There are invisible hands behind BTC manipulating bull and bear.

Will the U.S. election really push Bitcoin up? Is it a historical law or a coincidence? With the reduction of block rewards for miners, can the "halving bull market" still stand? What are the economic principles behind the four-year halving of Bitcoin? The market changes in bulls and bears, how can we use these laws to escape the top and the bottom? This article will take you to interpret the invisible hands behind Bitcoin from an economic perspective.

Speaking from the "bull market" of the US election

Ryan Watkins, an analyst at the research institute Messari, believes that the previous U.S. elections will push the price of Bitcoin to rise. Watkins marked the Bitcoin trend chart after Obama and Trump came to power in the picture. Looking at the picture alone, this inference seems to be correct. However, relying on the trends after only two elections to summarize the laws is hardly sufficient evidence. Even if it is reasonable and relevant, why would the US election affect Bitcoin? After all, from the perspective of the entire financial market, Bitcoin is still very niche, and the relevance of US policy to Bitcoin is actually very weak (and difficult to prove). However, there is really a "coincidence" between the previous US elections and the trend of Bitcoin, and there is an interesting correlation.

Is "halving the bull market" still reliable?

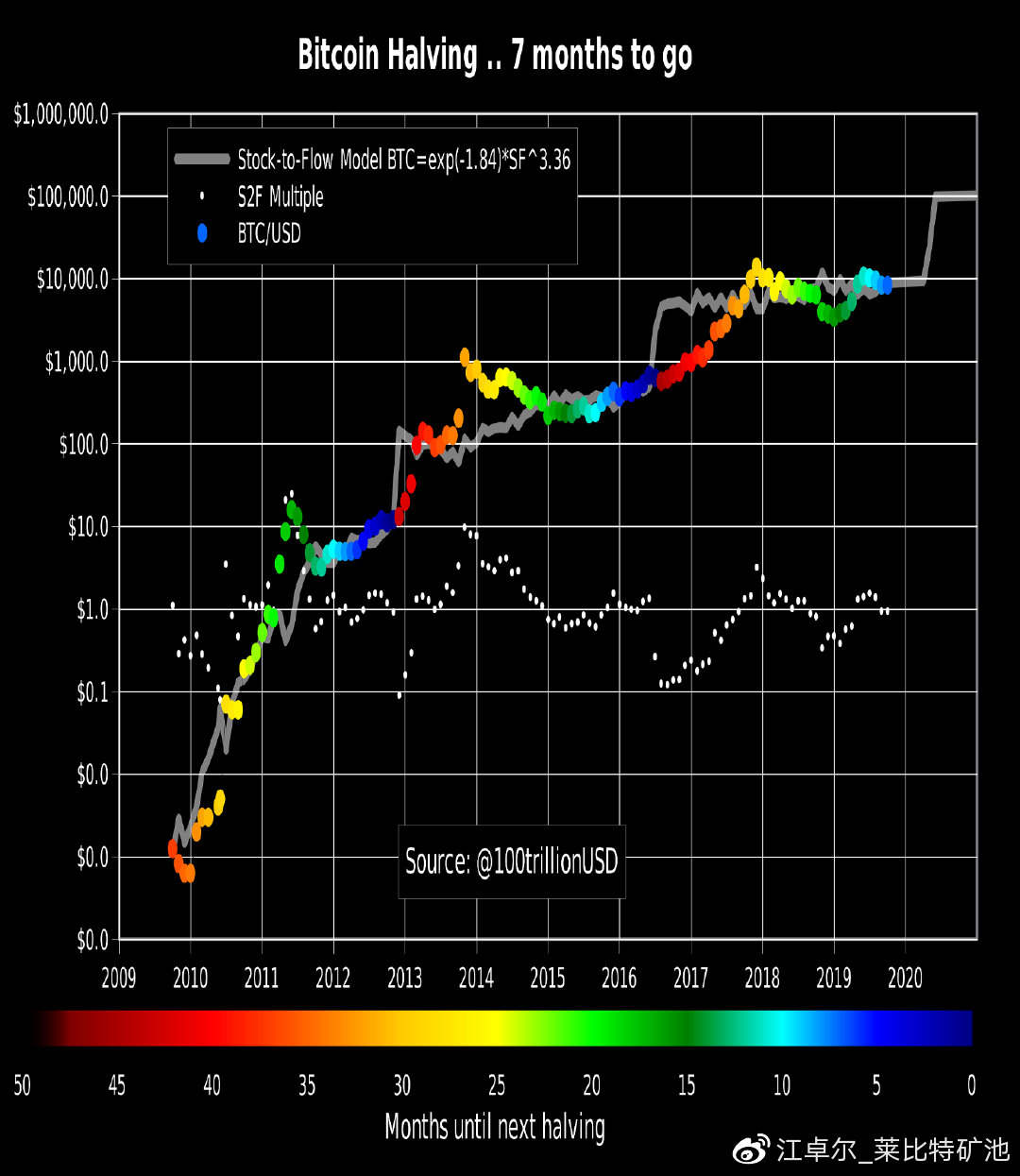

