Grayscale Investment is currently the world's largest digital asset management company. They have conducted research on Bitcoin investors for two consecutive years, aiming to make in-depth analysis on the changing attitudes and opinions of Bitcoin. It has been more than ten years since Bitcoin was born, and it has become one of the most concerned issues for investors, consultants, financial institutions, service providers, regulators and policy makers. As more and more stakeholders come to the discussion table of this emerging asset, it is bound to bring a variety of new perspectives and perspectives to the entire industry, and it will also help us better understand how digital currencies adapt to existing Global financial system. However, Bitcoin has not really integrated into people's daily lives, and its development is also in its early stages.

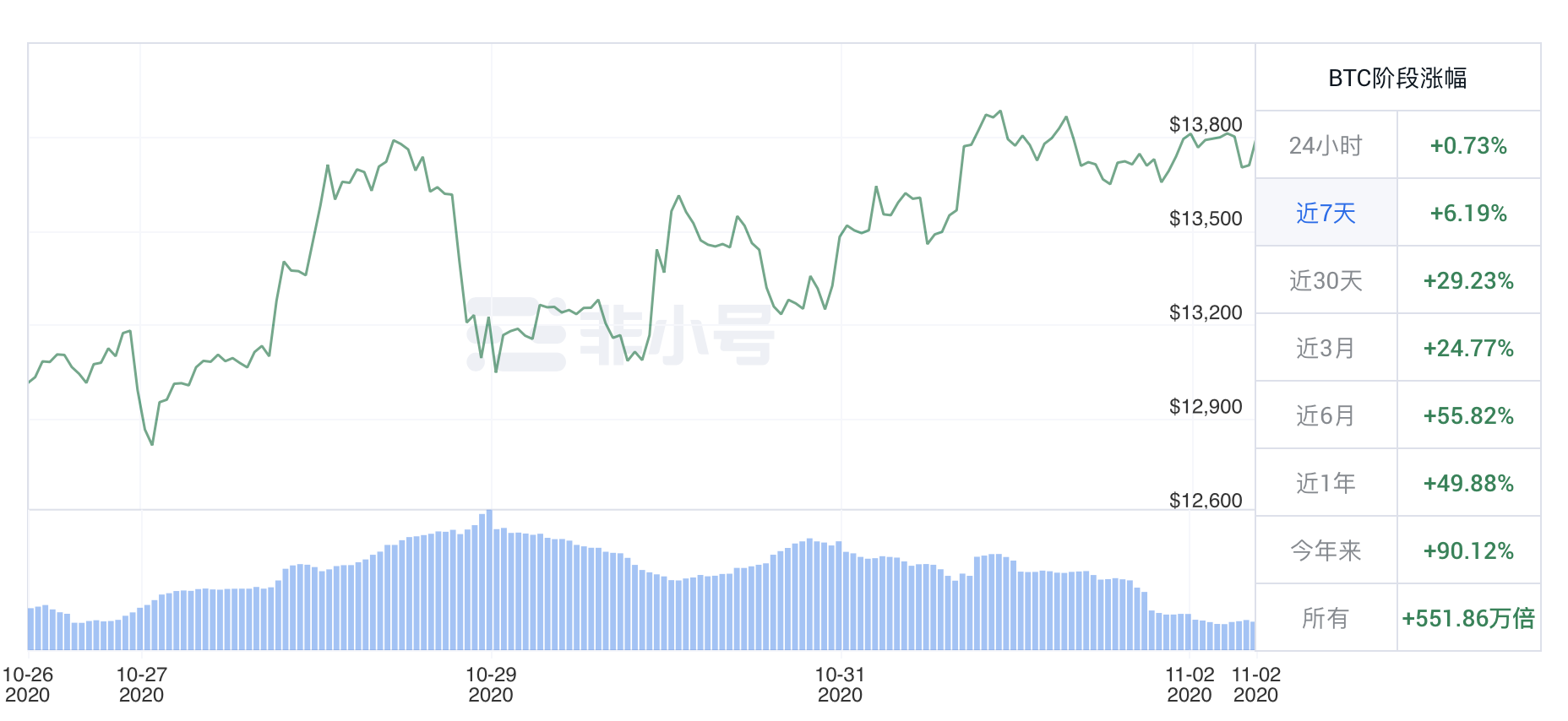

2020 is different from any previous year. The new crown virus epidemic and the subsequent economic recession force individuals, small businesses, large companies and governments to make major strategic adjustments in the short term, and also force investors to take corresponding measures. . According to Grayscale Investment's survey and analysis, people are more and more interested in safe harbor assets than in 2019-given the market situation, this trend is not surprising. As of October 27, the total scale of Grayscale Asset Management has reached 7.5 billion U.S. dollars. The transaction price of Bitcoin Trust Fund (GBTC) was 15.67 U.S. dollars per share, an increase of 8.97% from the previous day; the transaction price of Ethereum Trust Fund (ETHE) It was US$62 per serving, an increase of 7.98% from the previous day.

