If the month is profitable, you will lose, and the water will overflow. Ant Group, which has one billion users, tens of billions of profits, 100 billions of revenue, and trillions of valuation, encountered some "challenges" when it launched its IPO.

On October 8, the last strategic placement fund of Ant Group was finally completed. It has been 14 days since the first day of the public placement of the Ant Match Fund. And even in the funds that have completed the over-raising earlier, most investors have more than 80% of the allocation quota. Compared with the recent popular public offering funds in the market, which are frequently sold out in a single day, with a placement ratio of only 20 to 30%, the public's enthusiasm for the Ant Group placement fund is lower than expected.

On October 24, Jack Ma’s remarks at the Bund Financial Summit sparked controversy-innovation is becoming more and more challenging to regulation, and yesterday’s approach cannot be used to manage the future-this has been interpreted as a bold call for the establishment of an inclusive financial system , Has also been interpreted as a "complaint" and "impact" to traditional finance, stabbing a " horse's nest " in the financial industry .

Even so, under the mainstream voice of "singing many ants", these episodes are nothing. Just last night, Ant Group announced the final offer prices of its A shares and H shares. The offer price of H shares was 80 Hong Kong dollars per share, corresponding to the price of A shares of RMB 68.8. 1.67 billion shares, and the total number of new shares issued by A+H does not exceed 11% of the post-issuance share capital (including green shoes), the market value of Ant Group's two places is about 2.1 trillion yuan. This has already surpassed the market capitalization of the "Industry (1.79 trillion), Agriculture (1.13 trillion), China (953.8 billion) and Jian (1.61 trillion)" four state-owned banks and Ping An of China (1.5 trillion) (both as of October 26). The closing market value of A shares on the day).

Don't talk about it, I believe that any analyst or investor will not miss the opportunity to scan such a "not seen in a century" sexy company. Regardless of whether you ultimately vote with your feet to become a "shareholder", understanding and thinking about ants is a compulsory course in the world of capital and technology. At the moment when this feast is about to begin, "Capital Detective" interviewed a number of investment researchers in the secondary market, trying to restore the true appearance of this financial giant.

There are three core points:

At present, more than half of Ant's revenue is channel business with strong financial attributes, and it is the main source of revenue growth, and the proportion is still rising rapidly. The "technology" story is more focused on the future.

The market value of US$200 billion is very stable, but the high of US$400 billion may require market sentiment to increase.

With the simultaneous issuance of the two places, Ant's performance on the A-share STAR Market will be significantly better than that of the Hong Kong stocks. Whether it is during the subscription of new shares or the adjustment period after listing, the pressure on the valuation of Hong Kong stocks is significantly greater than that on the A-share STAR market.

The Art of Valuation of Tech Story

What kind of story to tell is closely related to valuation. For example, Xiaomi has always emphasized its Internet properties. The core reason is that hardware companies have low profit margins, simple business models, and limited imagination. The P/E ratio is definitely not as good as that of high-growth Internet companies.

A few months before the launch of the IPO, "Ant Financial" changed its name to "Ant Technology Group" with obvious intentions. But what I have to say is that "technology" is still a relative future, and its prospectus shows that it still focuses on finance.

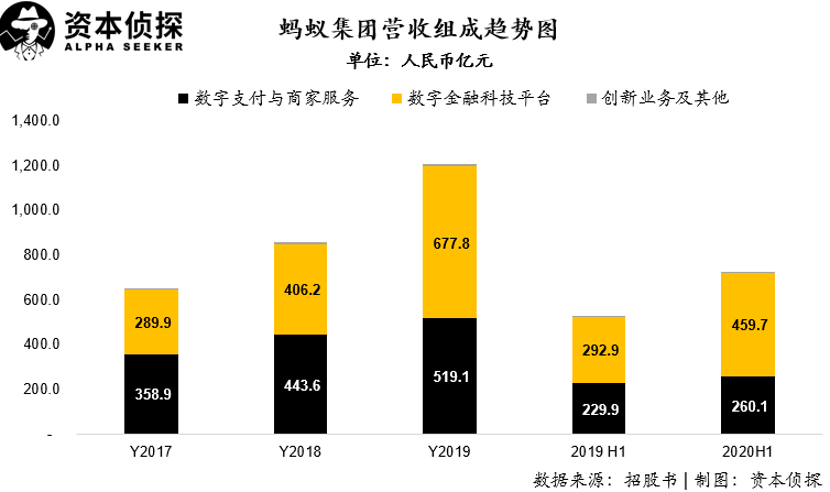

The prospectus shows that Ant’s digital payment and merchant services and digital financial technology platform businesses contributed more than 99% of total revenue during the reporting period.

