Although Playtika was acquired in 2016 in a "snake swallowing elephant" manner, the important task of Giant Network is still the last step-to incorporate it into the listed company system.

But Shi Yuzhu also has his own plan B. Recently, it has been reported that Playtika has submitted a low-key document to the US Securities and Exchange Commission (SEC) and is expected to be listed in the United States by the end of 2020 or early 2021. Not long ago, Giant Network also issued an announcement that Playtika intends to seek its first overseas listing. It is reported that Playtika plans to raise 1 billion US dollars this time, and its valuation may reach 10 billion US dollars.

The listing of Playtika is particularly important for Shi Yuzhu and his giant network.

Giant network "curve to save the country"

As a legend in the domestic business world, the outside world always likes to look back on Shi Yuzhu's wonderful past, but the term Shi Yuzhu and Playtika have been deeply tied together in the past two years.

As an Israeli game company established in 2010, although Playtika has the name of artificial intelligence, its main business and Giant Network are games. The only difference is that Giant focuses on traditional online games such as "Zhengtu", while Playtika focuses on board and card games.

Shi Yuzhu's relationship with this game company can be traced back to November 2016, when Giant Networks backdoor Century Cruises returned to A shares for one year, and the company name has not been changed to Giant Networks. At this time, the overall volume of Giant Network is far from that of Playtika, and the overall revenue and net profit are far less than the latter, so that shocking acquisition was also called "Snake Tunxiang" by the outside world.

At that time, Shi Yuzhu convened many investment institutions including Yunfeng Capital, a private equity firm founded by Jack Ma, and spent US$4.4 billion to acquire Playtika from Caesars Interactive Entertainment.

Although Playtika's overall business situation is good, the acquisition has never been recognized by the Securities Regulatory Commission due to the high suspicion of gambling in its main board game itself. This delay lasted for three years, the acquisition plan has also undergone several adjustments, and the acquisition plan was once terminated. Finally, at the beginning of July this year, Giant Talent officially announced that Jukun Network, a joint- stock subsidiary, completed the acquisition of Chongqing Cibi through capital increase, and owns 100% of Chongqing Cibi. While Chongqing Cibi holds 42.04% of Alpha, the core asset of Alpha is Playtika.

There have been rumors that had come to be called Shi Yuzhu "pro Friends of the group " because their heart is repeated delays Playtika acquisition of discontent, shortly before the Giants shareholder CDH and Hony series of holdings is perhaps therefore derived a chain reaction, after all, so The cost of putting a large sum of money inside can be imagined. Fortunately, this protracted acquisition has finally achieved initial results.

Interestingly, shortly before it indirectly took part of Playtika's equity, Giant Networks just sold another domestic board and card game company. In September, Giant Network sold all the shares of its wholly-owned subsidiary Hefei Lingxi to Shanghai Zhuoxian in two times, and received a total of 475 million yuan in funds.

While buying a chess and card game company, while selling a chess and card game company, the buying and selling of Giant Network is worthy of fun.

In this regard, some game industry observers said to Understanding Notes: "Shi Yuzhu is interested in Playtika not only for its profitability, but also for its AI technology and opening up the international market. Playtika is compared to other competitions in AI technology. The opponents really have to be a lot ahead, and they can continuously improve the fine operation of their own games through related technologies. In addition, the current Playtika business covers many overseas countries, which is also what the giant needs. In comparison, Hefei Lingxi is simply a spin-off The assets are a bit similar to the initial divestment of Wangjin Finance."

According to the official statement of Giant Network, the sale of Hefei Lingxi is to better focus and focus on core business. From another perspective, Giant Network probably not only needs to focus on its core business, but also needs to use the overseas market to boost its morale in the capital market.

After backdooring back to A in October 2015, the stock price of Giant Network has gone up all the way, and its market value was once as high as 170 billion yuan. However, the good times did not last long. After a short period of time, its stock price ushered in a long decline. Now the market value is only 36.5 billion yuan (as of October 19), which is nearly 80% lower than the peak.

