In 2020, the scope of artificial intelligence applications will continue to expand, and computing power, as a driving force for carrying artificial intelligence applications, promotes the evolution of the entire artificial intelligence industry. AI chips provide necessary computing power support for cloud, edge, and end multi-party collaboration, and have naturally become a hot spot for domestic and foreign industry and academia.

AI cloud training chip design is difficult and the industry has a high degree of monopoly. There are only a handful of domestic chip companies that can independently complete the design, tape out, and achieve mass production and commercialization. Suiyuan Technology is one of them.

On October 28, Suiyuan Technology's cloud training acceleration chip "DTU" (DTU, Deep Thinking Unit), which was specially developed for artificial intelligence applications, was awarded the "China Chip" annual major innovation by China Electronics Information Industry Development Research Institute Breakthrough product award. This award is oriented to “single chip products that have major technological innovations, fill domestic technology or market gaps, have a greater contribution to the improvement of the independent supply chain, and produce more significant economic and social benefits”, and the only four award-winning chips One of the products.

Sense Chip has caught up with the critical period of the explosion of commercial value in the industry. According to market research firm Tractica, the global AI chip market will grow from US$5.1 billion in 2018 to US$72.6 billion in 2025, with a CAGR of 46.14%. According to IDC, China will have 27.8% of the global data volume by 2025. With the explosive growth of data volume, artificial intelligence application scenarios are becoming more and more abundant. The huge demand for computing power makes China's IC industry face severe challenges, but it also contains great opportunities.

This year, the State Council also issued "Several Policies to Promote the High-Quality Development of the Integrated Circuit Industry and Software Industry in the New Era", focusing on supporting integrated circuit companies from a combination of fiscal and taxation, investment and financing, research, talent, intellectual property, market applications, and international cooperation. And the development of related industrial chains.

The Chinese chip market is in strong demand, but it is not easy for domestic brands to leverage the monopoly of giants. The 2019 "AI Chip Industry Research Report" released by iResearch pointed out that the current AI chip industry is close to the top of the Gartner technology curve bubble. Only high-quality teams that have passed market inspection and screening can continue to gain industry, policy and capital favor and support.

In this context, how does Suiyuan Technology quickly complete its own design, tapeout, and mass production? How to promote commercialization in a highly monopolistic environment? With these questions, we interviewed Zhang Yalin, founder and COO of Suiyuan Technology.

The following is a compilation of the content of the interview between 36Kr and Zhang Yalin.

Successful one-time tape out in 18 months, design and mass production were completed independently

Suiyuan Technology has won the "China Chips" Annual Major Innovation Breakthrough Product Award for all the links from architecture design, product design, software and hardware development, tape-out, and even mass production to the Suiyuan Technology team.

As a start-up company that enters the data center market with high-end artificial intelligence training products, Suiyuan Technology has only experienced 18 months of high-intensity development. In December 2019, it released the "Yunsi" artificial intelligence training chip and the "The chip's artificial intelligence training acceleration card "Yunsui T10".

Q: What is the main reason behind the success of the AI training chip "Xiansi" at one time in 18 months?

Zhang Yalin believes that there are three main reasons. "First, we have set the goal of'holding high and hitting high' and a focused execution plan; second, we have established a very excellent R&D team and have received strong support from many strategic partners in the industry; third, we have a A systematic project management system ensures that every milestone of the project can be reached smoothly."

Zhang Yalin believes that it was the original intention of "big chip, hard technology" that attracted like-minded partners at the beginning of the business and quickly formed a team. When the first chip was developed, there were only about 150 people in the company. "From product definition, architecture design, to chip research and development, tapeout to subsequent product testing and verification, mass production, etc., these 150 people form a full-link team." Zhang Yalin said.

The team members of Suiyuan Technology are basically concentrated in Shanghai Zhangjiang and Beijing Zhongguancun-two of China's oldest integrated circuit research and development centers. The average working life of all employees reaches 10 years, and many engineers even have more than 15 years of R&D experience. "The vast majority of them come from well-known semiconductor companies and software and Internet companies in the industry." Zhang Yalin said.

Q: In the entire R&D process, which part is the most difficult?

"I think there are two hardest parts-one end and the other." Zhang Yalin said.