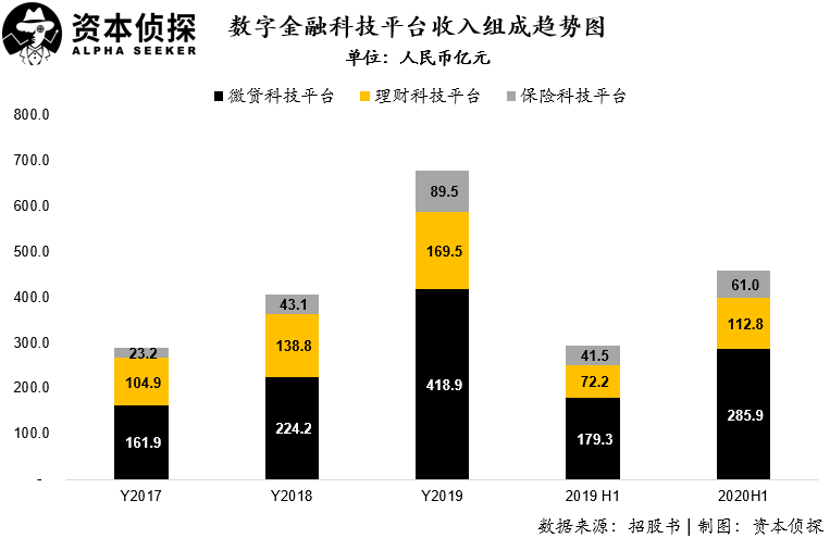

Digital payment and merchant service income are the commission income generated by our daily use of Alipay for various payments and transfers. The company's digital financial technology platform income mainly includes the income from the micro loan technology platform, the income from the wealth management technology platform, and the income from the insurance technology platform.

Among them, the micro-loan technology platform business is through cooperation with banks and trusts and other financial institutions to provide consumer loans to individuals and provide loans to small and micro enterprises through products such as Huabei and Bibei; wealth management technology platforms and insurance technology platforms are through Alipay A huge traffic entrance, which distributes wealth management products and insurance products for fund companies and insurance companies to obtain commission income.

Ant clearly disclosed in the revenue recognition section of the accounting policy of the prospectus that the company's digital financial technology platform revenue is based on the percentage of the revenue realized by the partner financial institution partners, and the revenue is recognized in the form of technical service fees. That is to say, the digital financial technology platform business uses Alipay as a huge traffic entrance, and the third-party financial product sales business is carried out . The company charges commissions in proportion, and technical services are the manifestation of income.

Since 2018, the proportion of Ant's digital financial technology platform business has surpassed the proportion of digital payment and merchant service revenue, becoming the largest source of income for Ant Group.

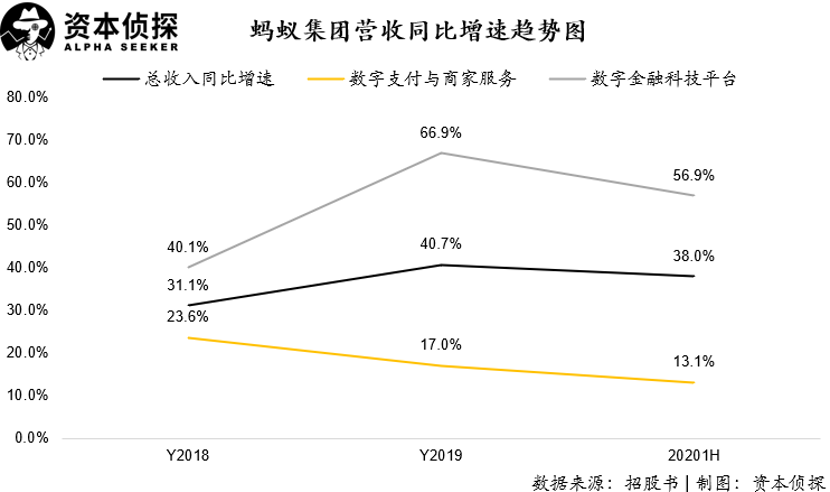

From the perspective of revenue growth trends, Ant Group has maintained rapid growth in its overall revenue in 2018, 2019 and the first half of 2020, with year-on-year growth rates reaching 31.1%, 40.7% and 38% respectively. However, from the perspective of the growth rate of sub-business lines, there is a more obvious trend, that is, the company’s current growth engine is mainly derived from digital financial technology business, while Alipay’s traditional payment and merchant service revenue has shown a significant growth rate. Slow down the trend.