In terms of business performance, the company achieved operating revenue of 2.571 billion yuan in 2019, a year-on-year decrease of 31.96%; net profit attributable to shareholders of listed companies was 820 million yuan, a year-on-year decrease of 23.9%. In the first half of this year, revenue was 1.22 billion yuan, a decrease of 6.35% from 1.3 billion yuan in the same period last year. Net profit was 527 million yuan, an increase of 4.4% from 505 million yuan in the same period last year.

Against the background of many game companies having a bumper harvest in the first half of the year, the situation of Giant Network can be imagined. This time, the acquisition of Playtika was completed through the "curve to save the country". Giant Network stated that the performance of "Playtika" will be reflected in the group's 2020 third quarter report. Obviously, Playtika's better revenue and profit are the elements that Giant Network needs most at this stage.

After all the vents have passed

Wu Xiaobo once commented on Shi Yuzhu in his "The Great Lost Game": He has a natural gambling nature full of recklessness, and this is an endowment necessary for entrepreneurial entrepreneurs.

Although Shi Yuzhu, now 58 years old, often calls himself a big idler, he has actually had no leisure in the past two decades. From the early 90s when he earned 1 million in 4 months with the Han card, to the end of the Giant Building and becoming the domestic "first loser", to the start of melatonin and realizing a comeback, Shi Yuzhu completed many major changes. Since then, the giant network with a market value of more than 170 billion yuan, coupled with the long-term investment in Minsheng Bank in recent years , especially good personal relationships with well-known entrepreneurs such as Jack Ma, have achieved the Nth peak of his life.

In fact, as early as April 2013, Shi Yuzhu published a retirement declaration on Weibo . At that time, he said that he had resigned as CEO of Giant Network and completely retired. But in less than three years, Shi Yuzhu returned to the giant again. One of the most important measures after the announcement of the return at the end of 2015 was to operate the giant to return to A.

In addition to the main game business of Giant Network, Shi Yuzhu is still chasing the outlet. In 2017, following the mutual gold boom, it acquired 40% of Shenzhen Wangjin Finance at a price of nearly 819 million yuan, and was entrusted to exercise 11% of the voting rights of other shareholders. To catch up with the trend, Mutual Finance's revenue accounted for 30% of the Giant Network's revenue, and Mutual Finance once became an important support for Giant's network business diversification. However, with the continuous occurrence of thunderstorms in the P2P industry, the severe external environment also makes it relatively high risk.

Finally, at the end of 2018, Giant Network announced the divestment of mutual gold business at a price of 479 million yuan.

In addition to mutual funds, Shi Yuzhu also took a fancy to a series of vent projects such as blockchain, insurance, and long-term rental apartments, but ultimately failed to make substantial progress.

From a certain point of view, the term "Zhufengkou" may be familiar to Shi Yuzhu. From the initial Hanka, later melatonin, to online games and even the financial industry, they are the most popular outlets of the time. And Shi Yuzhu, who is good at observing the market, also seized these opportunities and created one after another. In the past two years, Shi Yuzhu has continued to do the same, working hard on the front line, but in the end he was unable to wait for new hot models.

How does Giant Network face the future?

In fact, "The Journey" may be Shi Yuzhu's only truly successful work after melatonin. This game, known as the "most krypton gold in the history of domestic online games", has independently supported the entire Giant Network almost ten years after its birth.

If the company's revenue can be supported by the popularity of a self-developed game, then it can be said that the game itself and the developer are both successful. But if the game is still the main revenue source of a company 15 years after its release, it can only make the outside world lament the strong vitality of this IP, but also question the company's innovation.

The loneliness of "fancy matryoshka"

Giant Network is currently facing such a problem, and now 15-year-old "Zhengtu" is still the company's core IP.

At present, Giant’s PC-side online games mainly have 4 products, "Zhengtu", "Zhengtu 2", "Green Journey", "Zhengtu Nostalgia"; at the same time, there are also "Zhengtu Mobile Games", "Zhengtu 2 Mobile Games", "Green Journey Mobile Games" etc. To be able to derive so many products from one IP at the same time, we must also admire the giant's "mock doll" ability.