In addition, this year’s survey can also see that certain trends are still continuing. Although there are obvious differences in the market environment, no matter what type of investor you are, you need to fully understand the opportunities faced by Bitcoin as a new asset class. And challenges.

Survey conclusions and survey methods overview

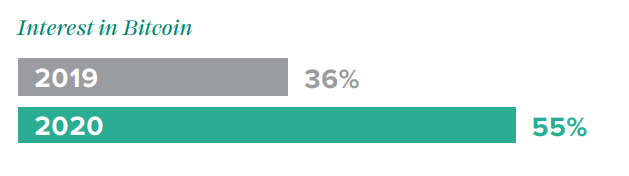

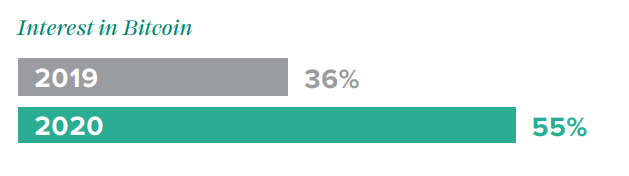

Grayscale Investment research found that people's interest in Bitcoin is rising. In 2020, more than half of American investors are interested in Bitcoin. In 2019, 36% of respondents expressed interest in Bitcoin investment products, and this year this number has increased significantly to 55% (more than half).

Investors are becoming more and more interested in Bitcoin, and the vast majority of Bitcoin investors have invested money in the past 12 months.

Grayscale Investment reports that 83% of Bitcoin investors will continue to invest in 2020, indicating that digital currencies have become an increasingly attractive component of modern investment portfolios. in particular:

1. 38% of Bitcoin investors have invested in the past four months;

2. 26% of Bitcoin investors have invested in the past 5-6 months;

3. 19% of Bitcoin investors have invested in the past 7-12 months;

4. 17% of Bitcoin investors have not invested money in the past year.

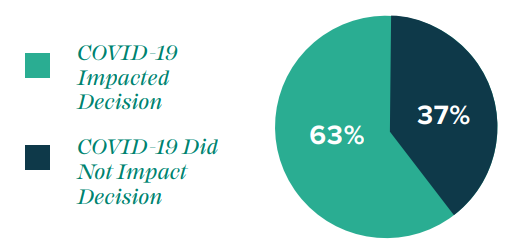

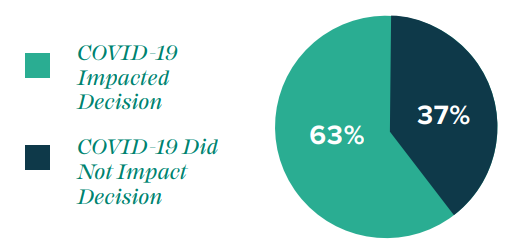

The outbreak of the new crown virus in 2020 is the main driver of bitcoin investment. 38% of bitcoin investors have invested in the past four months, and two-thirds of them said that the new crown virus epidemic prompted them to invest in bitcoin.

As shown in the figure above, 63% of the Bitcoin investment respondents surveyed stated that the decision to invest in Bitcoin was due to the impact of the new crown virus epidemic, and 37% said they were not affected by the epidemic.

Grayscale Investment stated that this survey was supported by 8 Acre Perspective. They conducted a survey of 1,000 American consumers between June 26, 2020 and July 12, 2020. The respondents were 25-64 years old. . All the interviewees participated in some form of personal investment, and their household investable assets were all above US$10,000 (excluding pensions and real estate), and their family income was all above US$50,000.