It can be seen that during the reporting period 2018, 2019 and the first half of 2020, the year-on-year growth rates of Ant Group's payment and merchant service revenue were 23.6%, 17% and 13.1%, respectively, showing a rapid decline. The company's digital financial technology business showed rapid growth in 2018, 2019 and the first half of 2020, with year-on-year increases of 40.1%, 66.9% and 56.9% respectively.

Although we cannot simply define Ant Group as a financial service company, at least from the current output of its main business, more than half of the company's channel business is with strong financial attributes, and the proportion of this part of the business is still expanding rapidly.

An analyst who did not want to be named told the "Capital Detective" that from the data disclosed in the prospectus alone, Ant is still more like a financial company and lacks a sense of technology.

This is reminiscent of the way Alibaba changed its financial report disclosure logic in the past, allowing the capital market to recognize that the company is not only an e-commerce company, but also a comprehensive group company.

(Slightly farther away) In 2016, Alibaba's business was already quite complex, including e-commerce, cloud, logistics, payment, etc., but the secondary market still valued its business in accordance with e-commerce logic.

Therefore, Alibaba cancelled the quarterly GMV data disclosure and only disclosed the annual GMV. At the same time, the revenue segmentation disclosure was more detailed, and the core e-commerce, cloud, large entertainment, and innovative businesses were separately disclosed.

The post-location of GMV data prevents analysts from major banks in continuing to use the market-to-sales ratio (P/GMV) method to continue tracking Alibaba’s valuation; more and more detailed segment information forces analysts to use SOTP ( Sum Of The Part (Sum Of The Part) valuation method to re-examine the value of each unit of Alibaba.

The SOTP valuation method has caused the value of loss-making businesses such as Alibaba Cloud , Cainiao, and Dawenyu to be re-evaluated. After Alibaba successfully changed the valuation method of the capital market, the market value also broke through the bottleneck and went up all the way.

Alibaba stock price trend in recent years

"On the other hand, Ant Group, in addition to using a lot of text to describe the technological attributes in the prospectus, the communication performance on the financial data side is average."

The above-mentioned analyst said: "Of course, on the one hand, Ant Group's digital payment business is widely used, and the business model has been deeply rooted in the hearts of the people. There is limited space for business model communication; on the other hand, for the digital financial technology platform business, due to its agency sales model It is too simple and the scale of the business is huge, so there is also limited room for disclosure."

Ant’s “technological story” is actually hidden in its business: its technological capabilities based on digital financial technology platforms are more reflected in the analysis of loan applicants’ consumption and repayment data to increase sales of financial products and reduce overdue In terms of risks-these are also the standard equipment for Mutual Gold's leading companies.

The other "hard technology" is that the Ant Group’s BASIC strategy corresponds to Blockchain, AI (artificial intelligence), financial security (Security), Internet of Everything (IoT), and cloud computing (Computing). In the first half of 2020, this innovation and other business revenue was only 544 million yuan, accounting for less than 1% of the total revenue. However, this part of the business is the real position that contributes to the future of Ant Group Techfin.

""Finance returns to finance, technology returns to technology" is the main keynote of current supervision," said an analyst at West China Securities . "Ant will desalinate financial and technology in the future. The technology stocks are positioned to 48-60 times the PE range in 2020, corresponding to a market value of 2.0-2.5. Trillion yuan. "

Guosen Securities also gave a similar valuation, believing that the corresponding dynamic PE of Ant in 2020 is 40-60 times, corresponding to an overall value of 1.7-2.5 trillion yuan.

Simple assessment of ants

However, just a few days ago, Reuters' IFR reported that according to the latest brokerage report, the valuation of Ant Group has been raised to between 380-461 billion US dollars, which is far more than Ant’s 21,000 public offering. 100 million yuan (about 310 billion US dollars).

One stone stirred up a thousand waves. Although the strong strength of ants has given everyone enough confidence and confidence, the figure of 400 billion US dollars is still too "crazy".