Before revealing the answer, let's take a look at a long-term Bitcoin halving bull market chart. Since the birth of Bitcoin, it has experienced three halvings, namely: the first halving (2012.11.18), the second halving (2016.07.09), and the third halving (2020.05.13). Before and after the first two halvings (when blue turns red), a "halving bull market" occurred.

Among the supporters of the "halving bull market" view, the domestic representative is Lebit mining pool Jiang Zhuoer. He believes that the long-term net supply of Bitcoin is only the output of miners, and the net demand is the demand for the purchase of coins by newcomers who are constantly entering the market. When the demand does not change suddenly, the supply will halve instantly, which will inevitably lead to an increase in the price, and then it may The formation of the "news ↔ bull market effect", the positive cycle continues to attract newcomers and new funds to enter the market. At the end of a bull market, when the market sentiment is frenzied and the bubble is serious, and the short-term currency price increase exceeds the speed of newcomers and new funds entering the market, the bubble of the bull market will burst and the bear market will begin. The design of Bitcoin's output halving every 4 years makes the "bull bear cycle" and the "halving cycle" resonate.

It can be seen that the important theoretical basis of the "halving bull market" is: when demand does not change suddenly, supply is halved instantly, which will inevitably lead to an increase in prices. Is this theory still valid after this round of Bitcoin halving?

