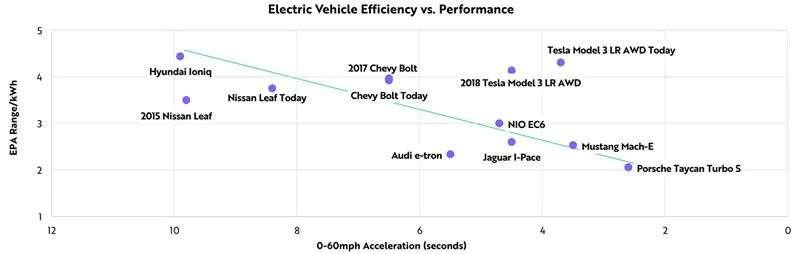

In addition to price, electric vehicles also compete in mileage and performance. The automotive market is shifting towards electric vehicles and autonomous vehicles. ARK believes that traditional automakers lack the software and electrical engineering talent needed to succeed.

▲Efficiency and performance comparison of electric vehicles

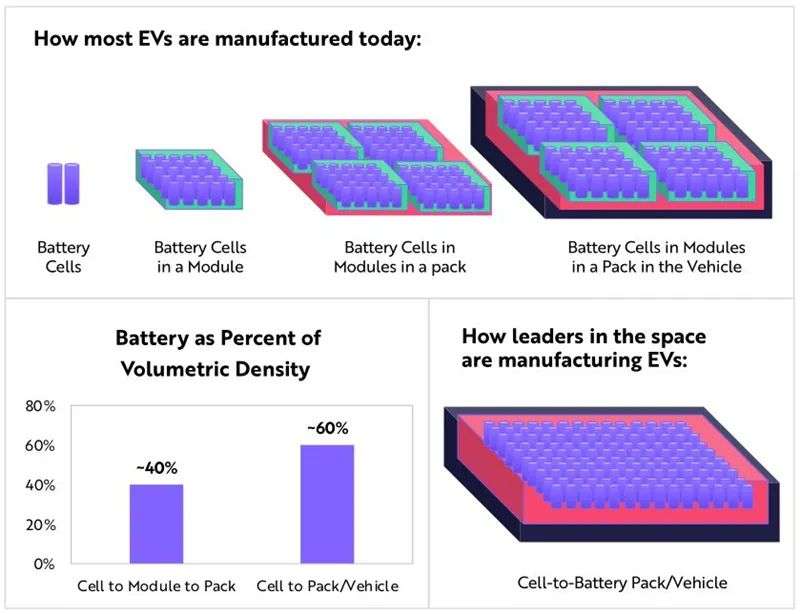

Compared with batteries integrated into modules and battery packs, the battery-to-car design increases the battery volume density by 50%. In the mass market, battery-to-car technology will enable electric car manufacturers to reduce the energy density and cost of batteries, and produce more kilowatt hours to increase the car's range.

With a given battery pack size, the "battery-to-car" technology should be able to achieve longer-distance cars at a lower price.

▲Electric car battery

If traditional automakers overcome these obstacles, by 2025, global electric vehicle sales will increase approximately 20 times from 2.2 million in 2020 to 40 million.

▲Global sales of electric vehicles

08.

automation

The era of robots is coming, creating more job opportunities. People are generally worried that automation will destroy employment opportunities, but ARK believes that automation will empower humans to increase productivity and wage growth.

Automation may transform unpaid labor into paid labor. For example, as food services become automated, they will transform food preparation, cleaning, and grocery shopping into marketing activities that include food delivery.

ARK believes that automation will increase US GDP by 5% in the next five years, or US$1.2 trillion. The US economy is at a level of automation similar to the US manufacturing industry in the early 1990s. Although it took about 25 years for the manufacturing industry to reach the current level of automation, ARK believes that in the next five years, the US economy will automate five times faster than it is now.

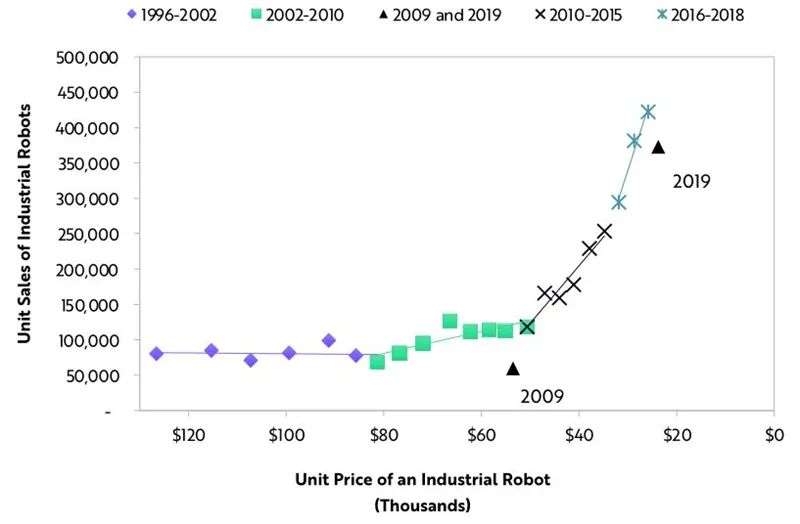

After the "great recession" in 2008/2009, perhaps affected by this, the demand for industrial robots has reached an inflection point.

The trade tensions between the United States and China may have added to this momentum before COVID-19 will cause headwinds in 2020.

According to ARK's research, short-term obstacles will not prevent a rebound in industrial robot sales, and may encourage companies to automate and cut costs more aggressively.

▲Price elasticity of industrial robots

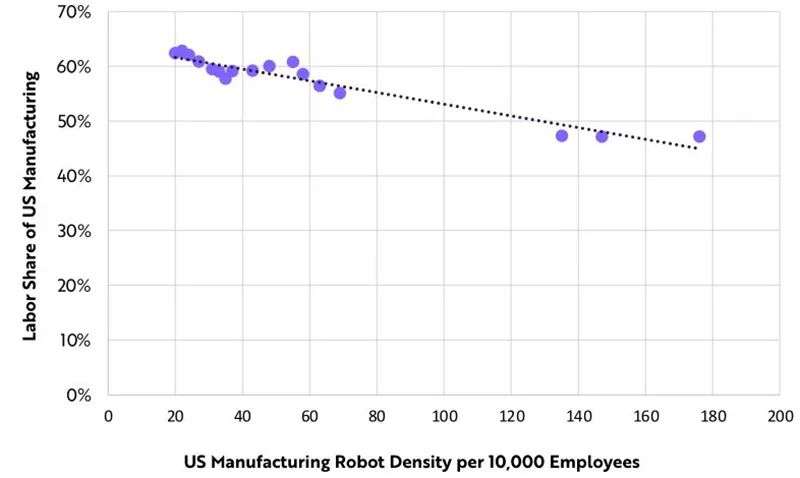

The decline in labor relative to capital does not necessarily mean that wages are falling. Conversely, output can grow faster than wages. Due to increased productivity and automation, ARK expects the following four results:

Higher wages: benefit employees;

Lower prices: beneficial to consumers;

Higher profit margin: good for the company;

Higher investment: create a virtuous circle.