Bitcoin is being accepted by the mainstream

Although Bitcoin was only a niche asset that attracted a few investors in its early stages, it is now increasingly being accepted by mainstream investors. According to this year's Grayscale Investment survey:

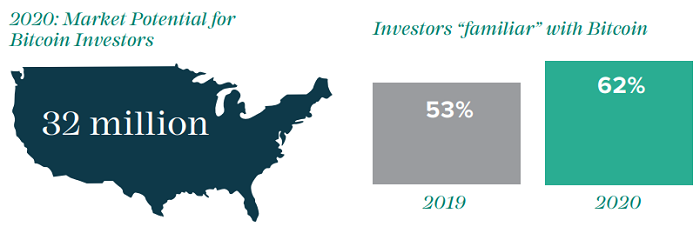

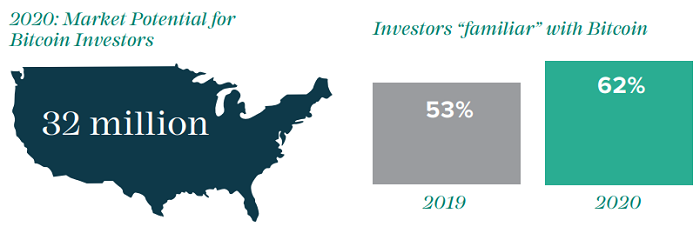

1. In 2019, the number of potential investors in the Bitcoin market was approximately 21 million, but in 2020 it has grown to 32 million.

2. In 2019, 53% of investors said they were “familiar” with Bitcoin, but this has increased to 62% in 2020.

3, more than 50 percent of respondents predicted that digital goods coin will become the mainstream in 2030.

In terms of demographics, there is not much difference between investors interested in Bitcoin and other types of investors, except that the average age of investors interested in Bitcoin is slightly lower-the average age is 42 years old, which indicates contrast The average age of investors who are not interested in Bitcoin is 49 years old. Apart from this, investors interested in Bitcoin look very similar to "normal" American investors in most other respects.

"Key Features" of Bitcoin Investors in 2020

From 2019 to 2020, although the number of investors who have shown interest in Bitcoin and those who are more and more familiar with Bitcoin has increased significantly, the "main characteristics" of these investors are still relatively consistent:

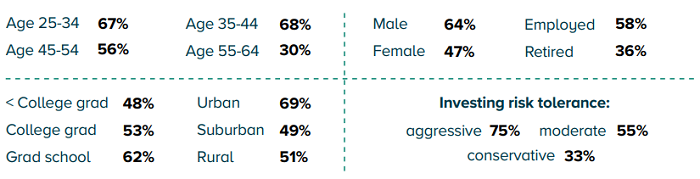

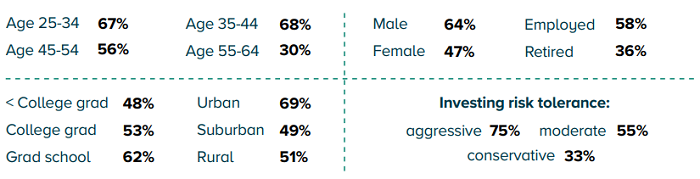

1. Compared with investors who are not interested in Bitcoin, most people who are keen to invest in Bitcoin are men, young people and employees;

2, Bitcoin investors, the highest proportion of people between the ages of 25-34, said Ming investment capital Bitcoin who have not yet entered into the "Revenue mature" stage;

3. Most investors who are interested in Bitcoin will also look for other investment opportunities. They have "active" risk tolerance, not only holding investment accounts in many companies, but also paying close attention to news hotspots in the consumer finance industry;

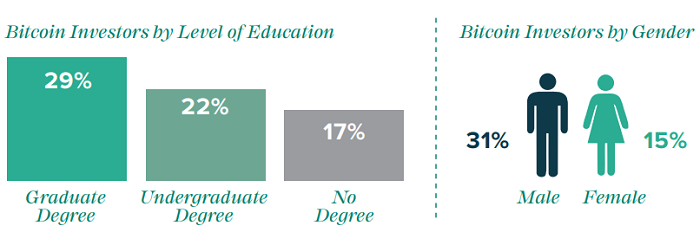

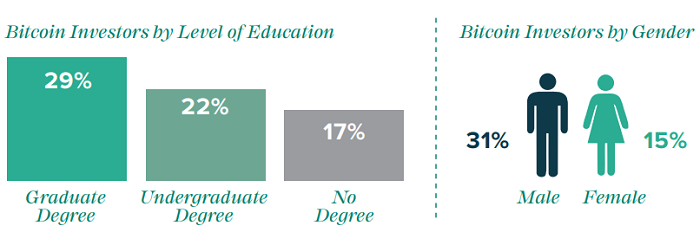

4. The higher the formal education that investors receive, the more likely they are to invest in Bitcoin. Among investors with a master's degree, 29% invested in Bitcoin; while those with a university degree Among investors, 22% invested in Bitcoin. It is worth mentioning that among all Bitcoin investors, only 17% have not obtained a degree from a higher school;

5. Among investors who have invested in Bitcoin (approximately 23%), there are twice as many men as women;

6. Among the female investors surveyed, 47% said they would consider trying bitcoin investment products (43% in 2019);

7. Among female investors interested in Bitcoin, 66% expressed a strong desire to invest.

Incentives for Bitcoin investment

Some of the factors that led to people's interest in Bitcoin in 2019 also resonated with many investors in 2020.