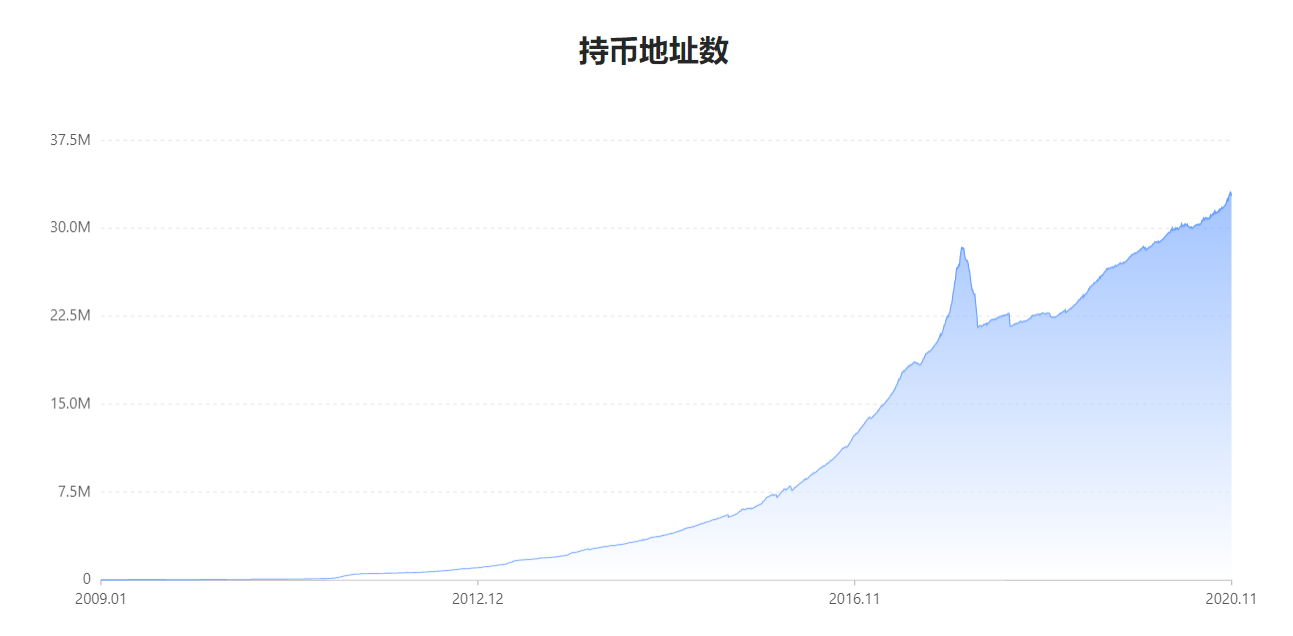

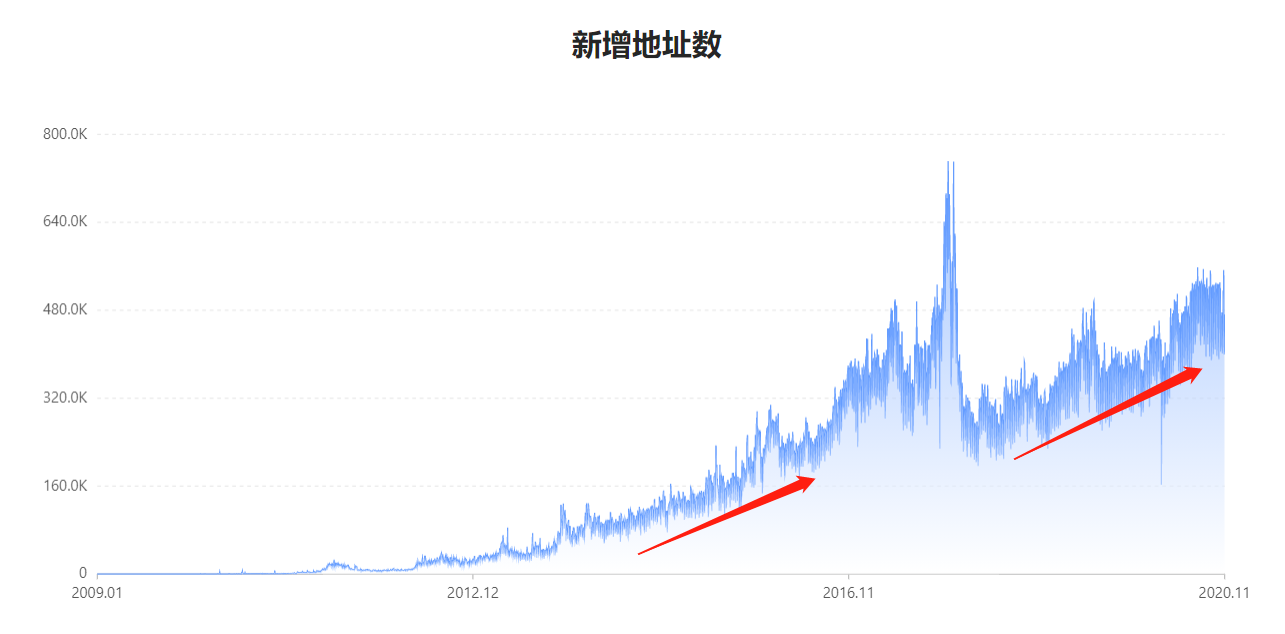

Let's look at the supply and demand of Bitcoin after the next three halvings. From the perspective of the supply side, the block reward of Bitcoin has changed from 50 BTC per ten minutes to 6.25 BTC now, which means that the original miner selling pressure (calculated by the number of coins) has become 1/8 of the previous one. Of the 21 million bitcoins, about 18.538 million have been dug up; from the demand side, the number of coin holder addresses can more accurately reflect the overall change in the current number of bitcoin holders, and it was halved for the first time The number of coin-holding addresses at the time was 996,506. At the third halving, the number of coin-holding addresses was 30247715, and the number of coin-holding addresses increased by about 30.4 times. From the observation of the changes in the number of new Bitcoin addresses, it can also be seen that the number of new users has indeed increased in different orders, and it is still in a state of continuous rapid growth.