▲U.S. manufacturing robot density vs. manufacturing labor share (1991-2015)

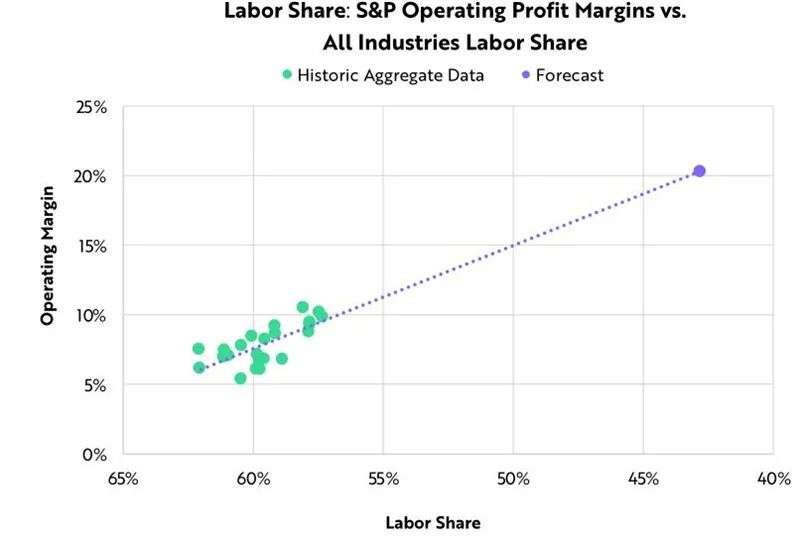

ARK's research shows that for every one percentage point decrease in the proportion of labor income in industry and agriculture , operating profit margins will rise by 30 basis points and 280 basis points respectively. You shouldn’t be surprised if you see similar relationships in all industries.

If the proportion of labor income drops by 15% like the manufacturing industry, then the operating profit margin may double to more than 20%.

▲Proportion of labor income: Comparison of S&P's operating profit margin and labor income of all industries

Between 1950 and 2000, 82% of the approximately 7 million agricultural unemployed people were unpaid family workers. Unemployment in an industry, or even in a major industry, does not mean that total employment will decline. With the rise of washing machine manufacturers and laundromats, washing machines have turned the time spent washing unpaid clothes into money.

As food services become automated, they will continue to transform food preparation, cleaning and shopping into marketing activities including food delivery.

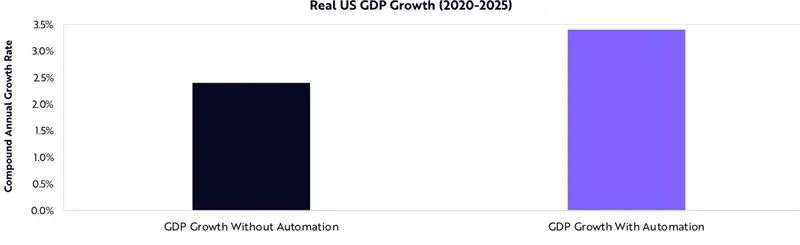

In the next five years, automation will increase US GDP by 5%, or $1.2 trillion. ARK believes that automation will increase the US real GDP growth rate by an average of 100 basis points per year to 3.4%.

▲The contribution of automation to U.S. GDP

09.

Autonomous driving car-hailing

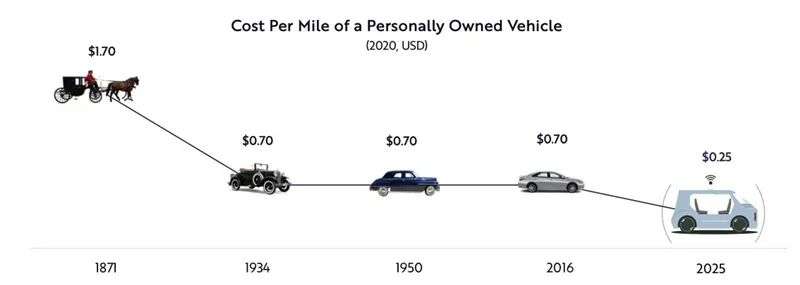

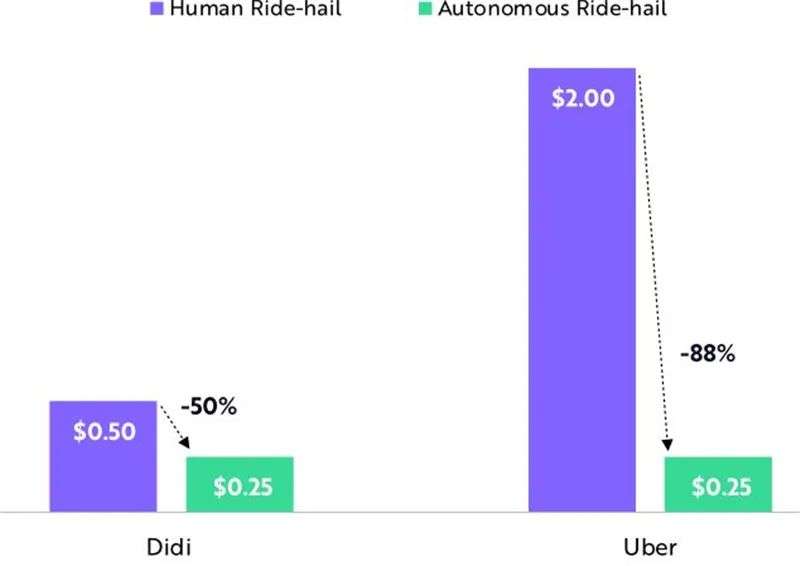

ARK believes that automated taxi-hailing services will reduce the cost of mobility to one-tenth of the current average cost of taxis, thereby promoting widespread adoption. After adjusting for inflation, the cost of owning and operating a private car has not changed since the Model T was off the assembly line. ARK estimates that if used on a large scale, the cost per mile of self-driving taxis is $0.25, which will promote its widespread adoption.

