The ants of last night went round and round.

November 3 evening, ants Technology Group Co., Ltd. (hereinafter referred to as "ants Group") issued a letter to investors, said ants Group today received the Shanghai Stock Exchange (hereinafter referred to as "the Shanghai Stock Exchange") notice, suspend the A-share Listing plan. Affected by this, its plan for simultaneous listing of H shares will also be suspended. "Ant Group apologizes for the trouble this has caused investors. We will properly handle the follow-up work in accordance with the relevant rules of the two exchanges."

As soon as the news came out, the share price of Alibaba , the largest shareholder of Ant Group, plummeted. As of the close of US stocks on November 4, Beijing time, Alibaba fell 8.13%, from 310 US dollars per share yesterday to 285.57 US dollars per share, and the total market value had evaporated by nearly 70 billion US dollars.

Source/ Screenshot of Tiger Securities Ran Finance

Tencent News "Frontline" learned through Ant Group related parties that on the evening of November 3, the news of Ant Group's suspension of A-share and H-share listings announced that the executive chairman of Ant Group Jing Xiandong convened an emergency meeting with the group's senior management that night. A person close to the Ant Group revealed that those who participated in the emergency meeting were at or above the P9 level of Ant Group. After the "suspend" was mentioned at the meeting, it is conservatively estimated that the time for Ant's re-listing will be delayed by about half a year.

It's not just Alibaba's market value that is affected by this. According to the previous steps, if Ant Group can successfully go public, A-shares will usher in the Big Mac with the largest market capitalization, and then the birth of Ant Group's internal employees and investors behind Ant Group shares will be born. According to media reports, only within the Ant Group, in accordance with its employee incentive plan, the total amount of rewards for Ant Group employees and consultants is about 137.7 billion yuan, an average of about 8.3 million yuan for each employee.

Participating in this feast is also a huge group of public and private equity funds. According to previous statistics from the media, there are a total of 6.66 million households in the A+H cities with more than 20 trillion yuan of funds to participate in the ant fight.

After the suspension of the listing plan, Ant Group will face more challenges. How to return the new funds? How to deal with the ant-related listed funds issued by fund companies? Will Ant Group go public again? If listed, how much will the valuation be affected? What changes will the Internet finance industry usher in?

All this has become a problem that Ant Group and the entire Internet finance industry need to face.

According to Tencent News, Jing Xiandong said at an emergency meeting that the new funds raised by Ant IPO will be returned to investors, including strategic investors and retail investors who invest through Alipay . When Ant Group re-applies for listing, it will re-launch the new listing.

Many analysts said that Ant will still go public, but the valuation may be affected. The focus of the dispute is whether Ant is a financial company or a technology company? If it is a financial company, ICBC, which had a net profit of 312.3 billion last year, had a total market value of only 1.76 trillion, while Ant Group’s net profit last year was only 16.9 billion. Calculated at the issue price, the market value was over 2 trillion, which is obviously high.

On the eve of listing, Ant replaced the 6-year-old abbreviation of "Ant Financial" and changed its business registration name to "Ant Technology Group Co., Ltd." in an attempt to remove the financial label and strengthen the technology label. The choice to list on the Science and Technology Innovation Board is also an important step.

However, the regulatory authorities believe that ants still have to return to "golden clothes."

According to Tencent News, a person close to Ant Group said Jing Xiandong was relatively optimistic at the meeting. Jing Xiandong explained to the participants that supervision is mainly to solicit opinions, and ants need to meet the specific requirements involved in the solicitation of opinions as soon as possible.

In the letter to investors, Ant Group also stated that “safe innovation, embrace of supervision, service entities, openness and win-win results will enable Ant Group to stand the test and trust.”

Ants pause

Ant Group originally planned to simultaneously list on A shares and H shares on November 5. In order to welcome the world's largest IPO, the capital market has been restless for several months since the date of its announcement of the prospectus.

From the announcement of the prospectus on August 25 to the hot new A-share market on October 29, Ant Group has promoted its listing at an extraordinary speed.