He recalled that in April 2018, when Suoyuan Technology launched the Yunsi chip project, there were only three people in the company, and "even the computer and the development environment must be prepared from scratch." From product definition, team recruitment, to cooperation with upstream and downstream partners in the industry chain, until May 2019, the successful tapeout.

"Tail" refers to the mass production link. In Zhang Yalin's words, "From the early design to the successful completion of the tape-out, it is actually only half the way."

In fact, it will take nearly a year from the chip back to the laboratory to light up, and then to mass production. In this year, there are many difficulties to overcome, such as chip yield, heat dissipation, stability, reliability, and cost control, performance optimization, etc. These problems involve many core technologies.

"Usually, if you have not participated in mass production of large chips, you will not master this core technology." Zhang Yalin said. "Fortunately, we have established a complete product design and mass production team. Many team members have experience in mass production of large chips, so we can successfully complete the entire process."

Q: What is the current production capacity of chips? How to control costs?

According to Zhang Yalin, after opening up the mass production process, Suiyuan Technology has stabilized its chip production capacity.

"The yield and thermal stability of large chips are very challenging. We have cooperated very closely with GlobalFoundry and ASE in the mass production process. At present, our yield has fully complied with GlobalFoundry's guidelines on yield." Zhang Yalin said.

At the same time, Suiyuan Technology uses verification methodology and verification coverage to ensure the quality of chip design and manufacturing, and realizes end-to-end performance tuning through the joint performance of software and hardware, ensuring product quality.

"This year, we prepared goods in advance and optimized the supply chain, so we have sufficient supply throughout the supply chain. And because our mass production links are not outsourced, the cost optimization and control rights are all in the hands of our team." Zhang Yalin said.

Domestic chips with high computing power and flexibility, "high cost performance"

In 2020, the AI chip market returns rationally, and investors begin to pay more attention to issues other than computing power and efficacy, such as which scenarios the product has entered, which customers have cooperated with, and whether there are software and hardware integration solutions. "AI is difficult to implement" has become an industry consensus.

Especially in the field of cloud AI chips, because overseas markets started early and the cost of hardware such as CPU/GPU that needs to be coordinated is high, this field has almost been monopolized by NVIDIA.

Q: Compared with the GPGPU solution, what are the competitive advantages of the TEC chip? What is the key difficulty for domestic brands to challenge traditional giants?

"The Pinnacle chip is specially designed for AI deep learning applications, supporting computer vision, speech recognition, natural language processing, machine learning knowledge graphs and other AI model training required performance, storage bandwidth and interconnection. While maintaining a high degree of flexibility, programmable While expanding, it has a competitive advantage in terms of computing power, energy efficiency ratio, and cost-effectiveness." Zhang Yalin said.

The full name of GPGPU is General Purpose Computing on Graphics Processing Unit, which is a graphics processing unit (GPU) capable of general computing. At present, only Nvidia has realized the large-scale commercialization of GPGPU on a global scale. The domestic gap in this field is still obvious. However, GPGPU is currently evolving to separate computing products and graphics products, optimizing the architecture separately, instead of merging. For example, Nvidia's Telsa series and RTX series and AMD's cDNA and RNDA are typical examples of the separation of computing and graphics. Computing products and architecture are mainly used for pure AI and scientific computing, while graphics products and architecture are mainly used for game-related acceleration.

Considering migration costs and risks, domestic chips must be comparable in performance to international giants, and at the same time have the flexibility of programmable expansion and a user-friendly software system to attract customers who are accustomed to giant products to choose their own solutions.

Zhang Yalin believes that to challenge the giants, we need to pay attention to three points: The first is product positioning. The second is product ecology, and the third is continuous differentiated competition with international giants.

Regarding product positioning, Zhang Yalin explained, “We will help customers reduce the cost of training product migration as much as possible. At the same time, we will do a good job of technical support to make our products the second choice of customers and help them reduce costs and increase efficiency. "

Second, in terms of product ecology, Zhang Yalin believes that what Suiyuan wants to do is to understand the true needs of customers, conduct more and more in-depth analysis on the scene, take multiple breakthroughs, and combine open source to build their own new customer ecology. .

Finally, in the long run, “Suiyuan is still a start-up company. We need to work through several generations of product iterations in the overall product architecture design, ecological strategy, and customer relationship, and slowly develop in the field we are good at. Differentiate from major international companies and provide customers with more value." Zhang Yalin said.

