"The whole idea of DeFi is revolutionary, and it may even reduce systemic risks to some extent, which may eventually lead to large-scale disintermediation of the financial system and traditional participants." Heath Tarbert, Chairman of the US Commodity Futures Trading Commission (CFTC) Give a high evaluation to DeFi.

However, from the current development point of view, DeFi is limited by multiple factors and cannot be further developed. Among them, a very important obstacle is the existence of high barriers to the circulation of encrypted assets based on different underlying layers.

Cross-chain can realize the full circulation of DeFi assets, break the island effect between public chains, promote the in-depth development of DeFi, and even hope to promote the crypto market to a bull market.

"The promotion of this or the next bull market must come from cross-chain applications." Hobbit founder Ju Jianhua said.

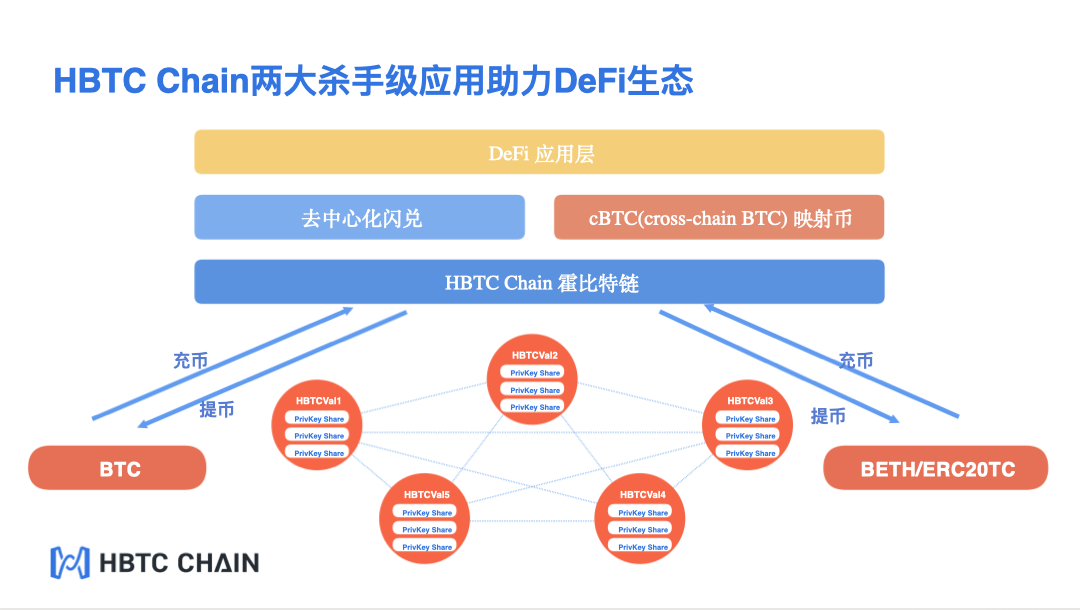

On October 20th, the open source public chain of the Hobbit Exchange team after two years of research and development-the HBTC Chain testnet will be officially launched. As a heterogeneous cross-chain DeFi public chain, the Hobbit public chain provides a more complete solution for the free circulation of encrypted assets: asset cross-chain bridge, OpenDex protocol supporting AMM (automated market making) + Orderbook (order book) dual mode and OTC solution for assets on the chain.

For centralized exchanges, increasing transaction volume is the main business. The basic public chain R&D investment is relatively large. Why did Hobbit choose this difficult path? How effective is the Hobbit public chain's cross-chain solution? Odaily Planet Daily will analyze them one by one.

After liquidity mining, what is the next hot spot?

DeFi liquidity mining has set off a boom this summer and promoted the prosperity of the crypto market.

According to DeFiPulse data, the value of on-chain lock-up has surged from US$1 billion in mid-June to US$11.1 billion at present, an increase of up to 1,000%. In the past five months, the market value of DeFi has also exploded, increasing by more than 1,600%. Reported to 16 billion US dollars.