According to the announcement on October 29, Ant Group issued 1921.3115 million new shares in A shares at an issue price of 68.80 yuan per share, and the total amount of funds raised was nearly 132.2 billion yuan. The issue price of Hong Kong stocks is 80 Hong Kong dollars per share, which is basically the same as A shares at the current exchange rate. Its stock code is very "Geely", with the A-share code being 688688; the H-share code being 6688.

Unexpectedly, the big ant who only needs to wait to ring the bell will usher in an emergency brake on the eve of the market.

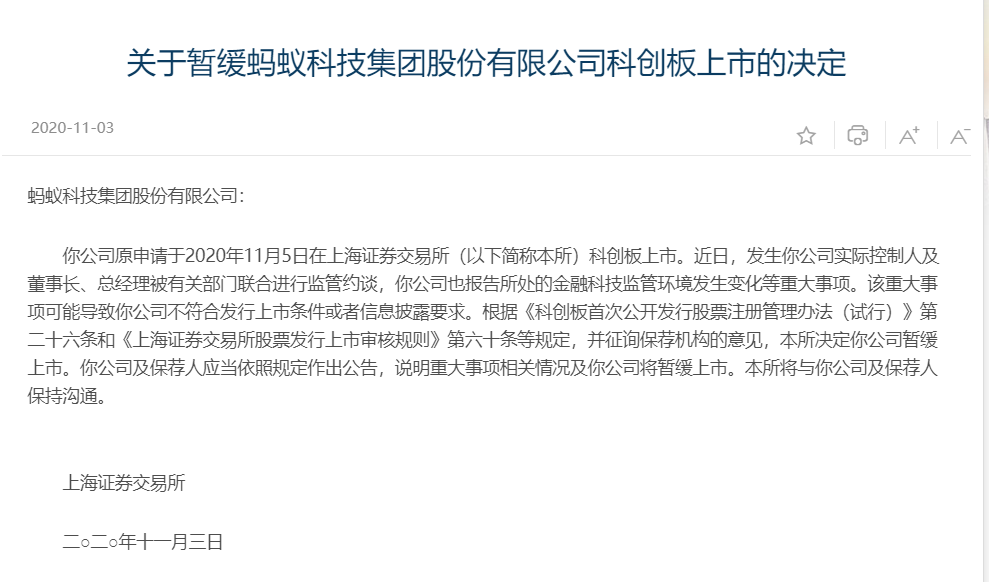

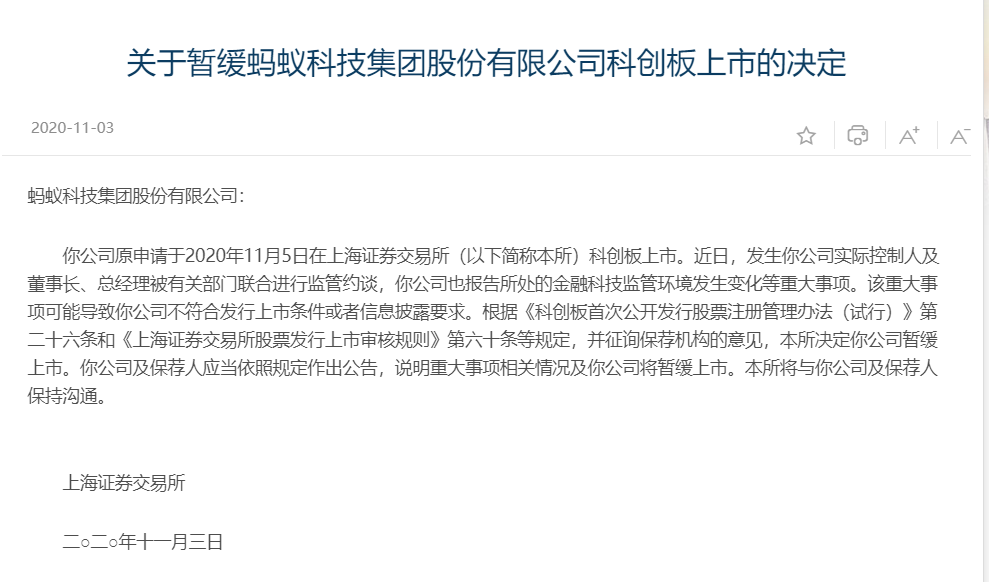

On the evening of November 3, the Shanghai Stock Exchange issued an announcement stating that the actual controller, chairman and general manager of Ant Group were jointly conducted supervisory interviews by relevant departments, and the company also reported major issues such as changes in the financial technology regulatory environment. This major event may cause Ant Group to fail to meet the issuance and listing conditions or information disclosure requirements and decide to suspend the group's listing.