▲Travel cost per mile

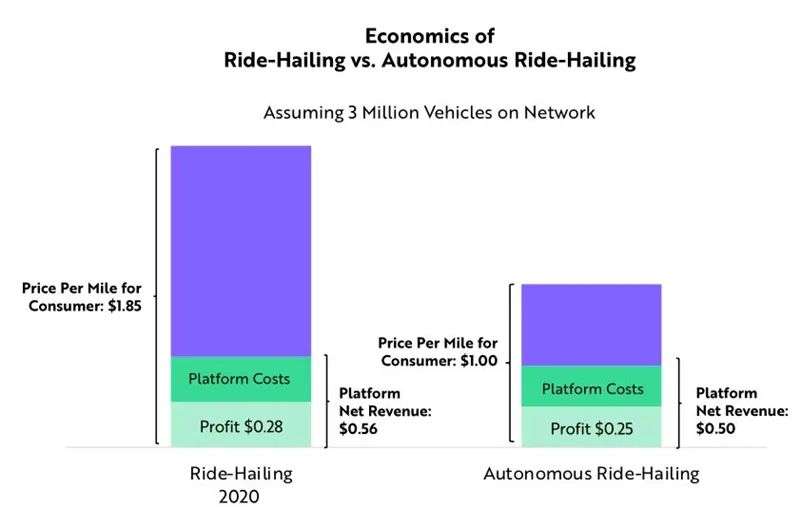

ARK's research shows that the current global revenue of the taxi-hailing market is about 150 billion US dollars, and the profit margin is as high as 50% in the outstanding cities.

Similarly, automated ride-hailing services can generate a 50% profit margin, but its lower price point will expand the revenue of the entire market from 150 billion US dollars to 60%, and reach 6-7 trillion US dollars by 2030.

▲Economic comparison between ride-hailing service and automatic ride-hailing service

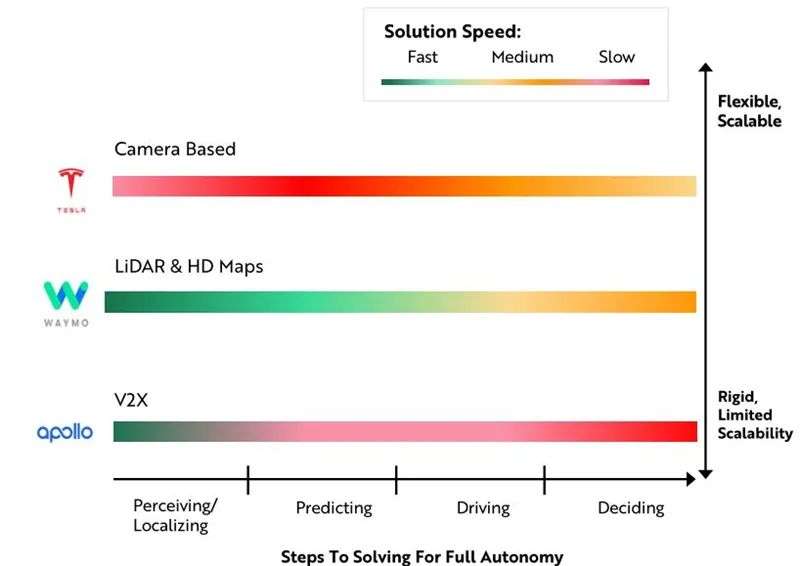

Three autonomous driving strategies are evolving:

Tesla's method is based on cameras. The camera's sensor accuracy is not as good as lidar, which makes the realization of a fully autonomous road a more difficult problem to solve. The camera does not rely on high-definition maps, and should be able to provide more scalable services. Tesla may become the first self-driving taxi network to expand nationwide.

Alphabet's Waymo uses lidar and high-definition maps. Waymo launched its own autonomous driving network in Arizona, but it may take time and a lot of resources to promote it nationwide.

Many Chinese manufacturers, including Baidu ’s Apollo, are building infrastructure sensors to help vehicles recognize road signs and traffic conditions. This kind of automated ride-hailing method requires a lot of infrastructure investment, and seems to be the most rigorous and least scalable of the three methods.

▲Comparison of three autonomous driving strategies

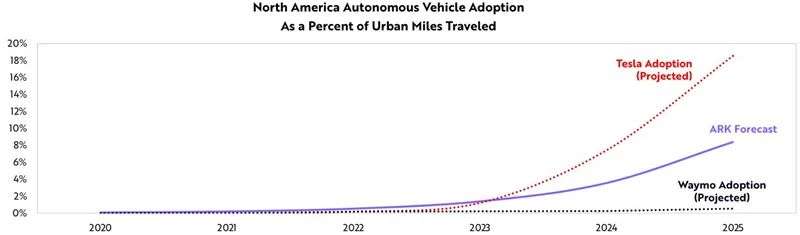

ARK estimates that if Tesla successfully launches an automated car-hailing service in 2022, the number of users will be close to 20% by 2025. If Waymo or GM succeeds, the adoption rate may be limited to 1% in the next five years.

▲Utilization rate of autonomous vehicles in North America as a percentage of city mileage

We believe that the cost of automated ride-hailing services will be reduced by approximately 90% and 50% in the United States and China, respectively. Therefore, the demand response of developed countries to cheap autonomous travel may be higher than that of developing countries.

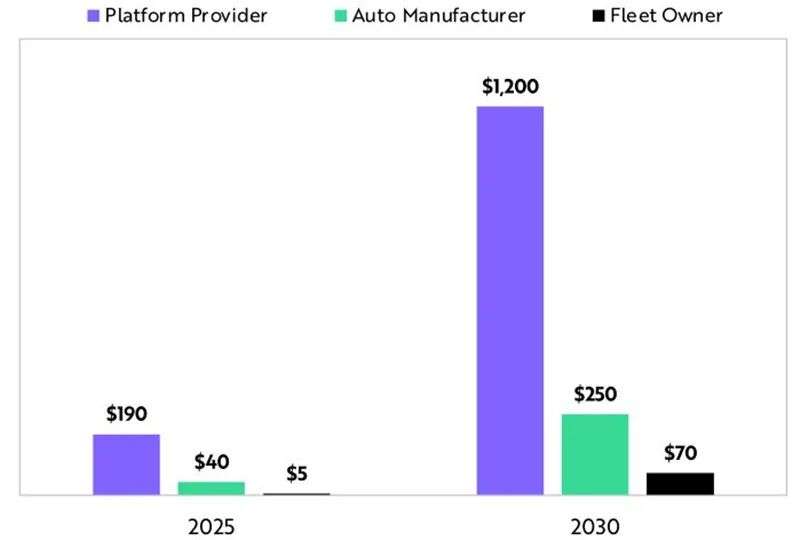

Platform providers, or companies with autonomous driving technology, should receive the largest share of the profits of automated ride-hailing services.

