This bull market will be very different.

In the early morning of November 18, 2020, Bitcoin broke through 17,500 USDT, setting a new high since December 21, 2017. Interestingly, in the entire history of Bitcoin, the time for the price to exceed 17,500 USDT was only 7 days.

In order to better summarize and summarize the structural transition under Bitcoin's periodicity, Odaily Planet Daily judged this round of rise as the early stage of "gray bull".

What is the difference between "Gray Bull" and the previous bull market? Who is behind the "Gray Cow"? What is it that makes this year's Bitcoin more popular than gold ETFs? Is Bitcoin currently high? Will there be a sharp retracement like in 2017? This article will answer these questions one by one.

A big gray bull is coming towards us

In ancient Western civilization, the bull represented strength, wealth and hope, while the bear represented restraining fanaticism, digesting oneself, and rebirth. As early as the 18th century, West Convenience chose the two species "bull" and "bear" to express the market's ups and downs.

From 2017 to 2020, there have been three "bulls" and two "bears" in the crypto market. Of these three cows, one is very big, the other is very empty, and the other has its horns; the two bears, one is "Big Bear" and the other is "Bear Two".

In 2018, Bitcoin almost used up its full-year retracement, which was a year of "bears".

In 2019, the rise of contract trading has accelerated the rise and fall of Bitcoin, which we call the "contract bull".

Looking back at history, the "contract bull" is still empty, and "Xiong Er" is not too strenuous to fight it back.

Beginning in March 2020, Bitcoin has risen from the lowest point of about $4,000, and has risen all the way to over $16,000, and it has become more aggressive. As the horns were first revealed and "Xiong San" hid his figure, we gradually saw the outline of this cow-the gray cow.

Why is this bull market a "gray bull"?

Grayscale currently manages $10 billion worth of cryptocurrency. Among them, Grayscale Bitcoin Trust (GBTC) was founded in 2013 and is the company's largest trust. Grayscale purchased 15,114 Bitcoins (approximately US$241 million) in the last week alone. As of November 15th, Eastern Time, Grayscale Bitcoin Trust's total holdings have reached 509,581 BTC.

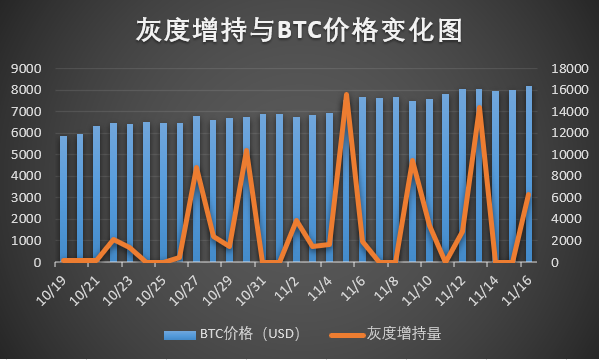

The Odaily Planet Daily reported the relationship between the increase in GBTC holdings and the price of BTC from October 19 to November 16.

As can be seen from the above figure, as time goes by, the gray-scale buying volume presents a continuous enlargement trend.

At the same time, from the technical chart, after BTC broke through $12,000, the higher the attack, the greater the resistance, but it still maintained a healthy upward trend.

Combining with the above grayscale accumulation chart, it can be seen that grayscale played a big role in BTC's upswing (huge buying power). The more sell-offs above, the larger the grayscale accumulation.