Source/Screenshot of Ran Caijing, Shanghai Stock Exchange

Subsequently, the Hong Kong Stock Exchange (hereinafter referred to as the "Hong Kong Stock Exchange") also issued an announcement stating that the listing of Ant H shares was suspended.

Before that, on the evening of November 2nd, according to the official release of the China Securities Regulatory Commission, on that day, the People’s Bank of China, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, and State Administration of Foreign Exchange jointly filed an agreement with Ant Group’s actual controller Ma Yun, Chairman Jing Xiandong, and President Hu Xiaoming conducted a supervisory interview.

On the same day after the interview, the China Banking and Insurance Regulatory Commission and the People's Bank of China issued the "Interim Measures for the Administration of Online Small Loans (Draft for Comment)" for public comments (hereinafter referred to as the "new regulations"). In principle, the new regulations prohibit cross-provincial business; the same investor, related parties, and concerted parties shall not have more than two shareholding data, and the joint loan capital shall not be less than 30%, etc., to strengthen supervision of small loan business.

The introduction of this new regulation was interpreted by the industry as a heavy pressure on Ant Group's small loan business.

Loan business occupies an absolute position in the segmented income of Ant Group. According to its prospectus, Ant Group’s revenue growth mainly comes from the digital financial technology platform, which is composed of three major components: the micro loan technology platform, the financial technology platform, and the insurance technology. Among them, the micro loan technology platform accounts for 39.41% Than tops.

After the announcement of the suspension of listing, there was a lot of discussion. "Economic Daily" issued a comment on the evening of November 3, and pointed out that before this, Ant Group had been approved by all parties and followed relevant procedures until now, and it is waiting to be listed. Since the listing of Ant Group, it has also received widespread market attention. Recently, after further understanding, related issues have been discovered. In order to discover and solve problems, all from the perspective of safeguarding the rights and interests of financial consumers and protecting the interests of investors, the supervisory authority decided to postpone the listing of Ant Group.

According to the "21st Century Business Herald", some investment bankers later pointed out that the post-conference events of major policy changes are after all matters that have a major impact on company operations and investors' investments, and it is necessary to carefully study and fully disclose them. "It can be listed again after supplementary disclosure."

Securities analyst He Jin told Ran Caijing that the relevant regulatory documents may not have been formulated recently, and it may have been brewing half a year or even 1-2 years ago. “So just postpone the listing, it should be a re-valuation.”

In fact, in the prospectus of Ant Group, relevant risks have been given, including "the risk that the company's micro-credit technology platform cannot maintain rapid growth" and "the risk that the company's micro-credit technology platform business depends on cooperation with financial institutions" Wait.

"21st Century Business Herald" reports show that this is not the first IPO to be temporarily suspended on the eve of listing. In April 2010, Hunan scenic mountains and rivers in the company is about to board the continental deep eve Exchange, because the media have issued a document called the prospectus disclosure is not real, allegedly inflated sales, etc., regulated emergency brake, suspension of listed companies to apply . Prior to this, Ningbo Lili Electronics and Suzhou Hengjiu had "after the funds raised were in place, the IPO was ultimately rejected."

Related beneficiaries sleepless

After the announcement of Ant’s postponement of listing, it quickly appeared in hot searches on major social platforms. As for the relevant beneficiaries such as Ant employees, new winners and investors in allotment funds, the mood is much more complicated.