At the same time, DeFi successfully "out of the circle". Even US regulators, which have always been cautious about crypto assets, are optimistic about the prospects of DeFi.

"The whole idea of DeFi is revolutionary, and it may even reduce systemic risks to some extent, which may eventually lead to large-scale disintermediation of the financial system and traditional participants." Heath Tarbert, Chairman of the US Commodity Futures Trading Commission (CFTC) Give a high evaluation to DeFi.

However, the ultra-high returns of liquid mining will not last for a long time after all. The craze has receded and the DeFi market is gradually showing signs of fatigue. All participants are exploring: What will be the next hot spot?

Recently, DAO (Decentralized Governance) and NFT (Non-Homogeneous Tokens) have also received widespread attention in the industry and have high expectations. However, judging from the current development situation, neither of them has really pushed the market towards a new round of prosperity.

Investigating its root causes, the demand for DAO and NFT is still relatively small, and it is difficult to stimulate market demand. To really stimulate the enthusiasm for market participation and promote market prosperity, we must target market pain points.

The real pain point in the current market is that there are high barriers to the circulation of various encrypted assets, which hinder the free flow of assets and public chain interaction, which in turn hinders the in-depth development of DeFi.

The DappRadar report shows that although about 96% of DeFi transaction volume is based on the Ethereum network. But in fact, the current total value of all Ethereum assets is only 100 billion US dollars, less than 1/3 of the total market value of crypto. In other words, more assets are blocked from the prosperity of Ethereum.

Take liquid mining as an example. Users holding crypto assets such as EOS and TRX, if they want to participate in Uniswap, Curve and other product mining, they must sell their assets and exchange them for the corresponding ERC20 tokens before trading. The process is cumbersome and complicated. . Moreover, some currency holders do not want to "sell" related assets at low prices. In the end, these people and assets were also blocked from the door of Ethereum DeFi.

How to achieve barrier-free circulation of assets and break the island effect between public chains has become the key to the next development of DeFi and the encryption market-cross-chain may become the next wave of hot spots.

From the data point of view, cross-chain demand has been growing. The main cross-chain WBTC (ERC20 version of BTC) has achieved rapid development in the third quarter of this year. Currently, the cumulative lock-up volume is close to 160,000, an increase of more than 1100%. Spencer Noon, head of crypto investment at DTC Capital, said that by the end of 2021, the total amount of Bitcoin (BTC) locked on the Ethereum blockchain will increase by 20 times, which also proves the prospect of the cross-chain market.

As early as 2 years ago, the Hobbit Exchange anticipated today's market pain points at the beginning of its establishment, and raised 20,000 Ethereum to invest in the development of the HBTC Chain. On October 20th, the Hobbit public chain testnet was successfully launched and three ecological applications were launched:

Cross-chain asset bridge: It can realize complete and safe asset decentralized cross-chain circulation exchange, and supports free circulation exchange on any public chain;

OpenDex protocol: It can support AMM+Orderbook dual-mode cross-chain DEX;

On-chain asset OTC solution: Supports targeted exchange and personalized exchange of on-chain orders, supplementing OpenDex.

"The promotion of this or the next bull market must come from cross-chain applications." Hobbit founder Ju Jianhua said. , Cross-chain not only enables the interconnection between chains, assets and assets, but also a more effective channel for the traditional world to connect and use blockchains.

Cross-chain asset bridge, how to realize the free flow of assets?

If the consensus mechanism is the soul core of the blockchain, then cross-chain technology is the key to realizing the value network, allowing different blockchains to achieve interoperability, thereby forming the “Internet” of the blockchain and realizing a larger application space And value.

In simple terms, cross-chain is an agreement that allows assets to be transferred from one blockchain to other blockchains and can be safely returned to the main chain from other blockchains.

Taking the Hobbit public chain as an example, TRX can issue its own ERC20 version of TRX tokens in it 1:1, so that native assets can enter the Ethereum ecosystem; it can also issue TRC20 version of ETH to introduce Ethereum into TRON .