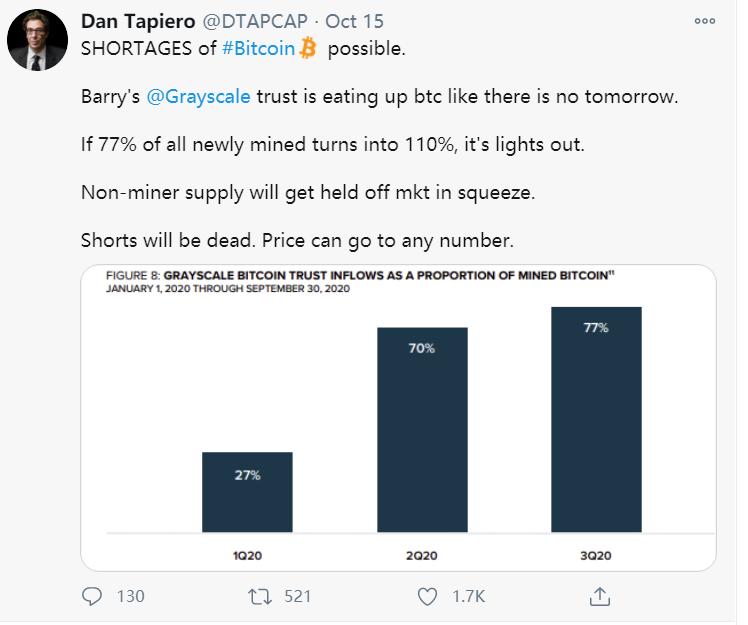

Extending the timeline a bit, macro investor Dan Tapiero said that the share of bitcoins purchased by Grayscale Trust accounted for the share of bitcoins generated by mining, which increased from 27% in Q1 to 77% in Q3.

On October 14, Grayscale stated in its financial report for the third quarter of 2020 that the inflow of funds for all of the company's products was US$1.05 billion. So far this year, this figure is US$2.4 billion, which is more than twice the total amount raised in 2013-2019. Grayscale Bitcoin Trust's inflow of funds in the third quarter was $719.3 million, and total Bitcoin asset management (AUM) increased by 147% in 2020.

It can be seen that this round of rise compared with the previous several times, the biggest variable is the large-scale buying of gray, which increases the demand for the market, solidly "builds the bottom", and holds the "selling pressure."

In addition, we also discovered another difference between Grayscale and "previous" investors.

Dare to buy if you dare to fall, "Gray Bull" is not "fear of heights"

Grayscale's investment style is a bit special: As long as Bitcoin dared to fall, Grayscale would dare to buy, and there was no trace of "fear of heights." This is clear from the technical drawing.

At the end of 2017, Bitcoin rose sharply, but the higher the price of the currency, the greater the volatility, and the BTC stayed at the high position for a short time, which could not be stabilized at all, which can reflect the FOMO mood.

Compared with the trend of BTC's high in 2020, BTC can be said to be a "small step" all the way up. As long as there is a big selling pressure, the bottom will take over. This makes the overall volatility of the current high of BTC much lower than in 2017, and the trend is relatively More stable.

These are just "phenomena" summed up from the disk.

The main force of the bull market is different: from retail investors to institutions

The reason why this round of bull market behaves differently is mainly because the "gray bull" has changed from the main driving force of the previous bull market. Grayscale itself is a trust company. It mainly earns management fees for trust products. It does not specialize in "money speculation". The main buyers behind it are not ordinary large investors. It can be seen from the grayscale financial report that the "Grayscale Bull" is the result of real money pushing up, not manipulation. So, who is so rich?

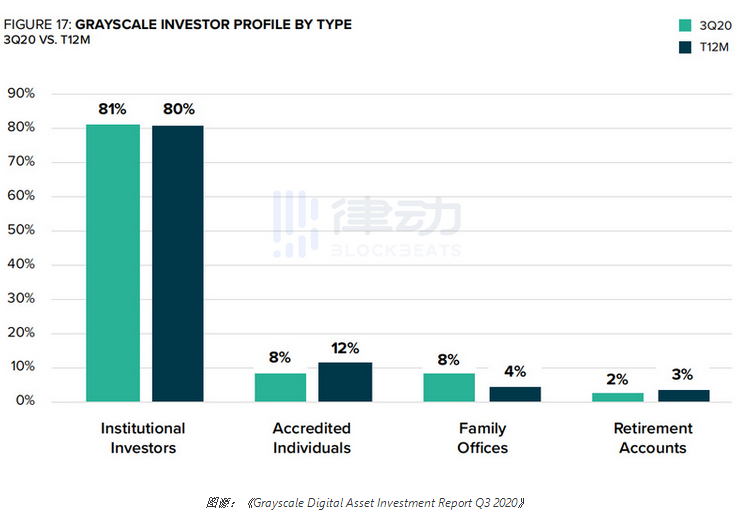

According to the data disclosed by Grayscale in the third quarter of 2020, the purchase users of Grayscale's products are mainly institutional investors (81%), followed by qualified investors and family offices (8% each). 57% of purchase users are from outside the United States.