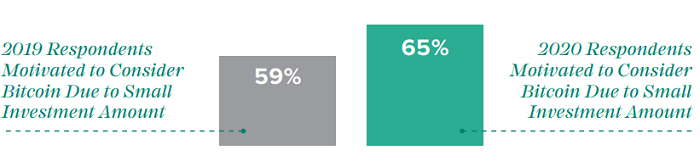

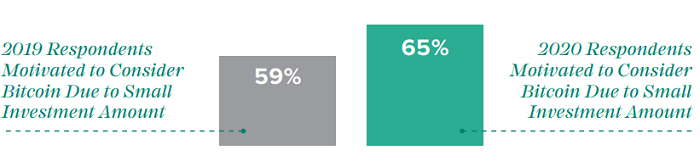

In 2019, 59% of respondents indicated that they would make a “small investment” in Bitcoin and are willing to invest more over time; by 2020, this proportion has increased to 65%. For people who have just entered the cryptocurrency market, this is indeed an important consideration, because Bitcoin is different from stocks and bonds. It is easy to buy a small amount of Bitcoin, and most stocks and bonds can only be done on the trading brokerage platform. Get "special" services for small transactions.

Bitcoin has been regarded as an asset with great potential for value-added, and it is also one of the important factors that more and more people are paying attention to. In 2019, 51% of investors regarded Bitcoin as an asset with potential for value-added; one year later, in 2020, this proportion rose to 59%-and among investors who are already interested in Bitcoin, This proportion is as high as 79%.

Investors seem to have "relaxed" their cautious attitude towards Bitcoin investment products, possibly because people's awareness and education levels have improved. In 2019, 69% of investors interested in Bitcoin said that a good investment record would affect their investment decisions. This number has dropped to 58% in 2020.

However, the market’s demand for Bitcoin “education” is still high. 58% of respondents said that if they can get more education related to Bitcoin, they will be more willing to invest. Given that more than half of American investors are interested in Bitcoin, financial advisory companies and other professional institutions should seize this opportunity to provide people with more education services on Bitcoin to cater to the growing investor base.

The COVID-19 pandemic has had a major impact on Bitcoin investment decisions

The new crown virus epidemic has already swept many countries around the world, and it has also had a greater impact on businesses and the investment community. According to Grayscale Investment's research report, two-thirds of the respondents who have invested in Bitcoin in the past four months said that the new crown virus epidemic has affected their decision to invest in Bitcoin. JP Morgan Chase (JPMorgan) analyst in August 2020 found that some retail investors, especially in the light cast funders main reason for choosing to invest Bitcoin is to respond to new virus outbreaks crown brings market uncertainty. When asked whether the new crown virus epidemic has more or less affected the choice of Bitcoin investment products, the number of people who answered “yes” was three times higher than the number of people who answered “no”.

According to the respondents’ answers, Bitcoin seems to have some things in common with safe-haven assets, such as:

1. Scarcity;

2. Verifiable;

3. There is not much correlation with the traditional financial market and it is out of control.

Therefore, investing in Bitcoin is similar to investing in traditional safe-haven assets. Investors interested in Bitcoin account for approximately 62%, of which:

1. The proportion of people who believe that they are certain (or likely) will make safe-haven investments during periods of market turmoil and economic downturn as high as 82%;

2. The proportion of Bitcoin as a "safe haven investment" is 38%, and the proportion who will definitely not consider Bitcoin as a "safe haven investment" is only 4%, and the others are somewhere in between.

What’s “interesting” is that the largest age group of people who see Bitcoin as a “safe haven asset” is 35-44 years old-this is not surprising, because they have experienced three recessions in the past few years , Has also witnessed that the performance of traditional hedging tools in market hedging is actually not satisfactory. As people's confidence in traditional "safe haven assets" is shaken, more and more investors will choose other more suitable alternative investment products, such as Bitcoin.