▲The average price per mile in China and the U.S. for manual vs. automated rides

ARK believes that by 2030, the annual operating profit of automated ride-hailing platforms will exceed $1 trillion. Automakers with successful electric vehicle platforms, working with autonomous driving technology providers, can generate approximately $250 billion in profits each year by 2030.

By 2030, fleet owners with automated ride-hailing service vehicles can generate approximately $70 billion in revenue each year.

By 2025, the enterprise value of independent platform operators may expand to 3.8 tons.

▲Estimated operating profit of the entire autonomous value chain

10.

Drone delivery

UAVs will greatly reduce the cost of transporting goods and personnel. Lower battery costs and autonomous technology should power drones.

ARK believes that in the near future, drones will deliver packages, food, and even people faster and more convenient than ever. Drones may change shopping behavior, reduce travel time, and save lives.

ARK believes that by 2030, drone delivery platforms will generate approximately $275 billion in delivery revenue, $50 billion in hardware sales revenue, and $12 billion in surveying and mapping revenue.

Automated air travel has become possible and inexpensive. Battery technology is improving, enough to make the flight energy reserve in line with regulations, so that air taxis and air ambulances can be safely launched. In addition, improvements in machine learning technology have made autonomous flight possible, greatly reducing costs.

In the past two years, the Federal Aviation Administration (FAA) has launched the commercial drone industry by allowing companies to operate drones out of sight, and in some cases, to operate drone airlines.

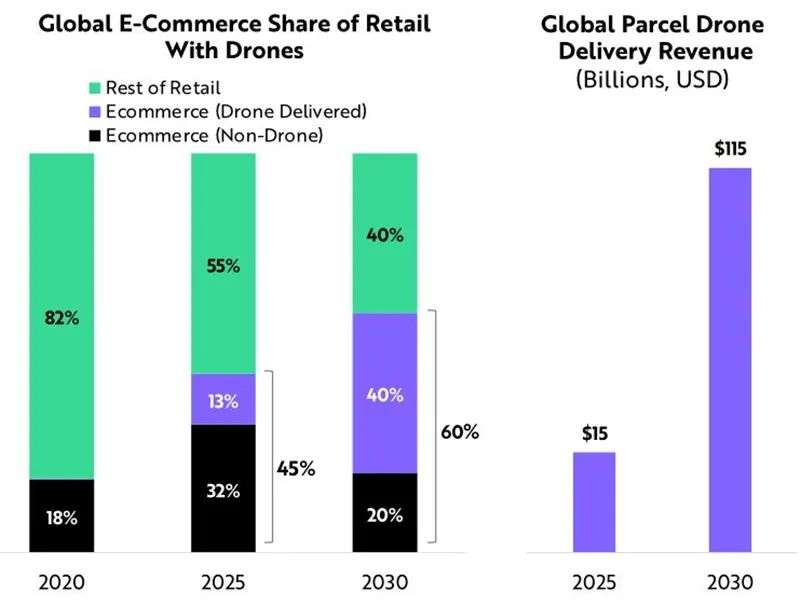

Florida is building the first UAV passenger vertical take-off and landing field in the United States, which is scheduled to be put into use in 2025. COVID-19 has accelerated the testing and adoption of e-commerce through non-contact drone delivery. ARK estimates that at some point in the next 5 years, drones will deliver more than 20% of packages.

▲The share of drones in global e-commerce retail

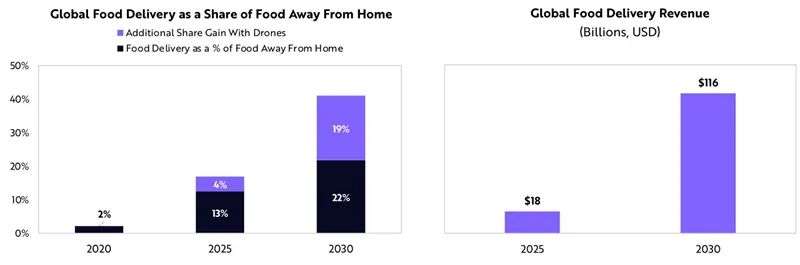

In 2020, global food delivery sales will grow by more than 40%. ARK's research shows that in about 40% of takeaway food, drone delivery will account for nearly half.

▲Global UAV takeaway revenue

ARK predicts that by 2025, the drone delivery platform will bring nearly US$50 billion in revenue, US$14 billion in hardware sales revenue, and US$3 billion in surveying and mapping revenue.

By 2030, the drone delivery platform may expand fourfold, generating approximately $275 billion in revenue, while hardware sales will nearly triple to nearly $50 billion, and the map business revenue will increase nearly fourfold to 120 billion. One hundred million U.S. dollars.

11.

Commercial Aerospace

The aerospace industry is taking off. Falling costs of rockets and satellites are disrupting an industry that was once considered monopoly and bureaucratic. Thanks to advances in deep learning, mobile connectivity, sensors, 3D printing, and robotics, the costs that have been inflated for decades have begun to fall. As a result, the number of satellite launches and rocket landings has surged.

According to ARK’s research, the Orbiting Space Opportunity—including satellite connections and hypersonic flight—will exceed $370 billion a year.

The aerospace industry will have three major uses in the future:

1. Connecting to the world: About 50% of the world's population lacks Internet connectivity, but with the increase in the number of satellites, cloud computing will go global.

2. Hypersonic point-to-point travel: With the reduction of long-distance flight time from more than 10 hours to 2-3 hours, the global economy may change.

3. Space migration: Humans have lived on the International Space Station for 20 years. Within ten years, humans will be able to settle on the moon and Mars.