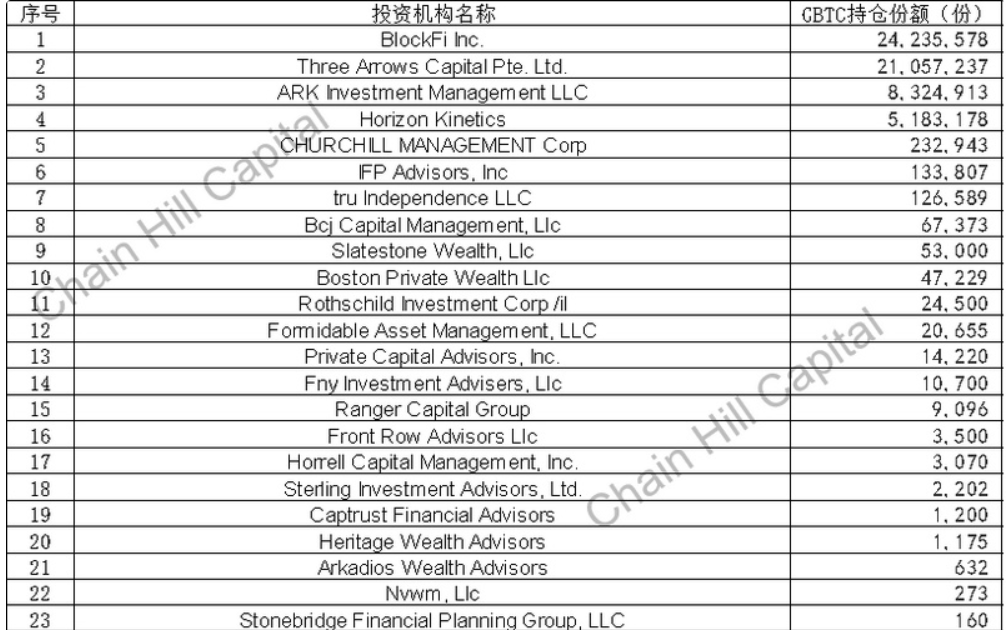

As of November 9, 2020, according to publicly disclosed information, a total of 23 companies (a total of 29 institutional-level accounts) hold Grayscale Bitcoin trust shares, with a total of 59,553,200 trust shares held, accounting for Grayscale Bitcoin 11.5% of the issued share of the trust (Note: The statistical caliber is the information disclosed by the institution in the US SEC. The share of trust held by the institution may change in different reporting periods. The statistics in this article are still holding trusts as of November 9, 2020 Share of institutions). The 23 companies include crypto asset lending companies, hedge funds, mutual funds, private wealth companies, consulting companies, family offices, etc.

Data source: Chain Hill Capital

It can be seen from these data that the main buyers of Grayscale are institutional investors, and “Grayscale Bull” is essentially an institutional bull. The previous bull market was dominated by retail investors and major currency players in the carnival, and institutional funds were not dominant. Since the beginning of this year, the inflow of institutional funds has been extremely rapid, and the leading role has been obvious. The strategic position of the institution also explains to a certain extent the "panel appearance" mentioned above-this time the rise has become more stable.

In addition, after the main force of the bull market has changed, the rhythm of the bull market has also changed a lot.

There were obvious signs of manipulation and hype by big players before, which caused the market to have a phenomenon of alternate rises. It was roughly that Bitcoin finished the rise of mainstream currencies, and then altcoins made up for the rise, followed by a major correction. But now institutional investors are generally value investors, who mainly invest in Bitcoin and a few other mainstream currencies, so the rotation market is very weak this year. However, we are also concerned about the recent surge in DeFi leaders. Because these DeFi projects have their own value, the recent rise is more of the return of value after the previous oversold.

Pushing hands more macro than institutions: a great transfer of world wealth

We believe that institutional investors will continue to enter the crypto market because the world is undergoing a wealth transfer. Especially this year's new crown epidemic and large amounts of water released by the central banks of major countries have also promoted such a wealth transfer . The following is a brief overview mainly from two dimensions.