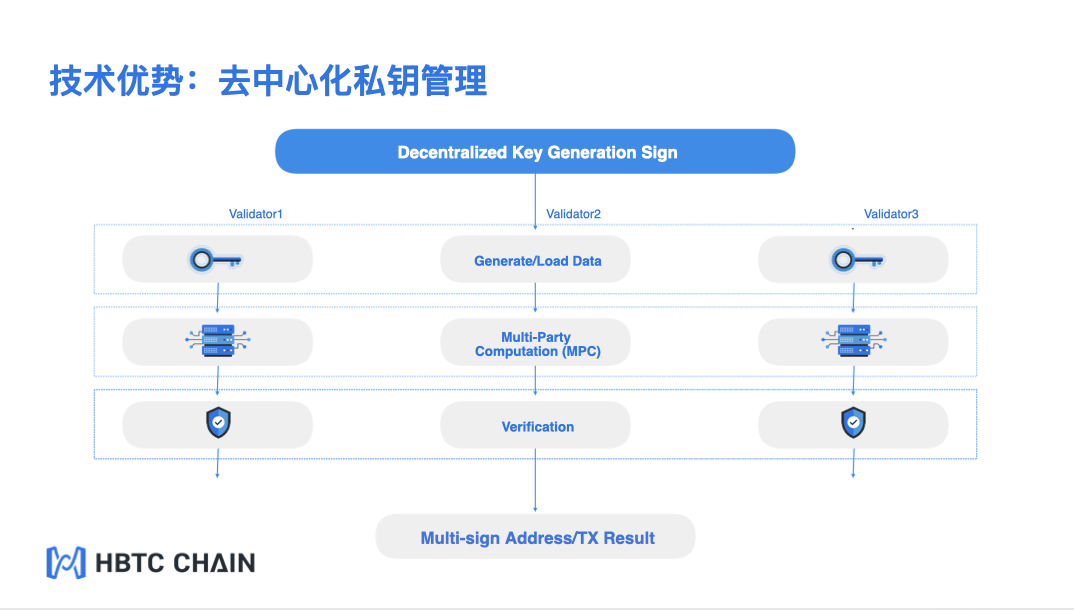

(1) Distributed private key control, taking into account efficiency and security

Since the blockchain systems are independent of each other, there are many difficulties in conducting transactions on two or more different chains. For example, how to confirm the authenticity of data and avoid problems such as inflated data.

The current common cross-chain solutions will basically introduce the role of " middleman " to undertake the information interaction between the two chains. The main modes are:

Notary schemes: trust a node or middleman to undertake verification, which is more centralized;

Sidechains/relays (Sidechains/relays): For example, Ethereum can be the side chain of Block A, and Block A can be the main chain of Ethereum;

Hash-locking: The system reaches a specific hash value to realize asset transfer out and back.

However, the above cross-chain scheme has some problems more or less. Take the currently widely used WBTC as an example. It belongs to the "notary mechanism". Users need KYC/AML procedures to verify their identities, and the entire cross-chain process highly relies on a single point of trust. The relevant data depends on the audit reports regularly published by the project party. Centralization, there are systemic risks.

In contrast, the asset cross-chain bridge of the Hobbit public chain is different from the above three models. It belongs to a relatively small group of "Distributed private key control" with a high degree of decentralization. Strong security.

(Decentralized private key management)

Since the inception of the project, the Hobbit public chain has chosen breakthrough innovations based on cryptography technology for cross-chain support, combined with cryptographic tools such as elliptic curve digital signatures, zero-knowledge proofs, and trusted multi-party calculations to achieve cross-chain custody of assets. the key generation in all core nodes distributed and signed name. In the whole process, the private key is completely invisible and never actually appeared, but is kept in the form of fragments on different core nodes; and supports the N*N cross-chain model, and supports the complete chain & inter-chain Data interoperability.

"Theoretically, we can be compatible with most mainstream public chains in the market as soon as we go online, and do not conflict with other cross-chain technologies, and solve problems from the bottom." Hobbit told Odaily Planet Daily.