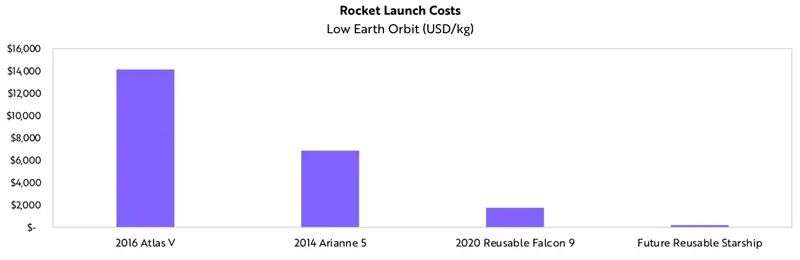

Reusable rockets can reduce launch costs by an order of magnitude. So far, SpaceX has successfully launched the same Falcon 9 rocket booster eight times.

▲Rocket launch cost

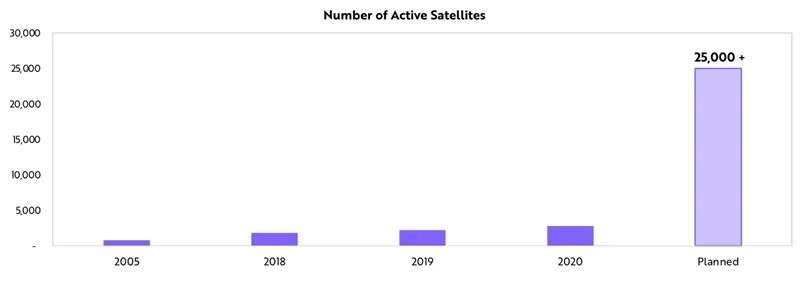

Lower satellite launch costs can achieve continuous global coverage with lower latency. Although satellites launched into geostationary orbit (GEO) attempt to provide global coverage, the delay limits their ability to provide compelling broadband Internet services. Today, many companies are starting to launch thousands of satellites in low earth orbit (LEO) to achieve continuous global coverage with low latency.

Due to lower launch costs, the number of satellites scheduled to enter orbit has increased significantly. With the launch of satellite networks and the use of data to serve terrestrial enterprises, satellites can promote GDP growth.

▲Change in the number of satellites at work

In the next 5-10 years, the U.S. satellite broadband revenue will be close to 10 billion U.S. dollars per year, and the world will reach 40 billion U.S. dollars. According to ARK's research, the opportunity to spend $40 billion to provide services to people who cannot access is only a small part of the satellite broadband market.

By 2025, the size of the market connecting airplanes, trains and cars may reach 36 billion U.S. dollars. Governments around the world are likely to further increase the demand for space services. In the medium term, the total value of the satellite connection market will reach US$100 billion per year.

Ark expects that the demand for hypersonic flight will rise sharply. According to ARK’s research, passengers on short-haul flights are willing to pay approximately $15,000 for every two hours saved on private jets.

Based on the economic situation of the short-haul flight market, ARK estimates that passengers and businesses are willing to pay $100,000 to save 13 hours of private hypersonic flight from New York to Japan for 2-3 hours.

If 2.7 million passengers pay about $100,000 for long-distance hypersonic flights, the market’s annual revenue will expand to $270 billion.

12.

3D printing

3D printing saves time, cost and waste, while creating a new component architecture. 3D printing is a manufactured layer by layer creation additive manufacturing mode body, the conventional manufacturing different subtraction, subtraction conventional manufacturing material is removed from a larger block.

3D printing shortens the time between design and production, transfers power to designers, and reduces the complexity of the supply chain at a fraction of traditional manufacturing costs.

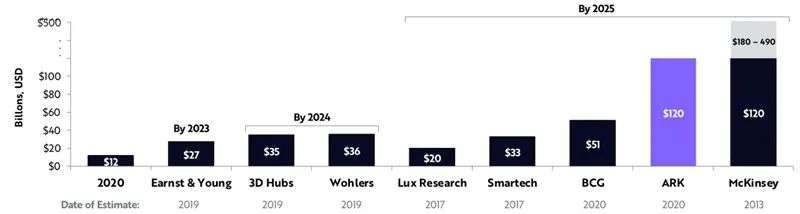

ARK believes that 3D printing will bring a revolution to the manufacturing industry, with an annual growth rate of about 60%, increasing from US$12 billion last year to US$120 billion in 2025.

Revenues from 3D printing declined in 2020, but new users took advantage of this technology during the epidemic.

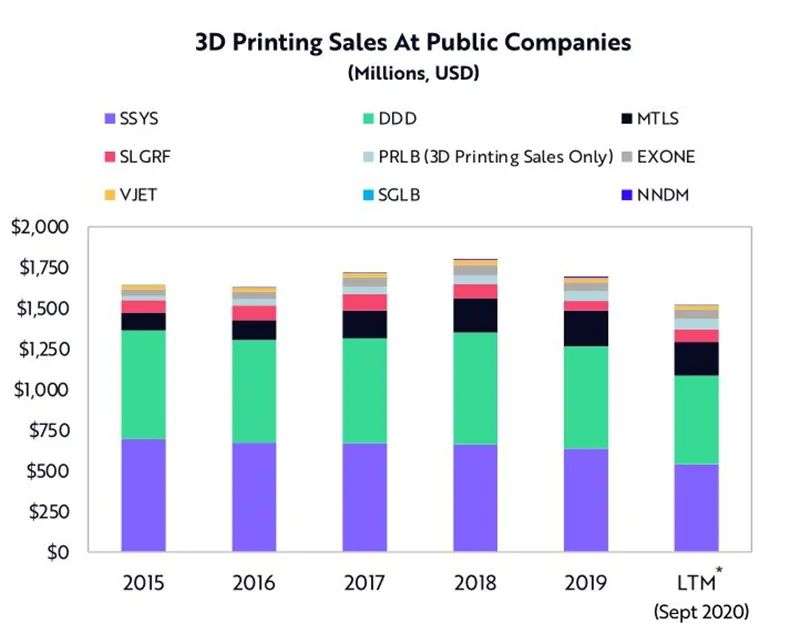

▲Sales of 3D printing in listed companies

Due to breakthroughs in autonomous driving technology and battery technology, the number and designs of aircraft are increasing sharply. Due to low cost and rapid prototyping, 3D printing is accelerating innovation. It reduces the weight of small and highly complex parts and saves a lot of costs. The aerospace industry should be the main beneficiary.

ARK estimates that by 2025, the total revenue of drone hardware will reach about $100 billion.