The wealth in the hands of the older generation began to transfer to the hands of the younger generation. Grayscale stated in the report "Wealth Transfer Promotes BTC to Become a Mainstream Investment Target" , although Bitcoin was only a niche asset that attracted a few investors in the early stage, it is now becoming more and more accepted by mainstream investors. . The survey data shows that in 2019, the number of potential investors in the Bitcoin market is about 21 million, but in 2020 it has grown to 32 million. In 2019, 53% of investors said they were “familiar” with Bitcoin, but this has increased to 62% in 2020. More than 50% of respondents predict that digital currency will become mainstream before 2030. Although most Bitcoin investors currently do not have much income, 68 trillion US dollars of wealth will be transferred to the younger generation who tend to invest in digital currencies in the next 25 years.

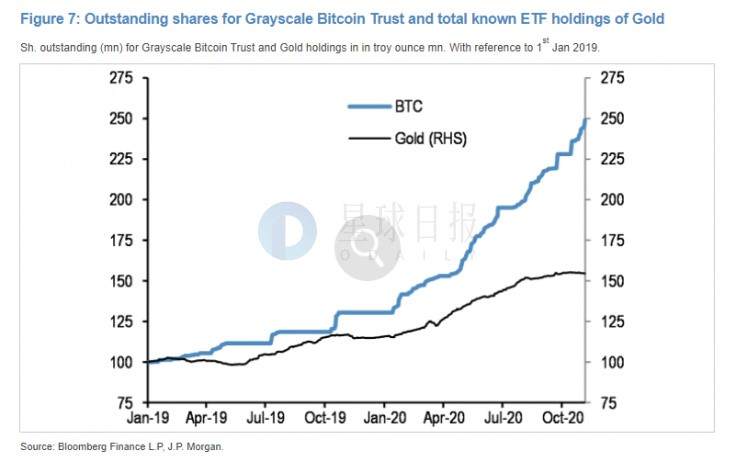

Nick Panigirtzoglou, a market quantitative analyst at JPMorgan, believes that "Over time, millennials will become the most important part of the investment world, so Bitcoin and gold will Intense competition is good for Bitcoin's long-term upward trend. From a technical point of view, Bitcoin's market value should increase by at least 10 times in order to match the gold market based on physical gold bars and coins."

Traditional institutional investors began to transfer traditional assets to digital assets. The fundamental reason for institutional investors' strategic holding of GBTC is that institutional investors recognize that the digital age has arrived and is irreversible, more and more people will turn to digital assets, and human wealth is undergoing a major migration. On November 9, JPMorgan Chase pointed out in a report that Bitcoin is eroding market demand for gold ETFs. Nowadays, institutional investors such as family offices regard Bitcoin as a digital alternative to gold, and their demand for Grayscale's Bitcoin trust exceeds the sum of all gold ETFs.