In the past few months, the "get rich" myth of Ant Group's listing has been the industry's talk before and after dinner. The most interesting thing is that each employee of Ant Group can get a huge wealth of over 8 million yuan, which can buy a 200 square meter luxury house in Hangzhou, where housing prices are high.

According to the information disclosed in the prospectus, according to the Ant Group’s "Economic Beneficiary" plan, as of September 30, 2020, the economic benefits under the Economic Beneficiary Incentive Plan totaled 3.079 billion shares of the issuer, which were granted to Ant Group. The ratio of employees and consultants is approximately 65%. If calculated at the issuance price of RMB 68.8, the employees and consultants of Ant Group can obtain a total economic benefit of approximately RMB 137.69 billion, with an average share of RMB 8.2647 million per person.

Earlier media reports stated that because of the listing of Ant Group, some employees have begun to look at houses, which even led to the rise of house prices in Hangzhou.

In the pulse , an employee with the ID of an Alibaba employee complained, “There are too many people smoking in the corridor.” The following part of the thread said that the postponement of listing is not a big problem, because it will come sooner or later. "It's just a question of valuation revaluation. If the valuation is really based on financial companies, then the options in hand will shrink significantly, and there will still be a huge psychological gap."

When Ran Caijing tried to contact the employees of Ant Group through a friend who works in Ali to find out more, the friend told Ran Caijing that it is impossible for the employees of Ant Group to accept interviews. The company expressly prohibits it. If you insist on accepting the interview, it is offensive to the company. The behavior of the red line.

In addition to the internal employees of the Ant Group, there are also a group of former "lucky people" who are also destined to sleepless tonight, that is, a large number of investors who participated in the Ant Group's new winners and purchased the Ant Strategic Placement Fund.

The information previously disclosed by Ant Group showed that Ant Group issued no more than 1.67 billion new shares in A shares, of which 1.34 billion shares were initially strategically placed and 334 million shares were issued for institutional and individual investors. On October 29, Ant Group disclosed the issuance subscription status and the success rate announcement showing that after the call-back mechanism was activated, the final success rate of online issuance was 0.12670497%, and the number of valid subscriptions for online issuance was approximately 5.16 million; the total subscription amount exceeded 190,000. 100 million yuan, breaking the record for A shares.

Figure / Weibo Ant Financial

On October 30, Ant Group announced its Hong Kong stock allotment situation. Ant H-shares were subscribed by nearly 1.5 million people, frozen funds were nearly HK$1.3 trillion, and both broke H-share records.

On November 1, Ant Group announced the results of the online lottery on the Science and Technology Innovation Board. There were 701,696 winning numbers, and each winning number subscribed for 500 shares. The previous 36Kr report showed that according to the arithmetic average increase of 161% on the first day of listing of the currently listed sci-tech innovation board stocks, the first lottery could earn about 55,400 yuan.

Some of the winners posted their "lucky ticket" on social platforms on November 1st, and said to themselves "500 shares, 34,400 yuan, can it be doubled?"

“Securities Times” previously reported that most public offerings participated in Ant’s new launch. Among them, 8 fund companies , including E Fund , Southern, China Universal, China Merchants, Harvest, China, China Europe, and Penghua, were strategic investors. 174 million shares were allocated, and the allocated amount was 11.972 billion yuan.

The data shows that the total number of shares allocated to Class A investors, which are mainly public funds, is 194 million shares, and the total allocated amount is 13.357 billion yuan; if corporate annuities, insurance, securities firms, and social security funds are excluded, Approximately 115 million shares were allocated to public funds, and the allocated amount was about 7.9 billion yuan.

Many fund products at the helm of celebrity fund managers have also participated in Ant Group’s offline launch of new products, and have received initial offline placements, including Zhang Kun, Liu Gesong, Feng Mingyuan and others.

Hu Ming is one of the investors who bought the Ant Allotment Fund. Earlier, he purchased Ant’s placement fund through Alipay. In his opinion, Ant’s new investment is a solid profit. He did not even understand the detailed rules of the product, nor did he consider the risks, so he directly purchased more than 100,000 yuan of funds.