Q: What is the uniqueness of Suiyuan GCU chip architecture?

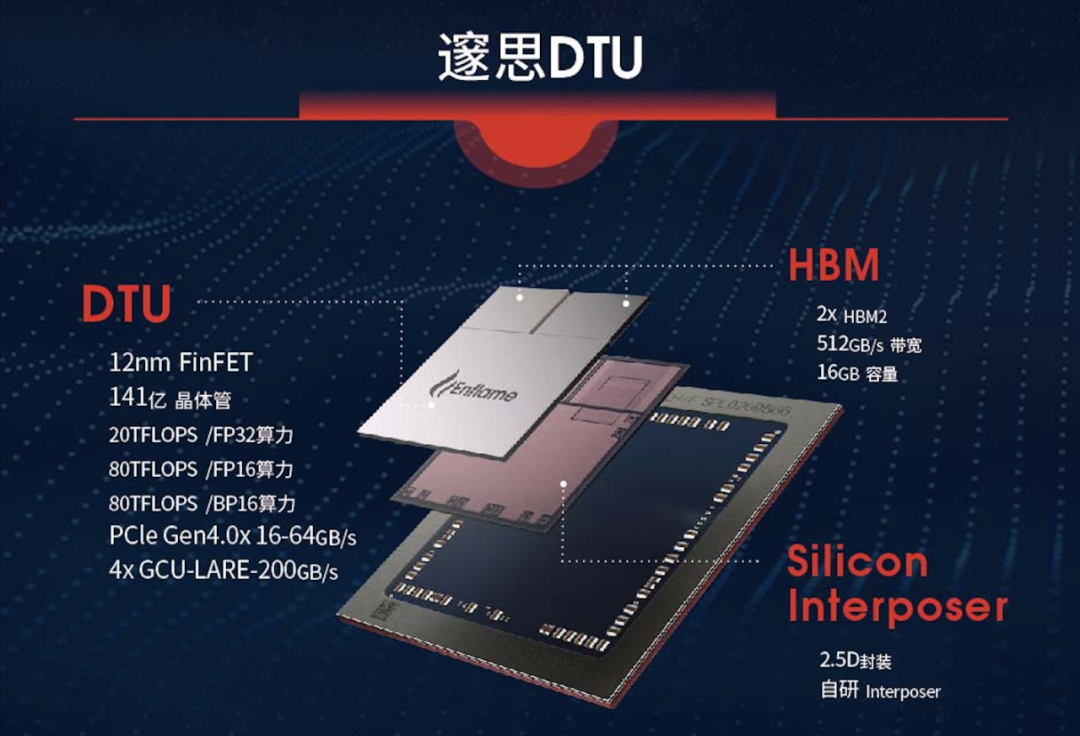

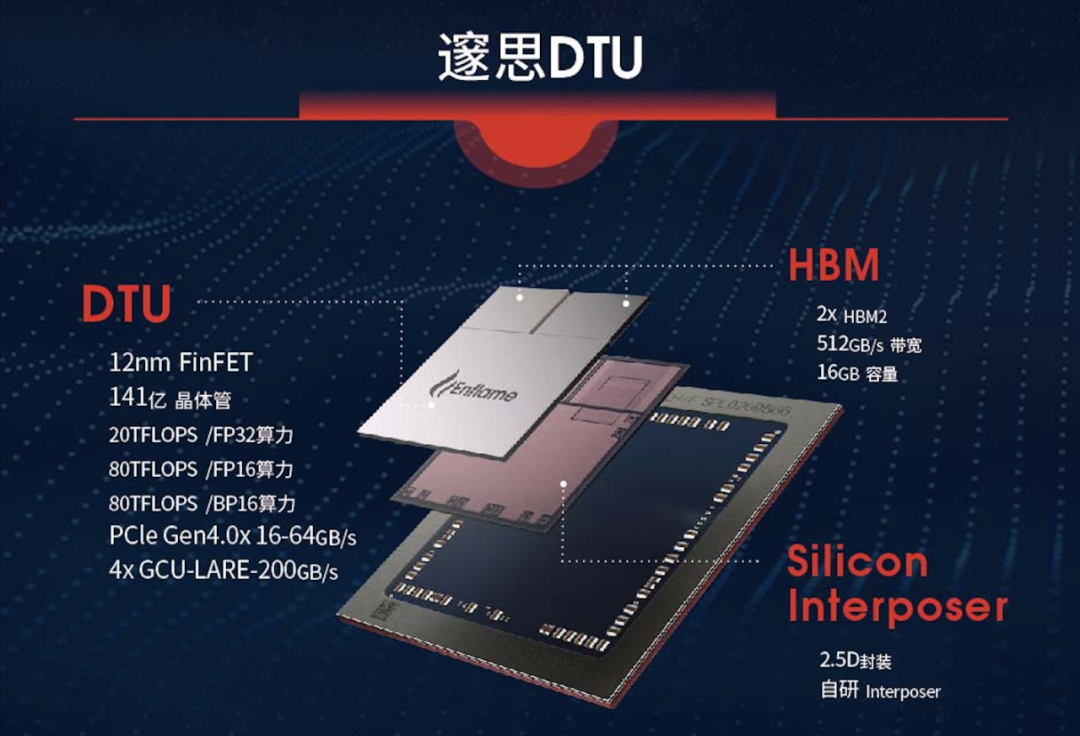

It is worth mentioning that the innovation of DTU is that it is based on self-developed core IP and innovative system solutions, and has Suiyuan GCU chip architecture with completely independent intellectual property rights. This is one of the advantages of Suiyuan Technology that distinguishes it from other chip companies.

Zhang Yalin said that Suiyuan’s GCU structure was built for calculations without any graphical part, but it includes all AI calculation modes and accuracy. "This makes the computing architecture of our entire chip very simple, which is why we can perform efficient and cost-effective operations."

In the process of computing, Suiyuan GCU architecture introduces 4 parts of cloud AI computing engine (GCU-CARE), data architecture (GCU-DARE), intelligent interconnection (GCU-LARE) and advanced packaging (GCU-PARE).

Among them, the cloud AI computing engine has the characteristics of global support for multiple data formats, ultra-high computing power, and flexible programming; the data architecture has the characteristics of programmable shared cache scheduling, asynchronous data loading, and improved computing parallelism; intelligent interconnection chip 4 channels 200GB /s high-speed interconnection, 800GB/s high-speed interconnection in the server; advanced packaging adopts full-coverage simulation design methodology and advanced high-parallel design process.

"These four parts of the Suiyuan GCU architecture together form a complete chip architecture, and also enable the chip to exert greater computational efficiency in AI training and inference." Zhang Yalin said.

Step out of the chip design laboratory and land in the canyon of commercialization

Although the commercialization of domestic cloud AI chips is not an easy task, from the medium and long-term dimensions, the boundary factors for expanding the growth of the semiconductor industry still exist. Considering the sufficient demand in the domestic market, this is a big cake.