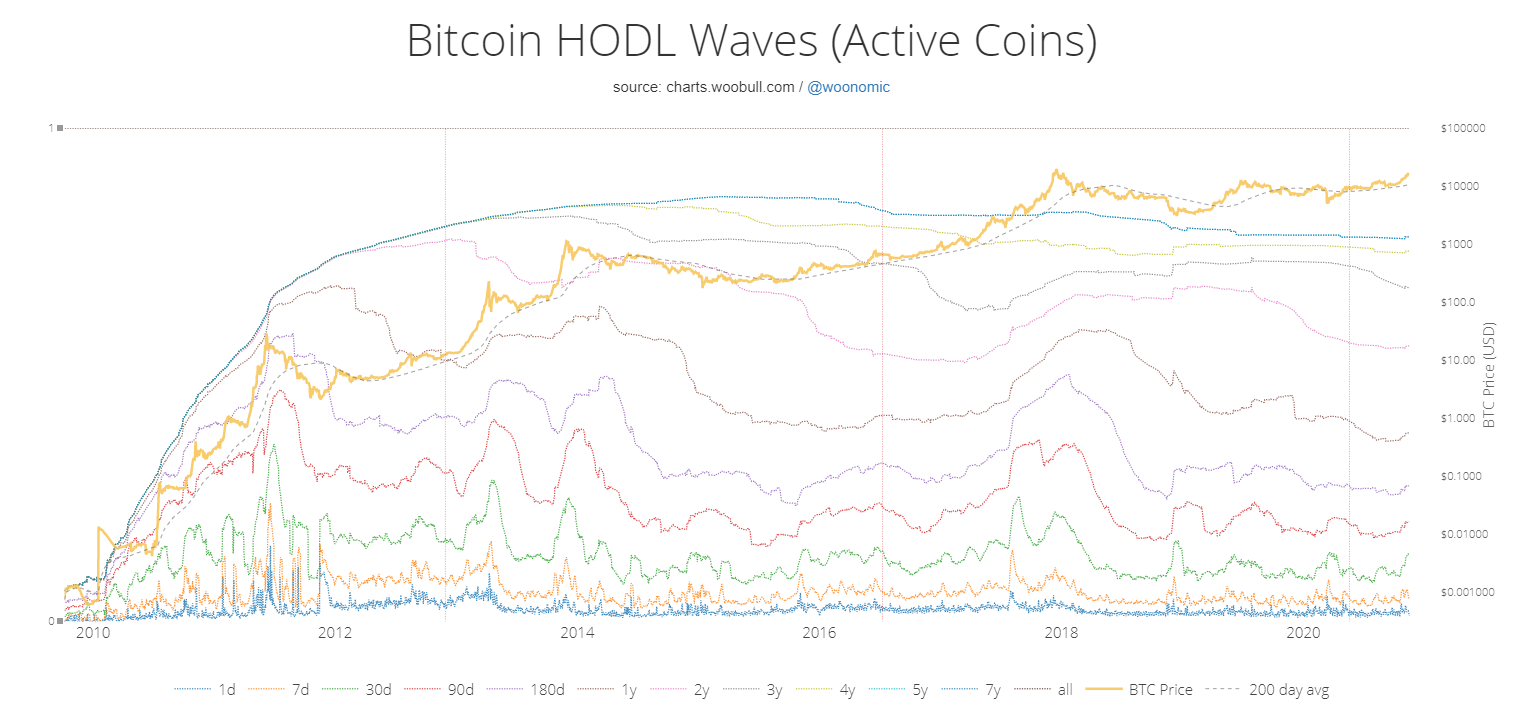

This view is also supported by data: in the process of entering traditional institutions, BTC chips have also been loosened at a high level and have been constantly shifting.

According to BTCparser monitoring, on November 7, 1,000 BTC mined in 2010 were transferred, and on October 3 this year, 50 BTC mined in 2010 were transferred for the first time. The figure below shows the transfer of BTC chips from a larger period.

BTC chip transfer graph over the past ten years

Why is it said that this round of "Gray Bull" will be Long Bull and Slow Bull?

So far, we have basically explained the cause of the original bull market and the differences from the past few times. Of course, for the majority of investors, what is more concerned is whether it is too late to get on the bus now? How long will the gray cow last?

Let me start with the conclusion, we believe that it is still in the early stage of "Gray Bull". There are two reasons:

The relationship between Grayscale and institutional investors: The compliance of Grayscale Trust products provides more and more restricted institutional investors with channels to buy BTC. In January of this year, Grayscale Bitcoin Trust was approved as the first digital asset tool that meets the standards of the US Securities and Exchange Commission. On October 12, the application for registration of Grayscale Ethereum Trust was officially approved. The compliance of Grayscale Trust products is one of the important incentives to attract institutional investors to enter this year, and this trend will accelerate in the future. As mentioned above, behind the continued purchase of grayscale bitcoin trust products by institutional investors is an irreversible wealth transfer.

(Odaily Planet Daily Note: In the United States, some institutional investors with investment restrictions cannot enter the cryptocurrency exchange to buy BTC in the name of an institution. They can only purchase bitcoin through trust channels. In addition, institutional investors are more accustomed to trust this A traditional investment method.)

The principle and mechanism of Grayscale Trust products: The design of Grayscale Bitcoin Trust makes it difficult to sell BTC, and its position planning is more inclined to long-term holding. Institutional investors will get gray-scale GBTC after buying gray-scale Bitcoin. Investors can exchange BTC for GBTC (with half a year to unlock), but cannot exchange GTBC for BTC. Grayscale Bitcoin Trust currently does not have any redemption plan. The trust can seek regulatory approval to implement the redemption plan. This means that neither Grayscale nor institutional investors are likely to directly sell the BTC spot market through the GBTC held in their hands.

Overall, institutional investors are still entering in large numbers, and the possibility of BTC hitting the market by a large margin is relatively low. With huge institutional funds flowing to a limited-scale currency circle, this bull market is bound to emerge from the long and slow bull market.

No comments:

Post a Comment