It can be seen from the data that the supply and demand forces of the Bitcoin network have undergone obvious asymmetric changes. The net supply force caused by the halving is getting weaker and weaker, and the growth of the demand side is getting stronger. Even if estimated by conservative data, the growth rate of the demand side is much greater than that The declining speed of net supply and the rise in the price of Bitcoin are more of a result of growth on the demand side. It can be seen from the number of coin-holding addresses and the number of new addresses that the obvious growth of the two is not affected by the "halving bull market", but has inherent logic and rhythm.

In the first two halvings, the ecology of the Bitcoin network is relatively simple, mainly miners, and the market selling pressure also mainly comes from the mining income of miners. When the block reward is halved, the mining income of miners will suddenly decrease. This will indeed have a greater impact on the price of the currency and make people feel like a "halving bull market". This is also the main basis for this theory.

With the reduction of block rewards, the motivation of miners to maintain the network will shift from relying on block rewards to relying more on fee income. (Odaily Planet Daily Note: In the Bitcoin network, the income of miners is mainly divided into two parts, one part is block rewards, and the other part is fee income for processing transfer transactions.) The change in the main source of miners' income implies Bitcoin The economic relations in the network are undergoing profound and complex changes. Miners have gradually changed from the role of "currency" distributors to the role of network service providers. This shift will further prove that the "halving of the net Bitcoin supply has spawned a bull market" gradually becoming less effective.

As a large number of bitcoins are mined, the theory of "halving the bull market" will gradually become a "historical illusion."

Although the basis for the "halving bull market" has weakened, the phenomenon still exists. This is mainly due to the economic principles behind the Bitcoin network.

The invisible hands behind Bitcoin

At the beginning, we introduced that there is a very interesting relationship between the US election and Bitcoin. In fact, this relationship is a four-year cycle. Bitcoin halves every 4 years, and the US election is every 4 years. This design is not accidental, but in line with the capitalist economic cycle. This is like a bull and bear with invisible hands manipulating the market.

The short capitalist economic cycle (also known as the Kitchin cycle) is only 3-5 years. The American economist Kitchin believes that the development of the capitalist economy will regularly fluctuate up and down every 40 months. The economist Schumpeter uses this short cycle as a method to analyze the capitalist economic cycle, and uses the cycle changes of inventory investment and the small fluctuations in innovation (especially the changes in equipment that can be produced quickly). Explain the Kitchin cycle. He also believes that 3 Kitchin cycles constitute a Jugala cycle, and 18 Kitchin cycles constitute a Kondratiev cycle.

After three production cuts, Bitcoin not only entered a small cycle again, but also at the beginning of the second mid-cycle.

(Odaily Planet Daily Note: I need to explain here that we consider Bitcoin as a commodity to discuss, and we believe that it has certain currency-like attributes. The reason for this assumption is that its high volatility is not suitable As a currency; in addition, from the current demand side, it is more traded and stored as a commodity or investment product. Although it involves a part of payment, the currency attribute is still not the main growth demand at present. In this assumption Under the circumstances, Bitcoin is more of a commodity attribute, and miners are production and service providers, that is, the supply side.)

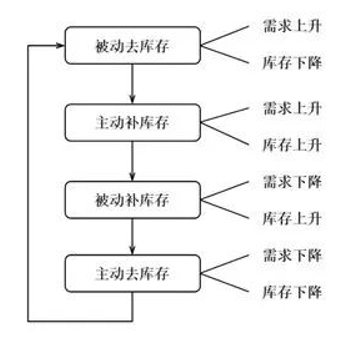

The internal basis of the Kitchin cycle is that the demand shock of commodities is passive and external, while the supply adjustment is active and internal. Therefore, the different changes in demand and supply (inventory) form four cyclical stages: passive Inventory, active restocking, passive restocking and active destocking. In the bull-bear conversion process of Bitcoin, these four cyclical phases are also in line.

When the market demand for Bitcoin increases, the price begins to rise, and the increase in mining profits stimulates the influx of more miners, and the miners’ inventory is too late to respond, so sales increase and passively destock.

The Bitcoin market demand has expanded significantly, the price has risen significantly, and the mining revenue has become more lucrative. Miners are expected to start to actively increase their inventory.

Bitcoin market demand has begun to weaken, prices have stagnated and fallen, mining profits have fallen, miners have no time to shrink production, and sales have fallen, leading to passive increases in inventory.