In addition to "Zhengtu", the mobile game " Battle of the Ball " can be regarded as a relatively successful product of Giant Network in the past five years. According to the official disclosure of the giant, its cumulative equipment installation has reached 600 million units, and its peak DAU has exceeded 29 million.

At present, the two IPs of "Ball Ball" and "Zhengtu" have jointly supported most of the giant's revenue, but even the "young" "Ball Ball" has been released for more than 5 years. For mobile games, the life cycle has gradually entered a decline.

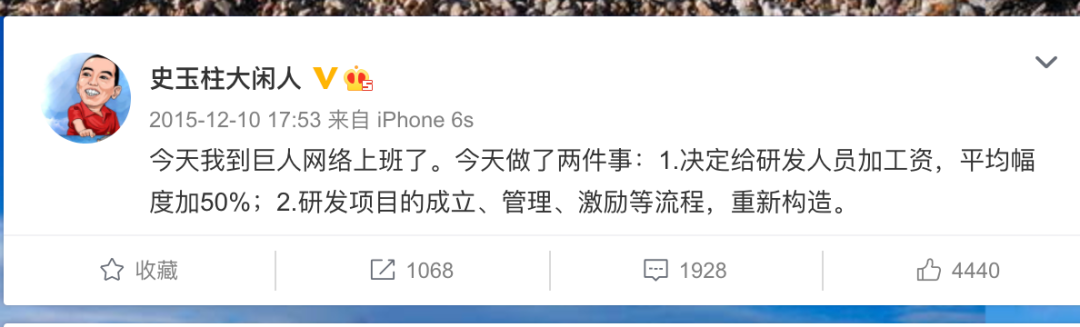

Five years ago, Shi Yuzhu made large-scale adjustments to the company when he returned to take control of the company. An important one was to increase R&D investment. At that time, he announced a salary increase for all front-line R&D personnel, with an average rate of over 50%, and promised that the net worth of the producers who made masterpieces would exceed 100 million. Shi Yuzhu hopes to stimulate employees and create better products.

But judging from the final effect, under the heavy reward, there is no "brave man" to take on the important task.

Regarding the status quo of Giant Networks, some game industry analysts said to understanding: "Assure a successful IP with a longer life cycle as much as possible. This is something every game company will do, but those excellent game companies continue the vitality of IP. , Is relying on this IP to continuously launch innovative products, and although the giant has launched various "journeys", most of them are the existence of changing the soup without changing the medicine. Doing so will only overdraw the IP value of the game ."

In addition, the above-mentioned analysts pointed out: “Playing games itself is a trial and error process, and the results of failure accounted for the majority. It is precisely because of this that many companies, especially the game companies that have been listed, will be more cautious, in order to ensure the performance of financial reports Willing to launch some products that are just'replacement' but can guarantee revenue, but doing so will bring the company into a slack state of boiling frogs in warm water."

Of course, in the past few years, Giant Network has not tried to launch new games. At the Apple Autumn Conference in September last year, as an example of the excellent performance of the A13, the 3D action mobile game "Pascal Contract" developed by the Giant Network TipsWorks Studio debuted for the first time, and a live demonstration was made.

This appearance has aroused a lot of attention, but from the perspective of the game itself, the excellence of "Pascal Contract" can hardly conceal the shackles of its buyout game form, causing the work to fail to receive good market feedback in the domestic market. From a business perspective, it is basically not successful. Fortunately, the appearance of "Pascal Contract" has proved the R&D strength of Giant Network, and the studio is now willing to spend more time and resources to try to create a real boutique game.

As the aforementioned analysts said, playing games is a trial and error process. Being able and willing does not mean that you can make a successful game, especially the kind of successful game and commercial success at the same time. This is also the key to test the giant's network endurance.

The aging of IP and the single product are not the problems faced by Giant.com, including Shengqu, Perfect World, Ninetowns, and Changyou. At present, most established domestic game companies are facing the same problems. Perhaps, facing a new generation of gamers, these established game companies should put aside their bodies and learn from the newcomers in the game industry such as Mihayou and Lilith.

No comments:

Post a Comment