At present, the focus of controversy regarding Ant's valuation is focused on the classification of technology and finance. Because the capital market has huge differences in the valuation logic of companies of different nature:

For Internet companies, whether in domestic A-shares, Hong Kong stocks or US stocks, the capital market is treated with a very tolerant and open attitude, as long as the company's business logic is clear, the market is large enough, and the product is groundbreaking , The user scale is large and the growth rate is high enough, the capital market usually gives a higher valuation. Corresponding valuation methods will not be limited to traditional price-earnings ratio (PE), price-sales ratio (PS) and other valuation methods based on financial performance, but will take more into account the company's future development prospects.

As for financial companies, since the financial industry is a relatively traditional industry that is heavily affected by regulatory policies, whether it is Ping An Group, which is listed on the Hong Kong stock market, or the financial technology company Lexin and 360 Digital, which is listed on the US stock market, more Most of them are valuations with reference to profitability, which is a multiple of PE.

In recent years, after regulators have imposed strong supervision on consumer loans and other businesses of Internet finance companies, the price-earnings ratios of U.S.-listed Internet finance companies that once had high valuations have fallen to within single digits (currently, the dynamic P/E ratio of 360 Digital is about 6 times. Lexin is about 10 times), which is very close to the financial companies listed on Hong Kong stocks and A shares (Ping An’s earnings ratio in both A and H stocks is about 11 times), which is much lower than that of technology companies. One hundred times the secondary market price-earnings ratio.

It can also be seen from this trend that the secondary market has gradually returned to rational valuation based on financial companies from the earliest valuation of Mutual Finance based on Internet logic.

The market has traces to the swing of ant's positioning. For example, Huachuang Securities put forward two valuation methods of ant in a research report:

Spin off various businesses and conduct benchmarking with comparable financial companies;

The typical user number estimation method of Internet companies adopts P/MAU or P/DAU method.

In fact, for Ant Group, if you simply understand from the book data, according to the valuation logic of Internet companies, it will undoubtedly be able to easily stand at US$200 billion in listed value. Over 700 million monthly activities, 118 trillion yuan of platform annual transaction scale, revenues of 120.62 billion yuan and 72.53 billion yuan in the first half of 2020, respectively, and non-international reporting standards attributable to shareholders' profits reached 24.16 billion and 239.1 100 million yuan, while maintaining an annual income growth rate of 30%-40%. Looking at the market, there is nothing better than AT (Ali Group and Tencent Group).

At present, Meituan, whose Hong Kong stock market value is around US$200 billion, has revenue of only 108.875 billion yuan in 2019. Another unlisted unicorn giant ByteDance has just exceeded its revenue in 2019. 100 billion, not to mention that these two companies are still in a strategic loss phase in 2019.

However, for smart investors in the capital market, it is obvious that they will not look at Ant Group in general, just as they could understand Alibaba's valuation logic before.

The core business of Ant Group is simpler than that of Alibaba Group. Under the SOTP model, it is mainly embodied as digital payment business + financial product channel sales business.

We can use the financial data disclosed by Ant Group to make a simple calculation based on the model.

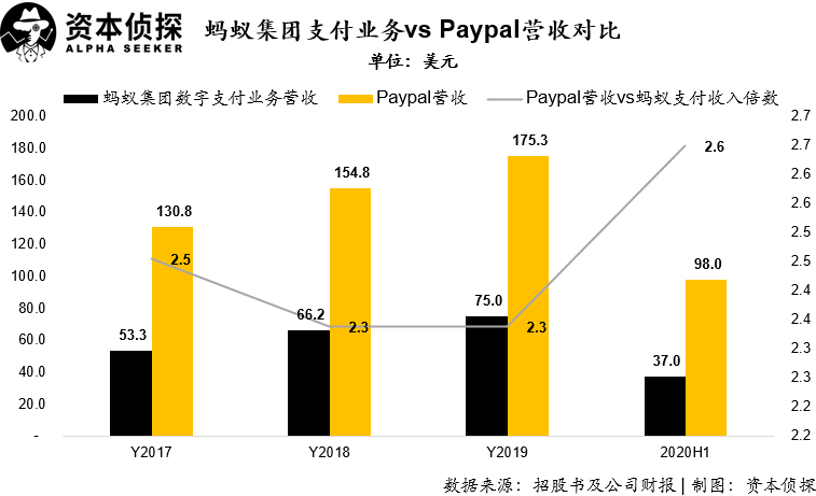

For the valuation of the third-party payment platform business, Paypal, which is also separated from the e-commerce platform eBay and listed on the US stock market, obviously has a strong reference significance.