Financial advisors and Bitcoin opportunities

Financial advisors trusted by customers usually have a significant impact on their investment decisions, and this is also true in the Bitcoin market. 31% of respondents and 40% of investors who are considering investing in Bitcoin said that if financial advisers recommend Bitcoin to them, their willingness to invest will be stronger.

For financial advisers, the opportunity to cater to these investors is much greater than they thought. Nearly half (47%) of the respondents indicated that they would communicate with their financial advisors to make decisions about whether to use Bitcoin investment products. This means that financial professionals have a great opportunity to help clients incorporate Bitcoin investment products. In their portfolio. Among the respondents who have already developed interest in investing in Bitcoin, up to 75% said they would consider investing if their financial advisor recommended Bitcoin to them. Among all the investors interviewed, more than half (55%) said they would consider referring to the recommendations of financial advisers.

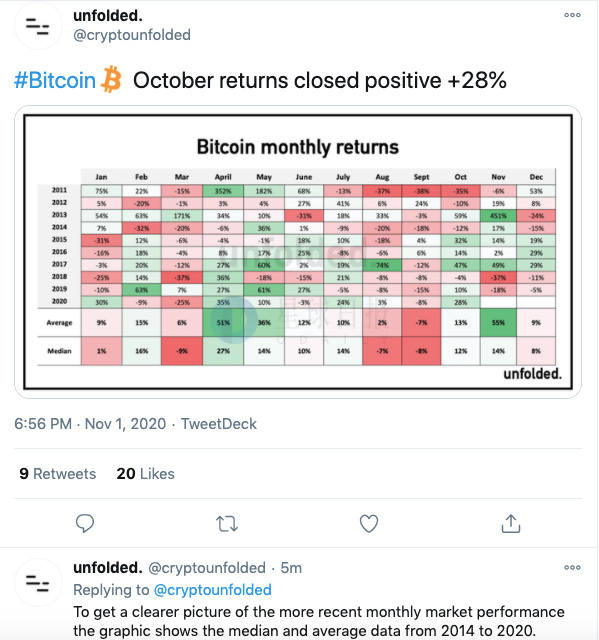

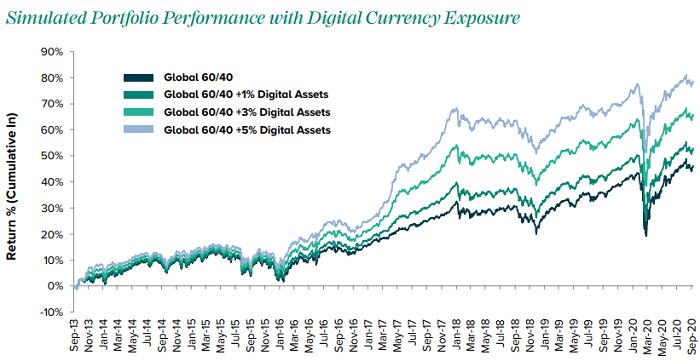

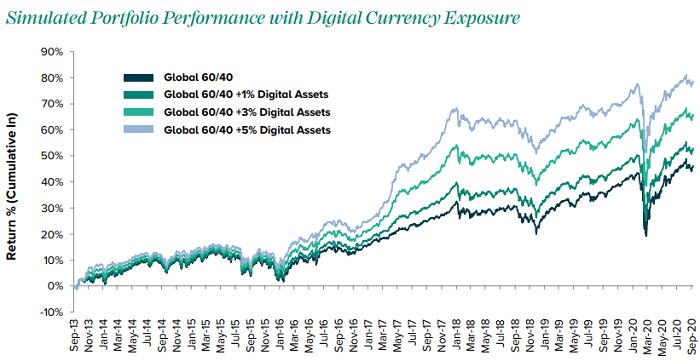

For investment consultants, time should be spent on self-education on digital currency, so as to have more opportunities to cooperate with young investment groups and provide them with bitcoin information and investment guidance services. Possessing professional knowledge in digital currency can help financial advisors establish relationships with clients who are still in their early career but have not yet fully utilized their potential income. When recommending bitcoin investment products to clients, most people pay more attention to investment Return, so the following picture may be more helpful for investment advisors:

Although the Bitcoin market is promising, there is still some resistance

Although there are many indicators that investors are becoming more and more interested in Bitcoin, the digital currency asset industry still faces some challenges, especially certain groups of people are always not interested in Bitcoin investment products. For example, in the 55-64 age group (the oldest people in the survey), only 40% of the respondents said they were “familiar” with Bitcoin, and only 30% of the respondents said they would consider using Bitcoin investment products .