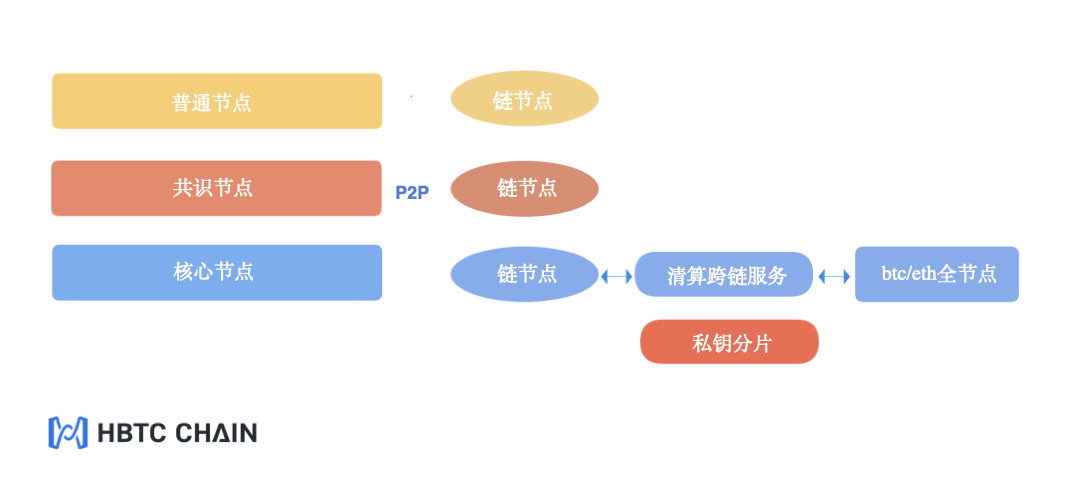

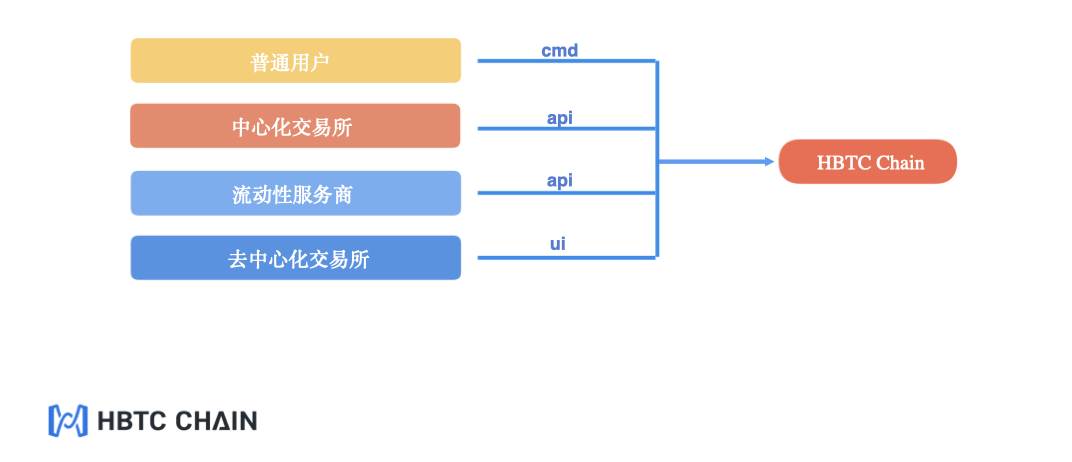

The Hobbit public chain adopts the BHPOS consensus and adopts the "three-layer node model"-ordinary nodes, consensus nodes, and core nodes to process cross-chain related data, key distribution storage, and transaction signatures. The specific architecture diagram is as follows:

(Three-layer node model)

The "three-tier node model" has two advantages: one is to ensure efficient processing performance, users can realize lightning deposits and withdrawals on the Hobbit public chain, and the time to reach the account can basically be within 3 seconds; the second is to ensure security and ensure privacy Key shards cannot be leaked, and non-healthy assets cannot circulate freely on the chain.