Comparing Paypal and Ant Group's third-party payment business income scale, in the past three and a half years, Paypal's income scale has been relatively stable at 2.3-2.6 times that of Ant Group's payment business income; at the same time, Paypal's income in 2018 and 2019 The growth rates were 18.4% and 13.3% respectively, slightly lower than the 23.6% and 17% revenue growth rates of Ant Group's third-party payment business. In addition, Paypal's net profit margin in the past three years has exceeded 10%, and it is also in a healthy state of profitability.

Based on Paypal’s current secondary market value of US$238.2 billion in US stocks (market value as of the last trading day of last week), while considering revenue growth and profitability, the Ant Group’s payment business valuation is calculated at a lower multiple of 2.3 times. The valuation of the group's third-party payment business will be around US$100 billion.

For Ant Group's digital financial technology platform business, it mainly includes micro-loan technology platform, wealth management technology platform, insurance technology platform business, and the core business is the sales of third-party financial products. At the same time, the company's micro-credit technology platform business is similar to the current mainstream Internet finance company's loan assistance business, and its revenue accounted for more than 50% during the reporting period (digital financial technology platform business revenue), so the valuation logic can be referred to Listed Internet financial technology company.

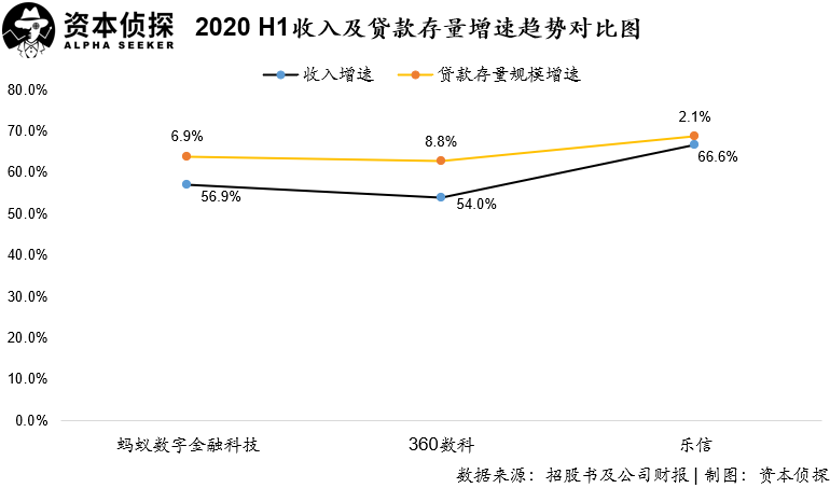

In addition, in the first half of this year, Ant Group's digital financial technology business revenue increased by 56.9% year-on-year, and the loan stock scale increased by 6.9%.

However, taking into account the epidemic situation, 360 Data Science and Lexin also achieved rapid growth in revenue, with growth rates reaching 54.0% and 66.6%, respectively, while loan stock increased by 8.8% and 2.1%, respectively. The growth rate was relatively close, so it has strong Comparability.

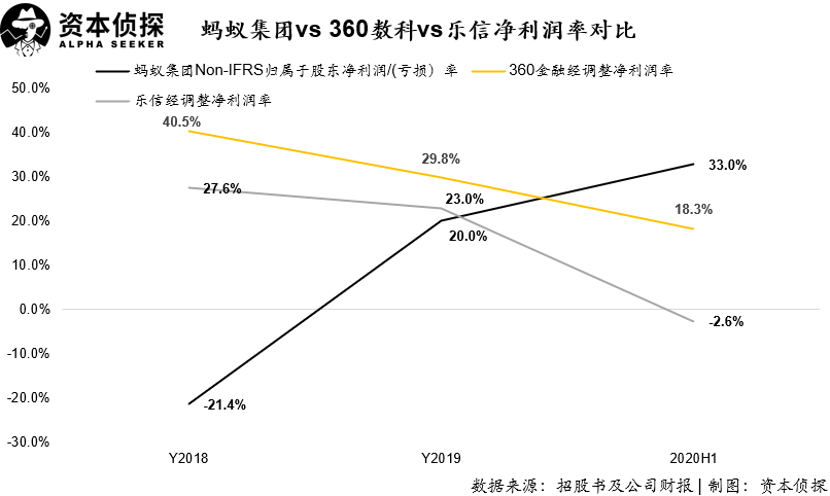

Since Ant Group did not separately disclose the profit of digital financial technology business in the prospectus, the overall profit rate of the group is 33% (higher than the profit level of 360 Digital and Lexin), and the Ant Group financial technology business is 56.9% in the first half of the year. The year-on-year growth rate of revenue is estimated to reach 106.4 billion yuan in 2020 full-year revenue (2019 revenue 67.78 billion * 156.9% = 106.4 billion).