▲Various forms of drones

The fusion of 3D printing and artificial intelligence makes possible highly optimized designs that cannot be achieved by traditional manufacturing. ARK believes that the global 3D printing market will grow at a compound rate of 60% per year in the next five years, from US$12 billion to about US$120 billion in 2025.

▲Global forecast of the 3D printing market from 2020 to 2025

13.

Long Read Gene Sequencing

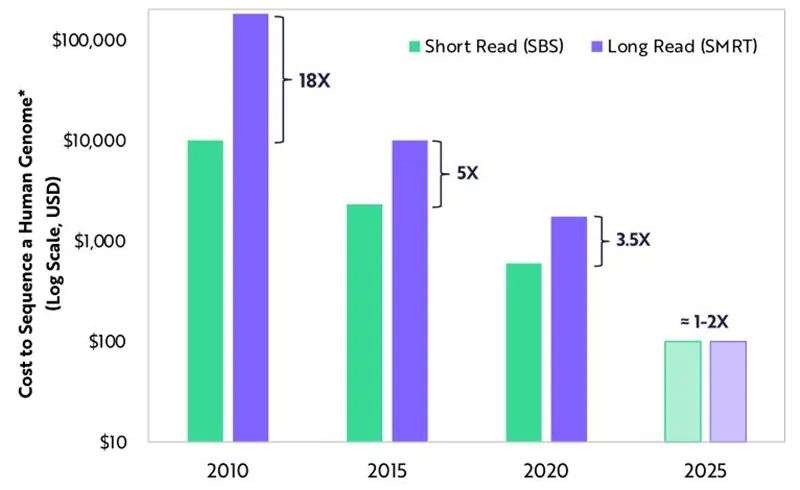

Long-read gene sequencing (LRS) can provide a more complete picture of the human genome. Next-generation DNA sequencing (NGS) is the driving force behind the genome revolution. Although short-read sequencing (SRS) has historically dominated, we believe that long-read sequencing will gain market share at a faster rate.

ARK believes that compared with short-reading platforms, long-reading technology provides higher accuracy, more comprehensive variant detection and a richer feature set. By the end of 2025, highly accurate long-read and short-read sequencing will be close to cost parity.

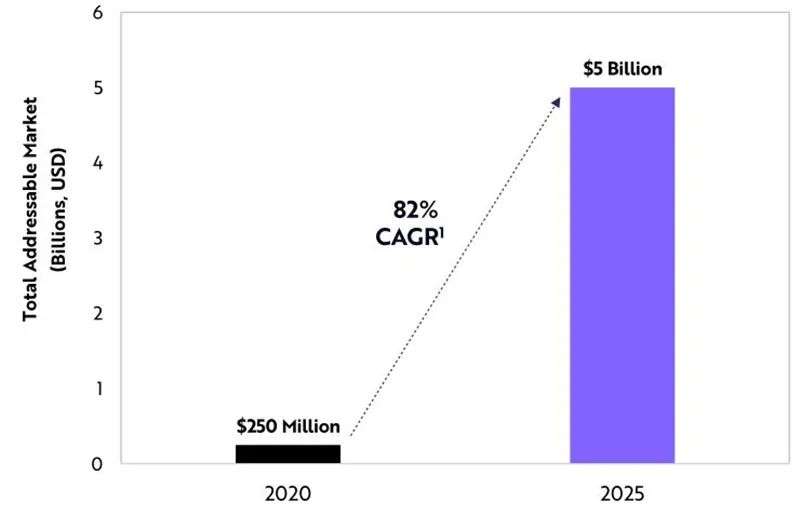

ARM estimates that the company's long-term revenue will grow at an annual rate of 82%, from $250 million in 2020 to about $5 billion in 2025.

The genome "toolbox" is expanding to provide a more comprehensive, richer, and more accurate perspective of biology.

The LRS and SRS systems have three things in common: (a) Decompose the genome into smaller fragments; (b) Use high-resolution optical analysis of the fragments; (c) Use efficient computer algorithms to reassemble the genome.

SRS mixes many small (150-bp) fragments (called reads) into a consensus sequence. This method can capture small mutations, but cannot detect larger recombinations, so-called structural variations, or mutations hidden in repeated genomic regions.

The old LRS system measures larger reads (>10,000 bp), and although it is less accurate at the level of each base, it provides a more complete picture of the genome.

As the cost of LRS is similar to that of SRS, many clinical applications may turn to LRS. Under the catalysis of deep learning algorithms, such as Google (GOOGL) DeepVariant, synthesis methods and nanopore-based LRS methods can all rapidly improve performance.

Although currently not so precise at the level of each base, nanopore-based LRS can generate the entire human genome sequence at a cost of about $500-more cost-effective and effective than SRS.

Although it is more expensive, according to the results of PrecisionFDA Truth Challenge V2, synthetic-based LRS is 2.5 times more accurate than SRS and 30 times more accurate than nanopore-based LRS.

▲By 2025, the cost of LRS and SRS based on synthetic technology will be close to parity

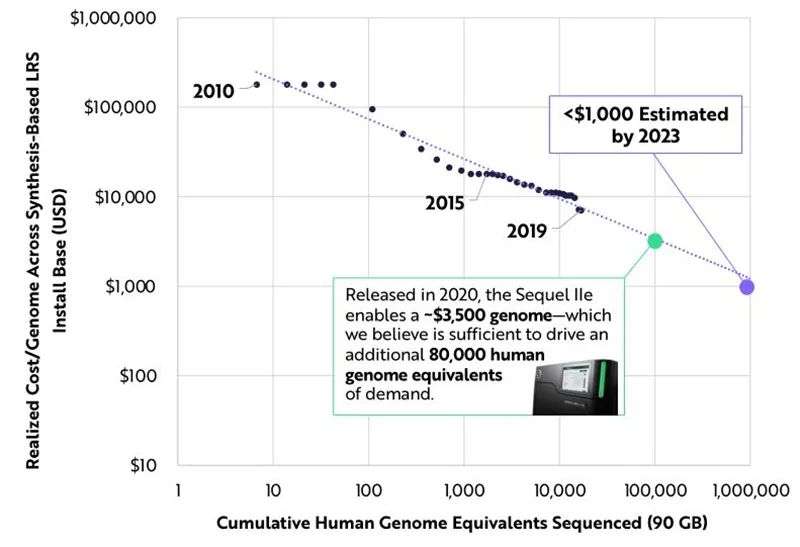

According to Layd’s Law, every time the data generated on the basis of its installation doubles, the cost of synthetic-based LRS will drop and will continue to drop by 28%.