"I didn't expect such a thing to happen at all." Hu Ming is very nervous now, because the purchase agreement clearly states that "this fund does not provide any protection, and investors may lose their investment principal." The water is empty.

e company reported that on November 4, in response to the impact of Ant Group’s suspension of listing on new funds planned to participate in the war, Alipay customer service responded to related questions, "At present, the funds have been established and the operation of the funds will not be affected." Alipay customer service It also stated, “The fund company will always manage your funds prudently and responsibly, select high-quality targets, and strive to bring you long-term returns. If there are any subsequent updates, the fund company and Ant Group will disclose it through an announcement.”

Wang Li also went through the process from happiness to sadness. Although she did not purchase the placement fund, she was once one of the lucky ones who won the lottery. Wang Li is a veteran stock investor. She is keen on newcomers. She has won the lottery 5 times, but the Ant Group is her biggest lottery so far. After winning the lottery, she was very excited. "It feels like getting rich overnight." For this, she comforted herself a bit, and even planned to travel once.

"Now I can only wait for the results of the subsequent processing with peace of mind." Wang Li is not sure whether the new funds can be refunded in the end.

An Internet practitioner said in the pulse, "Before all major platforms analyzed that ants would definitely make a profit. Then they put all the home studs in. I originally thought that if you get a new stock, you can wait for everything to become rich. It is impossible to expect after the placement. The release can still be postponed. I am now seeking help everywhere."

Ant Group announced that it will announce further details of the refund of the application funds as soon as possible. According to the latest news, the application monies for the Hong Kong public offering (together with 1.0% brokerage commission, 0.0027% Hong Kong Securities Regulatory Commission trading levy and 0.005% Hong Kong Stock Exchange trading fee) will be refunded in two batches without interest.

Regarding investors’ concerns, He Jin told Ran Caijing that the suspension of listing does not mean that it cannot be listed. “However, if it fails to go public, the winning funds will eventually be returned.”

Ant Financial

From the timeline, many people attribute the accident of Ant Group to the speech of Jack Ma, founder of Alibaba and actual controller of Ant Group, at the Bund Financial Summit on October 24.

Just as he said more than ten years ago, "If the bank does not change, we will change the bank." Jack Ma believed at the meeting that supervision cannot use yesterday's method to manage the future. Good innovation is not afraid of supervision. He believes that the global banking capital and risk supervision The standard is an "old people's club", which is not suitable for "young people" like China Finance, who believes that the biggest risk of China's finance is "no risk", and innovation must pay a price.

In the banking industry, he believes that "mortgage thinking", "pawn shop thinking" too old, and control technology based on large wind data rich data and large data credit system can be really positive solution must finance credit problems, and the new The financial system, "No matter whether we are high or not, we will definitely get up, and no matter whether we do it or not, someone will do it."

On November 2, the central bank, the China Banking Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange jointly interviewed Ma Yun and other relevant persons in charge of Ant Group. On the same day, the "Interim Measures for the Administration of Online Microfinance Business (Draft for Comment)" was announced and made public Soliciting opinions from the public, various official media intensively voiced to strengthen financial supervision, followed by Ant Group to make rectification of regulatory opinions, due to major changes in the regulatory environment that may affect specific businesses, Ant Group suspends listing.

In fact, Jack Ma’s remarks are not the starting point of the chain reaction. The real starting point is the business of Ant Group, whether it belongs to the financial category and whether it is applicable to the existing financial regulatory standards. Relevant industry insiders stated that the "Draft for Comment" cannot be released overnight. Jack Ma and other related parties participated in the whole process, and Jack Ma chose to call for supervision at this point. Undoubtedly, he wanted to fight for space for the Ant Group. Look, the supervision recognizes the legitimacy of the Ant Group, but the price is to include the Ant Group in the same regulatory standards as the bank.

Ant Group, which has always wanted to tear off the label of "finance" and deepen its impression of "technology", eventually had to return to "financial services."

The prospectus shows that Ant’s income is divided into three parts, namely "digital payment and merchant services", "digital financial technology platform" and "innovative business and others." Simply put, it is the payment business of Alipay, and the financial business represented by Ant Huabei, Borrowing and Yu'e Bao, including micro-lending, wealth management and insurance. The above businesses contribute more than 99% of Ant's revenue.