The expected profit of Ant Group's digital financial technology business in 2020 will be about 35 billion yuan (1064*33%=351). According to the price-earnings ratio of financial companies generally not exceeding 10 times, the corresponding valuation is about 350 billion yuan (3500/6.8 = US$51.5 billion).

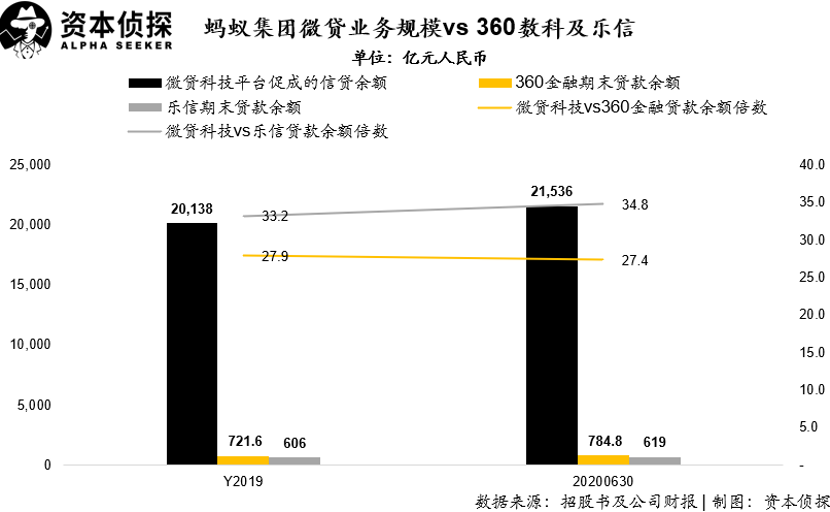

From another point of view to verify that, as of the end of June, the Group of ants microfinance technology platform letters credit balance amounted 21536000000000000 yuan, 360 times the number of Section 27.4 of the end of June the credit balance is 34.5 times Wessing credit outstanding.

As of the last trading day of last week, the market value of 360 Digital Technology and Lexin were US$1.832 billion and US$1.414 billion, respectively, and the corresponding valuations were US$50.2 billion and US$48.8 billion respectively according to the credit scale multiples.

According to estimates that the company's micro-credit technology business contributes about 62% of the total digital financial technology platform business, the current valuation of the digital financial technology platform business of Ant Group is reasonable in the range of 80 billion US dollars (500/62%=800).

Under the logic of SOTP, the overall valuation of Ant Group's digital payment business + financial technology platform business will be between US$150-180 billion. If you take into account the dominant position of the Ant Group in the market, the height of the business moat, and the deployment of Ant Group in technology such as blockchain (currently less actual revenue), a market value of more than 200 billion US dollars can also be achieved.

But the valuation of 380 billion to 460 billion US dollars, I am afraid that the market sentiment needs to be added.

A+H challenge

Whether Ant Group can enter a more reasonable valuation range is obviously of greater significance to the issuance stage and secondary market share prices (especially Hong Kong stock prices) after listing. It is worth noting that because Ant Group chose the A-share science and technology innovation board + the simultaneous issuance of Hong Kong stocks, it has put forward relatively high requirements for the pricing power of the underwriters.

"If the price is conservatively set, Ant Group’s fundraising scale will obviously be affected. However, if the price is too high, there are large differences between A-shares and Hong Kong stocks in terms of participants and valuation logic, even in the capital markets of both places. It is possible to raise funds in excess, but there will be considerable pressure on Hong Kong stocks whether it is in the dark trading stage before listing or the stock price trend after listing," a leading Internet brokerage practitioner told the "capital detective": "This It is a new feature of Hong Kong stocks. Many retail investors who subscribe to popular stocks trade immediately after winning the lottery. Therefore, there is relatively high selling pressure and institutions need to receive orders to stabilize the stock price."

In fact, entering October, the Hong Kong stock market has seen a relatively obvious decline in retail subscription enthusiasm and investment returns to rationality.