Regarding the commercialization issue that investors are most concerned about, Suiyuan Technology has a three-year plan. Zhang Yalin believes that the commercialization of Suiyuan has completed the process from 0 to 1, and then from 1 to N.

Q: What is the current commercial progress of Yunsi chip and Yunsui T10 training accelerator card? Is it difficult to land?

Zhang Yalin believes that the current commercialization process of Suoyuan Technology "has been completed from 0 to 1", because the distributed cluster composed of the "Yunsui T10" equipped with the Yunsi chip has been successfully implemented, and the Yunsi chip is already in the head of the customer. Business operations officially started in the data center. "Next, we will expand our customer base and build a customer ecosystem." Zhang Yalin said.

Now, the company's commercialization is "in the process from 1 to N", Zhang Yalin told 36Kr. Next, Suiyuan Technology will choose strategic customers and application plateaus, and "perform ecological polishing on each strategic customer and application plateau." "

Compared with international giants, the Chinese team of Suiyuan Technology also has a "home field advantage." Zhang Yalin believes that Suiyuan's localized team can provide timely support to Chinese customers and show more flexibility. "I believe that our commercial landing speed will be greatly accelerated in the future."

Q: What are the mid-term and long-term goals of Suiyuan Technology?

Zhang Yalin said that Suiyuan Technology’s mid-term goal is to "use three years to complete the entire cloud AI training and inference product deployment, improve the ecology, and make Suiyuan Technology a leading company in China's cloud AI chip field."

"In the future, we hope to be able to focus on the long-term development of data center business." Zhang Yalin said. "Is not limited to AI, we hope to bring to China's data center to high-tech products and a wider range of ecological systems."