At present, the ant is China's largest online consumer credit and small micro-credit platform operators, as of the end of June, to promote the consumption of ants letter credit balance, the amount of micro and small business operators credit balance totaling more than 2.1 trillion yuan, which makes the ants Micro-loan business revenue in the first half of this year was 28.586 billion yuan, accounting for 39.41% of total revenue. Overtaking payment has become Ant's core source of income.

The so-called micro-lending business, Ant is equivalent to a "financial intermediary", facilitating credit between banks and other financial institutions and individuals and small and micro enterprises that did not previously have loan qualifications. Ants can obtain a certain amount of interest income according to the cooperative financial institutions. Percentage charges "technical service fees", so income is closely related to the scale of credits it promotes. Among the loans facilitated by Ant, more than 98% of loans are actually made by financial institution partners or have realized asset securitization.

Figure / Weibo Ant Financial Technology

In translation, this 2.1 trillion credit balance is reflected in Ant’s own balance sheet of only about 40 billion yuan. During the same period, the two microfinance companies that Ant’s main microfinance service provided paid-in capital totaled 16 billion yuan. With a total net assets of 35.824 billion yuan and a leverage ratio of more than 50 times, it is basically unimaginable to use such a small volume and such a low capital to leverage such a high loan line by the standards of the banking industry.

Functionally speaking, Ant Microloan is not a lender nor a guarantor. It is mainly responsible for product design and other technical issues, as well as collection. Independent risk control, lending and interest collection are all responsible for the bank and other licensed institutions behind it. This solves the problem of its own credit scale and risk.

"Borrowing money and lending can still eat the spread without taking risks. There is no better business in the world than this." A financial practitioner sighed.

According to the prospectus, during the statistical period, Ants achieved net profits of 8.205 billion yuan, 2.156 billion yuan, 18.07 billion yuan and 21.923 billion yuan respectively. In the first half of this year, they made 120 million yuan a day. This is mainly the high-margin micro-loan business. Together with the 1 billion users of Alipay and the broad prospects of consumer loans, they will jointly support Ant's 2.1 trillion market value.

However, as soon as the new regulations came out, ants and banks treated the same and directly blocked the leverage ratio. This meant that in order to comply with the regulations, Ant Group would either reduce the loan scale or increase the capital contribution. If the capital contribution ratio was increased to 30% in accordance with the regulations, it would mean If Ant wants to drive 1.8 trillion of joint loans, it needs to expand its capital to 140 billion. Based on the current 40 billion, it needs to supplement 100 billion.

This is almost the total amount of Ant Group’s A-share fundraising. In other words, don’t do anything with the money raised. It will be used to fill the hole. This will inevitably affect the future of Ant Group. It's hard to do.

Some experts believe that the signal released by supervision is not to try to dissociate from financial supervision under the guise of technology. Financial innovation has boundaries. No matter how financial technology is packaged, it is essentially financial, and risk prevention is the first thing. Otherwise, once the ant group has a thunderstorm, the whole society will need to pay for it.

Some media criticized Huabei and Bibei by name, "It often forms excessive credit granting, and the scene induces to stimulate advanced consumption together, causing some low-income groups and young people to fall into debt traps, ultimately harming consumer rights, and even bringing harm to families and society. "Harm", this set of combined punching actions against the Ant Group means that from now on, whether it is JD Digital or Tencent Finance, all Internet finance and financial technology, as long as it involves high-risk leveraged business, it will be Incorporate into uniform supervision.

In the long run, supervision also affirms the status quo to a certain extent, that is, the market position and vested interests of the Ant Group, because strict supervision also limits the latecomers, which also means that after the Ant Group, it is difficult for anyone to reach such a height. , The small brothers of Douyin, Meituan, and Didi who do Internet microfinance can only watch a "good era" pass eagerly. Ant Group has become a regulatory-certified financial institution. But there may not necessarily be such an opportunity. Just the amount of fundraising and the regulations of the same province have blocked their living space.