(2) Specific cross-chain process

Below, we use BTC to map Ethereum to introduce the cross-chain process of the Hobbit public chain in detail:

Users deploy smart contracts on Ethereum and issue 21 million cBTCs (the number is set by themselves);

Charge the entire amount of cBTC into the Hobbit public chain, and then initiate a btc-cBTC asset mapping proposal (mainly to check the security of smart contracts). After the proposal is passed, a btc-cbtc asset mapping pair will be created and all cBTC will be locked;

Any user deposits BTC at the custodial address of the Hobbit public chain, exchanges cBTC 1:1 through mapping pairs, and mentions cBTC to Ethereum for circulation;

After that, the user can transfer the cBTC back to the Hobbit custodial account, exchange out the BTC, and then withdraw it to their own BTC address.

As a completely decentralized DeFi public chain, the Hobbit public chain does not require KYC verification and can achieve privacy protection.

The Hobbit public chain also supports the issuance of asset mapping and exchange agreements by any user, as long as the smart contract for mapping and exchange needs to go through security audits and governance on the chain. In the future, in addition to BTC, more encrypted assets will realize free circulation through the Hobbit public chain, which will promote the in-depth development of DeFi.

Cross-chain OPENDEX: Support AMM+Orderbook

In addition to building cross-chain channels for encrypted assets, the Hobbit public chain also provides trading channels for these cross-chain assets, and launched its own decentralized cross-chain exchange OpenDex to facilitate users' transactions on the chain.

In fact, DEX is also a popular track for DeFi this time. Whether it is the three major exchanges, or Hobbit, FTX, etc., after entering DeFi, they have chosen the DEX track. The fundamental reason is that the development potential of DEX is gradually becoming prominent, and it is impacting the core position of CEX.

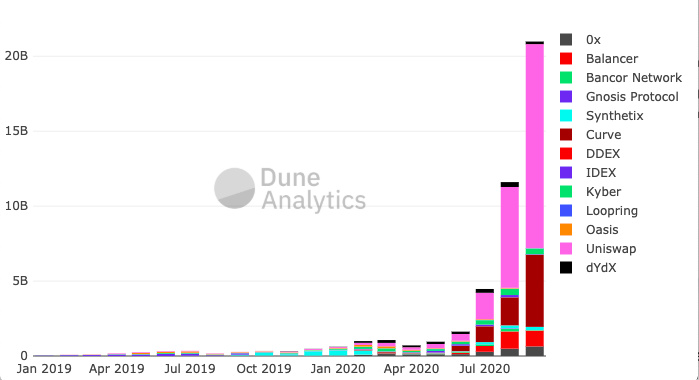

Dune Analytics data shows that in September this year, the DEX market transaction volume exceeded 20 billion U.S. dollars, an increase of nearly 3000% from the beginning of the year, while the total DEX transaction volume last year was only 2.4 billion U.S. dollars.

(DEX monthly trading volume, picture from Dune Analytics)

In terms of specific application examples, on August 30 this year, the 24-hour trading volume of the decentralized exchange Uniswap reached US$426 million, surpassing the centralized exchange Coinbase for the first time.

Faced with a series of data pressures, Hobbit, as a CEX, also had to pay attention to the development of DEX.

"CeFi lowers the threshold for user participation. Users can quickly participate in the market. For some people who lack professional knowledge, they can achieve better security. The trust issues that CeFi faces include misappropriation of user assets and inflated assets. Waiting happens to be something DeFi can make up for.” Hobbit told Odaily Planet Daily.

However, Hobbit's OPENDEX, as a latecomer, also faces considerable pressure. Compared with the long-established Uniswap, how does OPENDEX get out of the siege? Odaily Planet Daily summarized some of the advantages of OPENDEX:

First, the OPENDEX model is more comprehensive, supporting AMM (automated market maker) + Orderbook (order book). DEX such as Uniswap currently adopts the AMM model. Although it has gained a large audience, it is not attractive to many centralized users who are accustomed to the Orderbook model. OPENDEX is compatible with two major models at the same time and uses the same liquidity pool to enhance user experience.