Among the respondents who are not interested in Bitcoin, most of them are also elderly investors. They are usually close to retirement and therefore hope to get investment income as soon as possible. In addition, among those who are not interested in Bitcoin:

1. 81% of people believe that the price of Bitcoin fluctuates too much;

2. 84% of people believe that Bitcoin is too risky for their investment status.

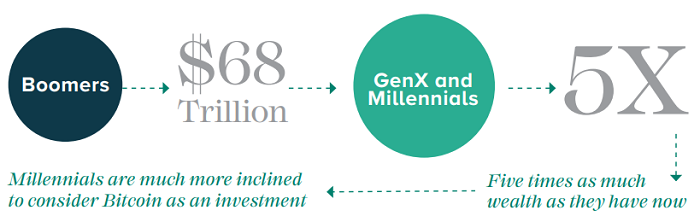

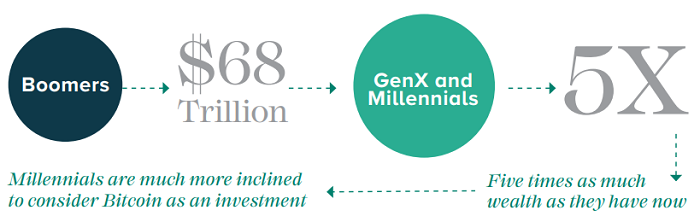

This type of investor is a risk aversion. Basically, most people will gradually reduce the risk tolerance of their investment portfolio as they grow older. When evaluating the overall market opportunities of Bitcoin investment products, we need to consider a factor, namely: older investors have more wealth than younger investors, and younger investors are expected to inherit inheritance from the older generation in the future . Well-known asset management and research firm Cerulli Associates real estate agency chain brand Kuwait International Real Estate (Coldwell Banker) estimates that over the next few years later, has $ 68 trillion will be transferred from generation to Generation X and Baby Boomers to Millennials. By 2030, millennials (who are more inclined to consider Bitcoin investment) will have five times the wealth they have today. Therefore, although the investment power of young people is not strong enough, their investment potential after the redistribution of wealth in the next few years cannot be ignored.

There are other issues that have also attracted the attention of investors (not limited to older investor groups). For example, 70% of respondents believe that Bitcoin is vulnerable to cyber attacks, but if it is properly protected, it is even the most Powerful hackers cannot crack Bitcoin. Investors may confuse cyber attacks with exchange theft. In this case, hackers have been able to use inadequate security measures to access digital wallet passwords. This is actually a robbery of a specific exchange or service provider’s digital bank. It is also illegal. Of course, investors also question the security of the US dollar. After all, someone can rob the bank and take cash from the vault. In fact, security has always been one of the most concerned issues in the financial industry. As security measures have been fully improved in the past few years, substantial progress has been made in related issues.

In addition, 63% of investors expressed concern about the regulatory status of Bitcoin, and 62% of investors believed that the government does not have any supervision over Bitcoin. The results of this survey may be somewhat inconsistent with reality, because government agencies in the United States and many countries around the world have regulated and supervised the Bitcoin ecosystem. In the United States, the Internal Revenue Service (IRS), the United States Commodity Futures Trading Commission (CFTC), the Financial Crime Enforcement Network (FinCEN), the United States Securities and Exchange Commission (SEC), and the Federal Reserve regulate Bitcoin in some way. As of 2019, 32 states in the United States have enacted or passed legislation to accept or promote the use of Bitcoin.

in conclusion

In 2020, Bitcoin seems to be gaining recognition from the investing public, and people’s interest in investing in Bitcoin is also increasing. More than half of American investors have expressed interest in investing in Bitcoin—this is a household with 32 million households, each family A huge market with more than $10,000 investable assets.

Traditional stock markets are becoming increasingly volatile. Once the correlation between asset classes collapses, more market participants will introduce Bitcoin into their investment portfolios. Financial advisers will play an important role in the Bitcoin ecosystem, this digital currency revolution in large part by a new generation of highly-liang good education investors start pushing, they will use the Internet a lot of information to make investment decisions.

The digital age has arrived, and more and more people will definitely turn to digital assets. Although most Bitcoin investors do not have much income at present, there will be 68 trillion US dollars in wealth transfer to tend to tend to In the hands of the younger generation of digital currency investment, this is a huge opportunity for Bitcoin. Digital currency has come a long way in the past ten years, and now more and more investors are interested in this type of digital asset. Good days may be ahead.