Mainly due to the increase in cost and throughput, the unique capabilities of LRS should inspire wider adoption. The advantages of LRS are: (a) does not require amplification; (b) can detect methylation naturally; (c) can span all RNA molecules.

According to ARK estimates, the cost of using long-read technology to sequence the entire human genome will drop to US$100 to US$200. By the end of 2025, the technology will be more accurate than SRS in all variants.

▲Synthetic-based LRS market (SMRT) follows Layd's law

ARK believes that LRS analysis is superior in many sequencing applications. Some clinical applications, such as rapid whole-genome sequencing (WGS) in pediatric intensive care settings, have a high reimbursement rate, allowing diagnostic providers to switch to LRS more flexibly.

Genetic variations of various sizes-from small to large-exist in genomic regions that are easy to sort and difficult to sort, and can affect the phenotype of patients. In ARK's view, the LRS tool provides the most comprehensive variant detection, regardless of sequence background.

ARK predicts that by 2025, the LRS market will grow at an annual rate of 82%. ARK believes that the demand for LRS is reaching an inflection point due to the reduction of sequencing costs and the need for high precision and complete results.

Including sequencing consumables, instruments and services, LRS’s revenue will increase from US$250 million to US$5 billion by 2025.

SRS will continue to dominate the sequencing market, especially as liquid biopsy becomes the standard of care in oncology.

▲LRS market size

14.

Cancer screening

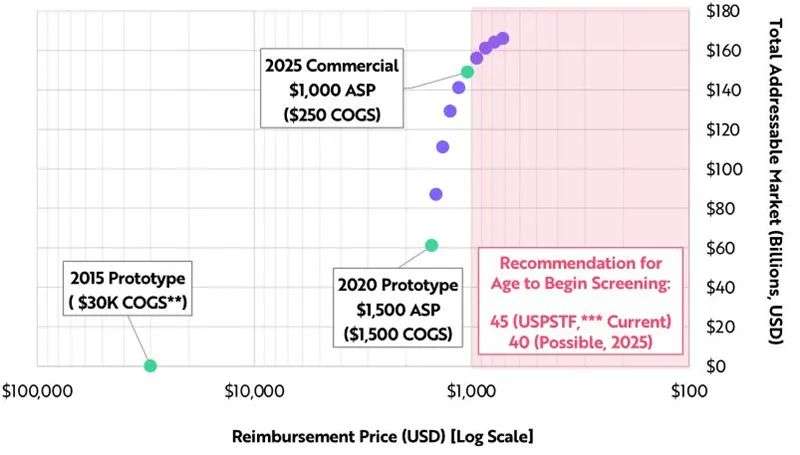

Liquid biopsy can reduce cancer mortality more than any medical intervention in history. According to ARK’s research, the fusion of innovative technologies has reduced the cost of screening for multiple cancers from US$30,000 in 2015 to US$1,500 today, a 20-fold decrease, and by 2025 it will drop by more than 80% to US$250 .

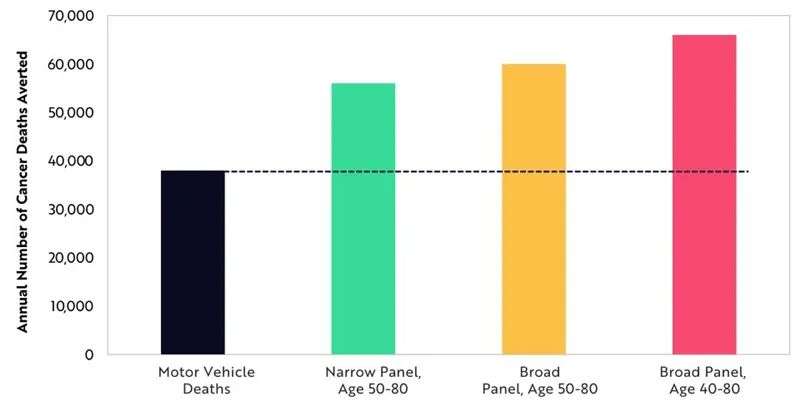

Therefore, the screening market for multiple cancers in the United States will expand to US$150 billion. In the United States, a multiple cancer screening program can prevent 66,000 cancer deaths each year and save 1.4 million lives each year.

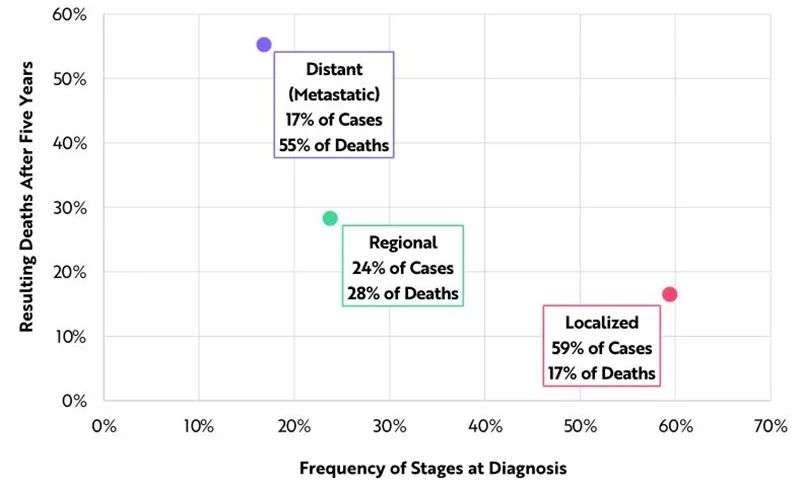

All solid tumors follow a predictable path, from locally treatable to metastatic and fatal, which provides a basis for early detection. Metastatic cancer only accounts for 17% of new cases, but it accounts for 55% of cancer deaths in five years. The weighted average 5-year survival rate for localized cancer is 89%, while the weighted average 5-year survival rate for metastatic cancer is only 24%.

Based on a single blood test, multiple cancer screenings can find dozens of early cancers. In addition to somatic mutations, circulating proteins, and immune signatures, machine learning algorithms have used DNA methylation as a new and highly sensitive biomarker for early cancer detection.

The rapid decline in the cost of next-generation DNA sequencing (NGS) has made liquid biopsy possible.

Advances in synthetic biology are helping clinicians find the faint signal of cancer in a noisy environment like blood.