Bitcoin market demand has further shrunk, prices have fallen, and mining profits have further reduced. Miners expect negative expectations and actively reduce inventories.

How to use the inventory cycle to judge the Bitcoin bull-bear cycle?

To put it simply, when miners sell at discounts and miners sell mining machines in the market, it actually means that the bear market has basically bottomed out; when mining machine manufacturers are producing mining machines at full capacity, the mining machines on the market There is still a great demand, and the payback period of mainstream mining machines has been greatly shortened. In fact, it may be very close to peaking.

Specifically, we can observe the peak signal of the bull market of Bitcoin by calculating the static return days of the mining machine (the price of the mining machine divided by the net income per day), and the signal of the bottom of the bear market can be observed by the difficulty of mining. In addition, we can also use the proportion of mining electrical and mechanical expenses to judge the bull-bear transition.

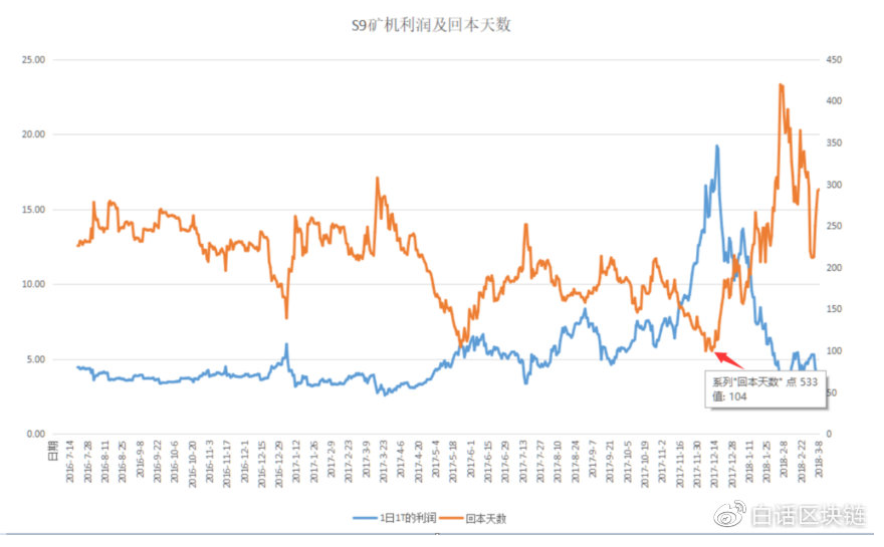

Regarding the peak index, Jiang Zhuoer once proposed a mining machine bubble index, which judges the bull market peak signal by calculating the static return days of the mining machine. The inherent logic of the index is that if the speed of industrialized production of mining machines is far behind the rate of increase in currency prices, it means that currency prices are rising too fast to be sustainable. It uses S9 as an example to introduce this important indicator. As shown below:

In the figure, 2016 and 2017 during the bull, S9 back to the static stability at 200 cycles to 250 days, every day Lee Run stable at $ 5. However, in December 2017, S9's payback cycle quickly dropped to around 100 days, and its daily profit soared from 5 yuan to 20 yuan, which showed a clear peak signal.