Second, OPENDEX has higher performance and lower cost. Low efficiency and high fees are the two most criticized points of decentralized transactions on Ethereum. Especially in this DeFi boom, the Ethereum network was extremely congested, Gas fees soared, and a single transfer once reached 1 ETH.

The BHPOS consensus mechanism adopted by the Hobbit public chain can achieve a TPS of more than 2000, effectively improving network efficiency; and the transaction cost is low, less than 1% of Ethereum, which is beneficial to attract target users of decentralized transactions.

The third is the experience of Opendex being close to CEX. OPENDEX supports cross-chain intervention in any currency transaction, not limited to Ethereum; at the same time, efficient matching, privacy protection and no threshold access provide a transaction experience no less than centralized transaction, which can ensure the safety, reliability and integrity of funds On-chain verification.

Fourth, OPENDEX provides a complete liquidity incentive plan and a zero-sharing model for project parties, which solves the problem of insufficient liquidity of DEX. OPENDEX adopts the SAAS model on the chain to facilitate the community/exchange/wallet, etc. to open its own DEX and obtain the corresponding benefit binding; at the same time, all DEXs share liquidity.

(All parties share liquidity)

"Our system is very convenient for liquidity market makers to intervene, and provides a complete protection and incentive mechanism. Using the ecology of our 280+ partners, we can expand the DEX market and provide in-depth support." Hobbit explain.

However, OpenDex is not perfect, and it has shortcomings.

On the one hand, the main direction of OpenDex is fast on-chain asset exchange transactions, and the directional exchange support for some large-value, personalized orders is insufficient.

However, the Hobbit public chain has also figured out a solution and launched an on-chain OTC solution. The main process is as follows:

Support users to create two types of OTC exchange orders (free exchange and directional exchange), free exchange can specify the target asset and price of the exchange, the single exchange limit range and exchange timeout time, and the directional exchange can specify the exchange target address and target asset And quantity.

The user of the exchange order can withdraw the order at any time, and the order will be automatically destroyed after the exchange is completed.

Directional exchange must be performed by the designated address, which can ensure the safety of both parties.

Free exchange users must exchange at a limited price, which can support a larger exchange volume.

On the other hand, as a newcomer to the entire public chain, the Hobbit public chain has excellent performance, but neither the number of users nor the brand influence is the same order of magnitude as Ethereum. Therefore, it is more difficult to steal Ethereum's traffic in a short period of time, and the only way to undertake the value overflow of Ethereum is through subsequent product services.

From this point of view, the Hobbit public chain and Ethereum are not a competitive relationship, but a cooperative relationship that promotes each other.

"HBTC Chain has always been very clear about its positioning: the infrastructure of the DeFi ecosystem, link users/communities/public chains/exchanges, and do a good job of linking and co-building."

Summary: DeFi ecological infrastructure

In fact, Hobbit is not the only centralized exchange that develops basic public chains. The three major exchanges have layouts.

Judging from the current development, in addition to Binance Chain’s mainnet, the other two are in the testnet stage like the Hobbit public chain. Hobbit expects that the mainnet will be launched in December this year, and smart contracts will be opened within 3-6 months of the mainnet, supporting wasm and evm dual virtual machines, facilitating project parties to migrate to the Hobbit public chain for application development, thereby improving The entire ecological value.

"Only when there are enough active users and asset deposits on the Hobbit public chain, can smart contracts be used to empower community developers to provide users with more choices."

In addition, the Hobbit public chain currently focuses more on decentralized and secure asset circulation and exchange. In the future, it will focus on the direction of digital asset derivatives to provide users with a one-stop decentralized and secure digital asset solution on the chain. , To become a new generation of DeFi ecological infrastructure.

No comments:

Post a Comment