▲The combination of innovative technologies is reducing the cost of screening

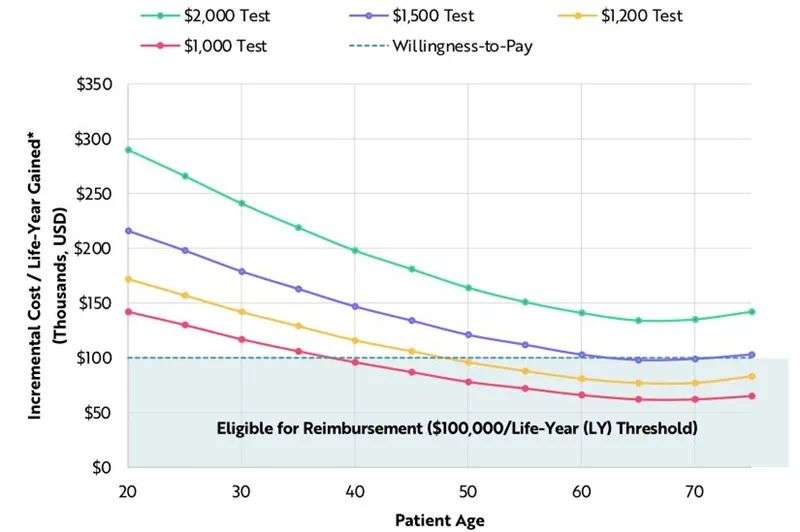

Due to the rapid decline in costs, the price of multiple cancer screenings has approached the reimbursable level. With the surge in clinical utility data of population size, ARK believes that the price tag of $1,500 will open up a variety of cancer screening markets for people aged 65 to 80, which is the age group with the highest incidence of cancer.

When the price drops below US$1,000, almost all people over the age of 40 can be effectively screened for cancer, saving 1.4 million lives each year in the United States alone.

▲Multiple cancer screening markets: cost and reimbursement

Multiple cancer screening based on routine blood combined with the improvement of single cancer screening can prevent 40% of metastatic diagnoses and increase local area diagnosis by 10%. ARK estimates that even if there is no improvement in cancer treatment, early intervention can prevent 66,000 cancer deaths each year in the United States alone.

▲Early detection can reduce cancer mortality

Although the unit price of US$1,500 can open the market, the unit price of US$1,000 may change the cancer mortality curve. The integration of innovative technologies has reduced the cost of screening for multiple cancers by a factor of 20, from US$30,000 in 2015 to US$1,500 today, and by 2025, it will drop by 80% to US$250.

If fully adopted, multiple cancer screenings will expand to a $150 billion market in the United States alone.

▲Multiple cancer screening may be one of the largest genomics markets

15.

Second-generation cell and gene therapy

Although cell and gene therapy is still in its early stages, new cell and gene therapy innovations can increase the total target market for tumor therapy by more than 20 times.

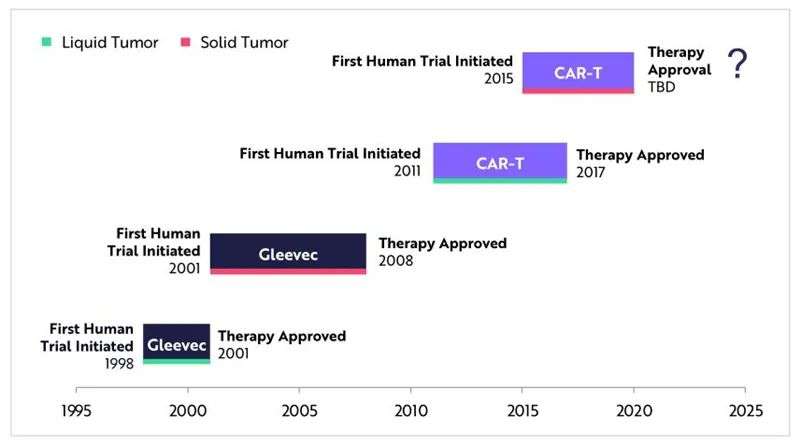

Usually, cancer therapies are first tested on liquid tumors. However, solid tumors account for 88% of diagnosed cancers. After 10 years of trials, the US Food and Drug Administration (FDA) approved oral chemotherapy Gleevec (Gleevec), of which 7 years were used for solid tumors. This timetable indicates that the FDA may approve the first CAR-T therapy for solid tumors in 2025.

Due to the emergence of artificial intelligence (AI), gene editing, and next-generation sequencing (NGS), the failure rate and time to market should decline, and the approval rate will also accelerate.

▲The schedule of cancer treatment

Oncology trials are shifting from autologous cell therapy to allogeneic cell therapy. Allogeneic cell therapy involves ready-made or donated cells, while autologous cell therapy modifies the patient's own cells.

One risk of allogeneic therapy is that the graft versus host disease causes the patient's immune system to attack the newly engineered cells. Despite this risk, allogeneic cells can promote early cancer treatment and reduce costs by an order of magnitude.

In today's gene therapy trials, 40% of the completed and 47% of the patient recruitment phase are allogeneic. In ARK's view, the transition to allogeneic testing will continue.

Gene therapy can shift from in vitro editing to in vivo editing. Transform the cells outside the patient's body in vitro, and then transplant them back into the patient's body. In vivo gene therapy changes the cells in the patient's body.

Unlike in vitro therapy, in vivo therapy cannot examine edited cells before transduction. In other words, in vivo gene therapy is more economical and easier to manufacture and scale up. It also allows more organs to enter the liver, eyes, central nervous system (CNS) and muscles.

Since 2010, gene therapy and editing trials have increased fivefold. So far, the FDA has only approved 10 gene therapies. As of the end of 2020, 712 active gene therapy clinical trials are in progress, of which 238 were launched in 2020. After adjusting for typical trial failure rates, approximately 170 gene therapies may be approved and commercialized within the next ten years, and cellular and cellular immunotherapy can increase revenue by $250 billion.

Innovations in cellular immunotherapy, including TILs, TCRs, and CAR-T cell therapies, can increase the potential market by nearly three times, adding $30 billion to the current total potential market (TAM) of $13 billion. Allogeneic therapy makes it easier to apply cancer early and may increase TAM by $70 billion. The combination of cell therapy innovation and allogeneic cells can add an additional US$150 billion, and increase the total TAM of tumor gene therapy by about 20 times to more than US$260 billion.

In vivo gene therapy can allow gene editing to cure thousands of rare diseases over time.

No comments:

Post a Comment