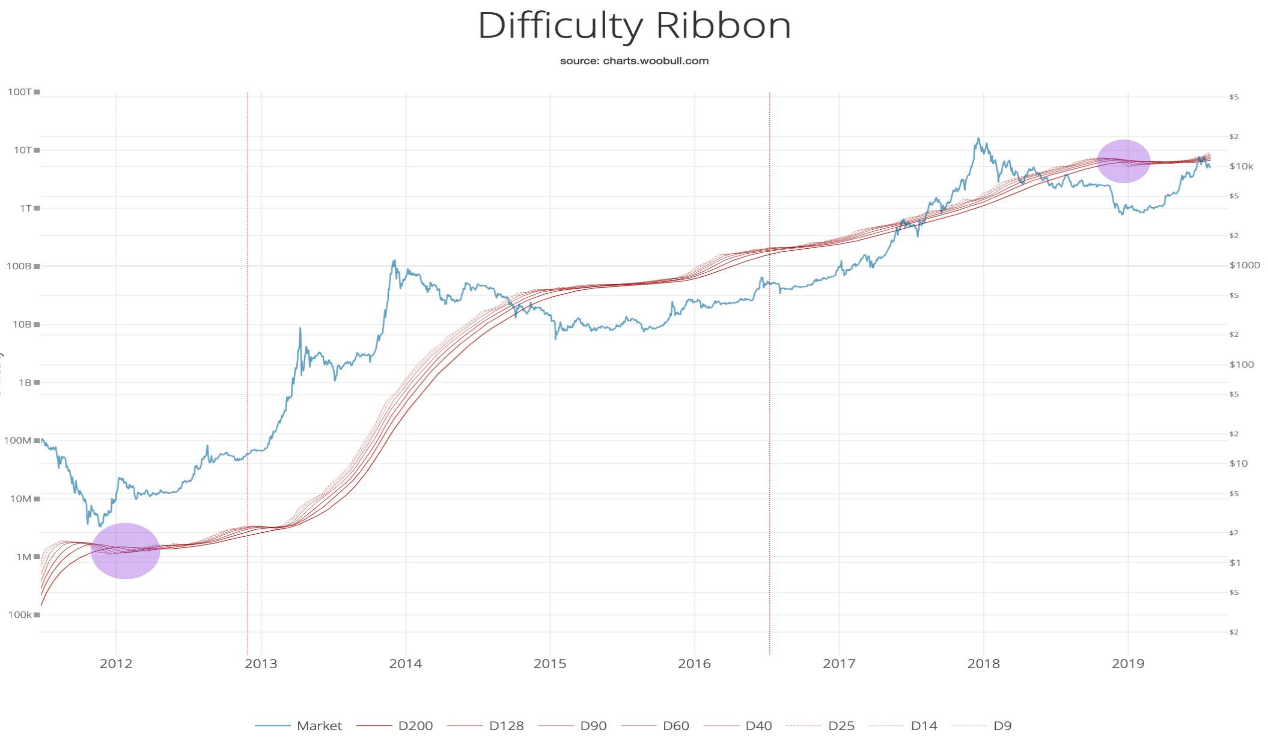

The mining difficulty zone proposed by Willy Woo is composed of a set of different periods of Bitcoin mining difficulty polylines, which is a good visual indicator of bottoming out. The theory believes that when miners dig bitcoin, they need to sell some of the coins to pay for electricity and other costs. However, as the price of the currency continues to fall, some miners will choose to shut down when they cannot afford to pay, and finally leave the most powerful one Some miners continue to mine. As the miners shut down, the computing power and mining difficulty of the Bitcoin network will decrease, and the difficulty band will shrink, and when they converge, there will be a better bottoming buy indicator.

In addition to the above indicators, it is also possible to judge the peak and bottom market by observing the proportion of electricity bills of mainstream mining machines. The proportion of electricity bills represents the most important electricity bill of miners. When the proportion of electricity bills is too high, part of the mining machines will have the strongest computing power in the market, which means that the market has entered the bottom; The currency price continues to rise, more mining machines on the market have begun to enter the mining mode, and the proportion of electricity costs has dropped significantly, which means that the market bubble is serious.

Where does Bitcoin's market demand come from

Digital migration is the demand of our age. The development of blockchain technology follows the same trend. Bitcoin network is the first successful application based on blockchain technology. With the development of blockchain technology, the market demand of Bitcoin Will continue to expand.

This year, central banks of various countries released a large amount of water during the new crown epidemic, making the already risky traditional financial system even more precarious. As the impact of the epidemic accelerates in the digital age, central banks are stepping up the development of their own digital currencies and trying to form a new digital financial payment system. However, the most successful, safe and time-tested digital currency is still Bitcoin. Financial tycoon JP Morgan Chase pointed out in a recent report that institutional investors such as family wealth management funds have begun to regard Bitcoin as a digital alternative to gold. In the future, the market demand for Bitcoin is still very large.

On the other hand, under the DeFi boom, the total number of bitcoins currently anchored on Ethereum is about 150,880, which is developing extremely fast. Bitcoin is constantly being given new value in more and more DeFi. Its essence is a wealth migration in which technology drives financial innovation, financial innovation generates market demand, and demand pushes up prices. With the gradual construction and improvement of the blockchain infrastructure this year, more blockchain applications will begin to explode, and the demand and value of Bitcoin will also experience greater growth.

No comments:

Post a Comment