Just a few days ago, First Service Holdings, a property stock listed on the Hong Kong stock market, and the pharmaceutical company Simcere Pharmaceuticals, both broke after the opening. The property services and the pharmaceutical industry to which these two stocks belong belonged in the first half of this year. Hot industry, and both companies achieved oversubscription of more than one hundred times during the fundraising stage.

Similarly, the big hot stocks Jiahe Bio and Genting Shinyao, which were recently blessed by Hillhouse Capital as cornerstone investors, were overbuyed by 1200 times and 600 times respectively during the public offering stage, and their share prices have fallen all the way after listing, and they have also broken. .

Therefore, the recent consecutive breaks of popular stocks have also brought great panic to the retail subscription of Hong Kong stocks.

Retail investors in Hong Kong stocks have dropped a lot of interest in property stocks such as World Trade Services, which has just completed its IPO, and the biomedical company WuXi Biomedical Co., Ltd., which is currently IPO , withdrawing their subscriptions. This kind of "ugly image" of relying on market enthusiasm to raise valuations and raise funds for more financing. In the current market environment where star companies are listed and broke, it is difficult to continue "routines" on a large scale to retail investors.

Therefore, if the Ant Group chooses to issue simultaneously in two places, if institutional investors cannot fully recognize its inherent valuation logic, they are more willing to hold A shares no matter before the issuance (the cornerstone investment stage) or after the issuance (undertaking the stage of selling stocks by retail investors) The shares on the Science and Technology Innovation Board are reluctant to hold Hong Kong stocks. After the listing, Ant Group is likely to show a huge valuation gap between A shares and Hong Kong stocks.

This kind of situation appeared in another giant company SMIC that returned from Hong Kong stocks to the Sci-tech Innovation Board this year . Up to now, the market value of SMIC's science and technology innovation board is about three times that of the Hong Kong stock market, which mainly reflects the difference in the understanding of company valuation by investors in the two regions.

However, for companies that are also listed on the US stock market and Hong Kong, whether it is Alibaba Group or JD.com and NetEase, which returned to Hong Kong this year, due to the close valuation system and similar investor composition, there is no significant difference in market value.

The feast has already begun.

Yesterday, Ant Group announced the details of its IPO in Hong Kong: the H-share offer price is HK$80 per share, and the number of H-share initial public offering shares is more than 1.67 billion H shares (depending on whether the H-share over-allotment option is exercised or not) Among them, the number of Hong Kong offer shares is approximately 41.768 million H shares; the number of international offer shares is approximately 1.628 billion H shares (subject to adjustment and subject to the exercise of the H-share over-allotment option). The maximum amount of funds raised is HKD 133.6 billion.

One lot of 50 shares, the entrance fee is 4040.31 Hong Kong dollars. But this has become a carnival for "capitalists"-according to information, the issuance of Ant Group in Hong Kong has only been one hour, and the issuance of H-share institutions has been oversubscribed, most of which are large orders of $1 billion. According to a report by the Financial Associated Press, in order to seize shares of Ant's IPO, sovereign funds have begun to prepare for both A+H.

According to previous news, the Abu Dhabi Investment Authority (ADIA), the Singapore Government Investment Corporation (GIC), and the Canadian Pension Fund Investment Corporation (CPPIB) have all expressed their wish to participate in Ant’s strategic placement of A shares. Singapore’s Temasek and Saudi Arabia’s Public Investment Fund (PIF) also plan to participate in the investment, and the China Social Security Fund will become Ant’s strategic investors on the Science and Technology Innovation Board. This means that five of the top ten sovereign wealth funds in the world for asset management scale have already planned to participate in the Ant IPO.

But at the same time, from a retail perspective, the winning rate of Ant Group's new Hong Kong stocks is likely to be between 80%-100%, which means that 1-2 lots can be purchased, and this is also the recent The highest winning rate of popular new stocks in the market (new stocks are scarce). If the increase in Ant's stock is limited after the opening, and retail investors are not willing to hold stocks, it is likely that they will escape. It is hard to imagine that institutional investors will choose to inhale ant stocks again at high levels in the secondary market.

I can't help but feel again that this is a research sample that has not been encountered in a century. The valuation art of Ant, the emotional feedback of the market, the decisions and choices of investors at all levels... will gradually surface as the curtain of Ant's IPO gradually opens.

No comments:

Post a Comment